The increasing digitization of every aspect of business is pushing bandwidth requirements to all-time highs. Enterprises need automation, artificial intelligence (AI), analytics and high-performance computing for their next wave of growth. Managing such highly valuable business workloads on premises is getting costlier and more complex.

Some businesses are opting to move their servers outside their organizations by partnering with colocation providers. They are doing this to unlock a range of benefits, such as reduced costs, ease of access to public cloud environments, better disaster recovery, improved flexibility, greater efficiency and improved security. Colocation also provides periodic, predictable operational costs, which help businesses budget and use their capital expenditures more efficiently.

How to Find a Partner When Moving Out of Your In-House Data Center

Businesses are flooded with partner options when planning to move out of their in-house data centers. Still, they encounter critical challenges like connectivity, cost, quality of services offered, availability of support and the data center's location.

Of all these factors, the location of a data center deserves maximum attention. Theoretically, a data center can be built anywhere with real estate, power and connectivity. But, practically, the location of a data center directly impacts the quality of services it provides. Here are some of the reasons why a data center location is of utmost importance:

- Harnessing renewable energy for greener and cost-effective operations

Many data centers worldwide still rely on diesel backup systems for continued operations, while some are exploring natural gas options to power their data centers. Recent geopolitical scenarios resulting from the Russia–Ukraine war and the COVID-19 pandemic have highlighted the fragile nature of worldwide supply chains. While the risk of broken supply chains is a reality, using such nonrenewable energy sources in day-to-day operations leads to a high carbon footprint for businesses. In its latest sustainability report, Microsoft stated that its combined Scope 1, Scope 2 and Scope 3 carbon emissions have risen by 29.1% in FY23 from its 2020 baseline, amounting to 17.1 million metric tons. And fuel- and energy-related activities constituted a significant share of 3.39%. To address this problem, Microsoft has come up with a new requirement for selection — high-volume suppliers that will provide 100% carbon-free electricity for all Microsoft-delivered goods and services by 2030.

With the rising adoption of power-hungry technologies, such as generative AI (GenAI) and large language models (LLMs), the estimation of carbon footprint generated is more important than ever. A recent research by an AI startup, Hugging Face, explored this arena where it estimated the overall emissions of its LLM, BLOOM.

The company estimated that while training BLOOM led to 25 metric tons of carbon dioxide emissions, the figure reached 50 metric tons when it considered the emissions produced by the manufacturing of the computer equipment used for training, the broader computing infrastructure and the energy required to run BLOOM once it was trained. The research also stated that the emissions associated with BLOOM are significantly lower than other LLMs of the same size, as it has been trained on a French supercomputer powered by nuclear energy. This further emphasizes the need for renewable energy for greener operations.

In addition to the pain caused by the rising carbon footprint, the drastically rising energy costs in many countries, such as the U.K., impact enterprises' IT strategy and digital transformation initiatives. In particular, electricity prices constitute about one-third of a data center's ongoing operational costs, which can lead to severe financial drainage if not optimized.

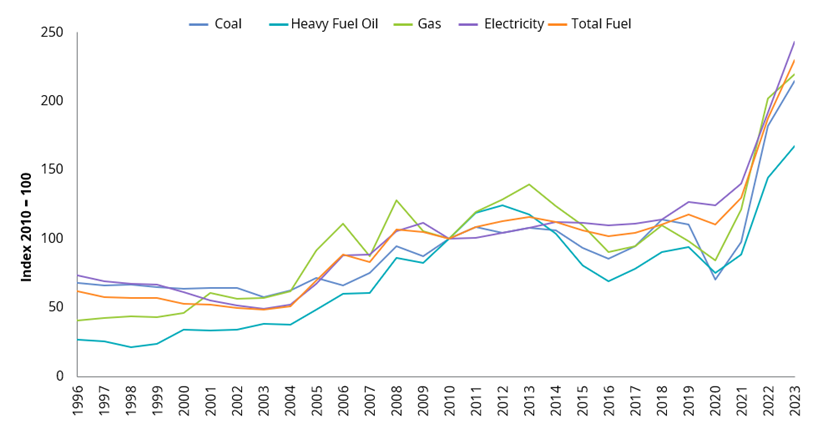

The graph below displays the drastic rise of industrial energy price indices in the U.K. over the past two-and-a-half decades.

Figure 1: Industrial Fuel Price Indices (Excluding CCL4) in Real Terms 1996 to 2023, U.K.

