Hello. This is Alex Bakker with what’s important in the IT and business services industry this week.

If you’d like to read this on the web, click here. If someone forwarded you this briefing, consider subscribing here.

Outsourcing Plans

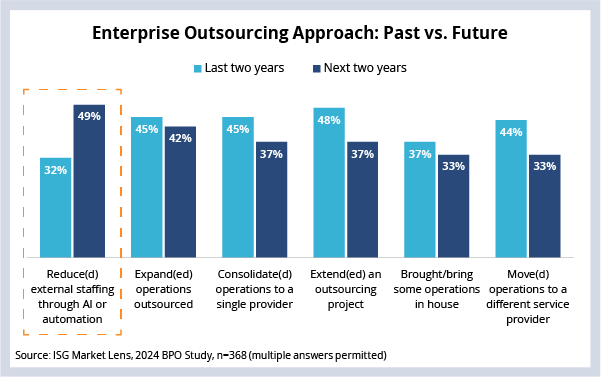

Enterprise expectations for their outsourcing partners are shifting. Data from our recent BPO Market Lens Study suggest that, in the next two years, companies expect AI to reduce external staffing and save cost – a top reason most enterprises outsource in the first place. This approach is so compelling that enterprises indicate it will displace other approaches often used to optimize outsourcing contracts, such as vendor consolidation and competitive renewals (see Data Watch). We believe some companies will delay new outsourcing activity over the next two years until they can be sure of these hoped-for savings.

Data Watch

Background

AI has become a top priority for companies to drive business growth and modernize their technology and operations. In our ISG Market Lens Studies on ADM and AI adoption earlier this year, it was clear that AI has been driving significant changes in the way companies plan to outsource IT. The latest data from the BPO study suggest that the impact of AI is changing enterprises’ approach to outsourcing more generally.

What’s Next

Over the last year, data from several studies show that talent availability pressures began to give way to broader cost pressures. And we’ve seen that the combination of flat budgets in IT and operations combined with planned increases in spending across multiple technology categories is amplifying internal pressure. This is, in turn, driving greater cost pressures on outsourcing spend.

This leads to one final critical challenge. We have been hearing from providers through our research that AI would lead to double-digit cost savings. But, as we mentioned on the Index call two weeks ago, we have yet to see actual contracts that produce this level of enterprise savings from AI. We do not doubt that many of the AI use cases and pilots are impactful, but we have seen that the real savings available depend heavily on the maturity of the company, their technology portfolio and their existing outsourcing contracts. To date, providers have not been willing to commit to a savings target upfront without first doing evaluations of a client’s operations.

Given the challenges enterprises are facing with budgets, costs and priorities, we see a mismatch in the market. Enterprises are interested in AI for its ability to reduce costs, and, in many cases, having those savings up front is a necessary part of the business case to drive new contracts – including those that have non-cost-saving use cases for AI. But, if AI can’t deliver those savings in the near term, we expect to see enterprises delaying larger contracts across BPO and IT and extending existing scopes of work until it can.

Don’t forget to register for the 2Q24 Index Call on July 11. If you would like to go deeper into the data behind the ISG Index Insider, talk to us about ISG Market Lens.