Source: Industrial energy price indices, Department of Energy Security and Net Zero, United Kingdom; CCL - Climate Change Levy

Enterprises now need to reconsider their colocation partners' energy sourcing strategies to ensure business continuity and cost efficiencies and reduce the environmental impact of their operations. A way to tackle this issue is to find colocation providers that offer services in locations with cheap and abundant renewable energy.

- Perks of cooler climate

With the advent of GenAI, the computational requirements of enterprises are increasing exponentially. High-performance computing (HPC) and high-density colocation are gaining traction, driven by advantages such as sophisticated analytics, automation and data-driven decision-making. Such high demand for computing infrastructure also drives the need for innovation in cooling techniques. Providers are looking to implement advanced and energy-efficient cooling techniques such as direct liquid cooling; however, locating the data center in a cooler region further helps energy-efficient cooling, leading to cost optimization and pushing sustainable operations.

- Safe and resilient locations

Locating data centers in seismically rated regions for protection against earthquakes and other natural disasters provides enterprises with a competitive advantage regarding business continuity. Similarly, locations with political stability and lower chances of man-made disasters or wars help ensure uninterrupted operations.

What does the Nordics offer?

While each region carries an advantage of its own, the Nordic countries are gradually emerging as a one-stop solution for some of the most pertinent problems businesses face in their journey toward colocation. Some of the significant benefits that businesses can expect are:

Sustainability and cost efficiencies

The Nordics have been able to offer energy at lower prices compared to other European countries for a long time, mainly because of the abundant renewable energy available in the region, which accounts for nearly two-thirds of the region's overall energy production. Using a combination of hydropower, wind energy and, to some extent, solar power and biomass, Nordic countries have created a diversified renewable energy mix. The countries plan to push renewable energy production further, reflecting Sweden's commitment to achieving 100% renewable electricity by 2040. A study by ICIS published in 2021 predicts that the Nordics will continue to provide Europe's cheapest power until 2050. Furthermore, power companies in Iceland are willing to sign long-term contracts of approximately 10 years with data centers at favorable prices, which provides another competitive advantage to this region.

With such stark differences in prices and other competitive advantages, Nordic-based data center operators can pass on the economic benefits to their customers.

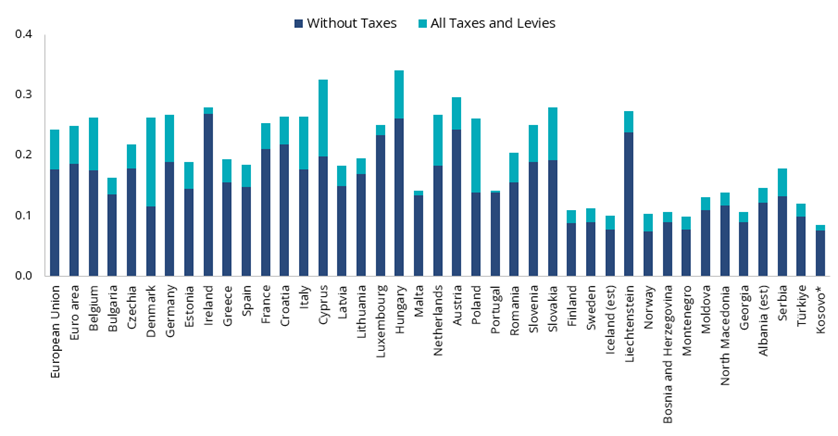

The image below shows the evident difference in energy prices between the Nordics and other European countries. Compared with countries such as Germany, France and the Netherlands, the difference is more than 50%.

Figure 2: Electricity Prices for Non-Household Consumers, Second Half 2023 (€ per kWh)

Source: Eurostat (online data codes: nrg_pc_205)

*This designation is without prejudice to positions on status and is in line with UNSCR 1244/1999 and the ICJ Opinion on the Kosovo Declaration of Independence.

Along with the economic benefits, businesses co-locating in the Nordics are expected to benefit from sourcing renewable energy for their operations, which would help lower their Scope 3 emissions, the most complex emissions to reduce. In addition, data centers located in naturally cooler Nordic countries would require less cooling, deriving energy efficiencies for environmental and economic benefits.

At-par connectivity

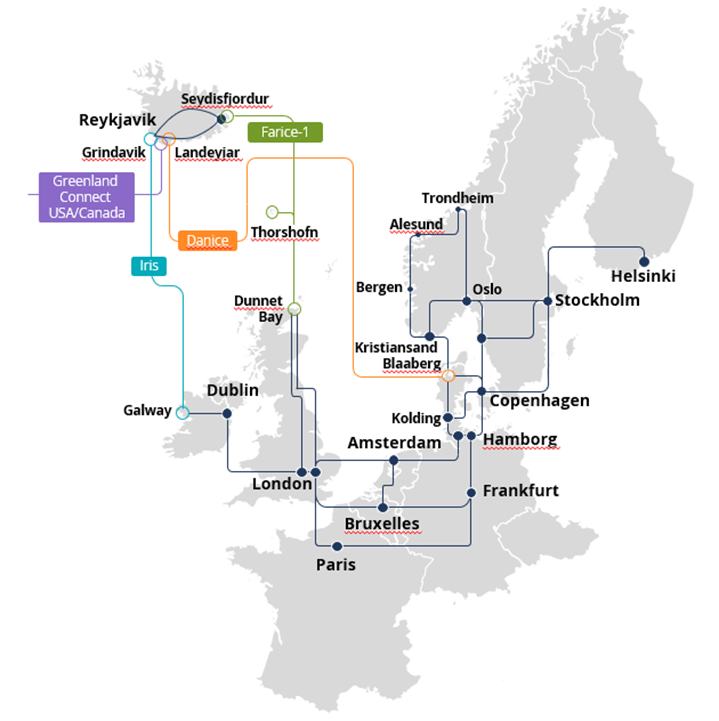

With improvements in international connectivity via subsea fiber-optic cables over the past few years, businesses are more open to locating their servers at remote locations, away from their customers' operations. Submarine connectivity has significantly reduced latency; for example, the recently operational IRIS network has reduced latency between Reykjavik and Dublin to just about 10.5 milliseconds.

Figure 3: Submarine Cable Systems IRIS, FARICE-1 and DANICE connecting Iceland to the rest of Europe.

Image Courtesy: Submarine Cable Networks and Farice

Another milestone in improving connectivity in the Nordics is an upcoming subsea cable network, IOEMA, that will connect five key north European markets: the U.K., Germany, the Netherlands, Denmark and Norway. This network is expected to reduce latency to just 5.5 milliseconds on specific routes and is planned for a late 2027 go-live date.

However, there remains a concern about ensuring the security of these cables. Given the immense importance of international communication in the global supply chain and economy, such cables are sometimes under the radar of cyberattacks that target the landing stations and network management systems used to monitor the cables remotely. Researchers from the U.S., Iceland, Sweden and Switzerland are developing an alternate methodology to reroute internet traffic from the undersea cables to satellite systems in case of a sabotage or a natural disaster to keep the communication chain intact.

Friendly geographic, political and regulatory environments

The Nordics offer a perfect combination of geographic and political resiliency, a stable economy and the availability of a skilled workforce. In addition, Denmark, Finland and Sweden are part of the European Union (EU), and the other two Nordic countries — Iceland and Norway, although not a part of the EU – are a part of the greater European Economic Area or EEA. While EU cybersecurity laws directly regulate the member states of the EU, the ones that are part of the EEA also informally follow the same laws as the EU. This explains why a changing regulatory landscape may not substantially impact where businesses store their data, as all Nordic countries follow a similar approach to cybersecurity regulations. However, enterprises should analyze the existing regulations by which the data center provider abides to avoid future redundancies.

Future data center landscape in the Nordics

The strategic placement of data centers can be crucial in addressing many of the challenges modern businesses face. With an ever-expanding array of options on where to invest, the Nordic region is rapidly emerging as the preferred destination for data center operations and colocation services. While enterprises should consider many other factors when choosing a colocation data center, an apt location provides the best combination of low latency, high reliability and geographic diversity to meet customer needs.

Further, with the rise of AI, high-performance computing and, eventually, quantum computing, the competitive advantages offered by the Nordics will become more evident. The Nordics is an ideal investment destination for data centers, and it is set to become a more attractive destination for businesses across the globe because of its unique value propositions.

ISG helps companies navigate the data center partner selection and negotiation process. Our ISG Provider Lens quadrant studies and specifically the IPL Private Hybrid Cloud Study 2024 are written to help you navigate the rapidly changing provider market and make the right choices for your company.

For a quick update on the U.K. and U.S. colocation market trends, read the following:

Focal Point-Private/Hybrid Cloud – Data Center Services 2024 - Colocation U.K.

Focal Point-Private/Hybrid Cloud – Data Center Services 2024 - Colocation U.S