5 Ways to Optimize Application Sourcing Costs in an AI-Enabled Market

Application sourcing —software, support, labor and managed services — presents a prime opportunity to reduce spend and improve value realization.

You can’t manage what you don’t measure.

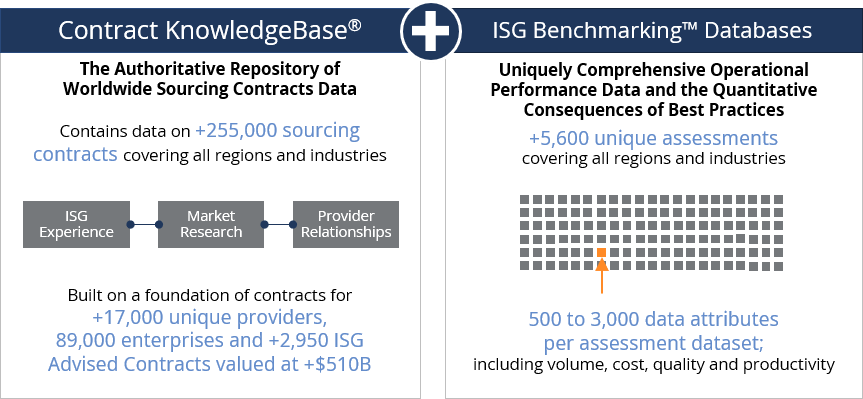

We have +15 years' experience helping enterprise clients compare defined services to the market.

We have the data and know-how to help you benchmark cost, quality and productivity across all functional areas of business and IT, including:

Find out the right benchmarking services for your needs and strategic objectives.

![]()

Price

Staffing rates, contract pricing and competitiveness

Cost

Total cost of ownership (TCO) and industry benchmarks

![]()

Performance

SLAs, user experience and provider relationships

Contract

Price, terms and conditions

Are total staffing levels and staffing utilization right for each functional area?

How do our level of assets compare? Are we providing the right service levels to users?

Are we spending the right amount of money in total, and by major functional area?

Where are the variances from leading practices?

Why and where are there gaps? How do we drive sustainable improvement?

What are the high impact, high ROI changes we can make in the immediate term?

Are there services currently provided in-house that should be outsourced, or vice versa?

What complexity or constraints could be alleviated through automation or simplification?

Outsourcing contracts become uncompetitive over time, but it’s difficult to know when it will happen – or by how much.

Whether you want to benchmark your outsourcing contracts’ price, compare your internal service delivery cost to the market or both, ISG gives you at-a-glance visibility into price competitiveness via a single-pane dashboard, plus access to deep dives into real-time IT industry market price intelligence.

In addition to the above project based price benchmarking services, you can also monitor the price competitiveness of your contracts in real time using using the ISG Probenchmark® price monitoring service.

Acting on timely, accurate and actionable price data allows enterprises to more quickly respond to changes in market prices and make more strategic decisions regarding their IT services.

To get a complete picture of your landscape, you need to understand your service quality and personnel productivity, potential efficiencies and gaps, user satisfaction, and how all these elements relate to cost and compare to the market.

We offer a holistic benchmarking solution that gives real-time, online dashboard visibility into the three key components of performance:

By comparing your spend, staffing allocations and performance across the enterprise, we help you identify opportunities to improve your financial and operational performance.

TCO Benchmark: Compares your total cost of ownership against industry standards of cost, quality and productivity for a variety of IT products and services.

Industry Benchmark: Compares costs against industry metrics, such as IT spend as a percent of revenue.

Get real-time access to cost benchmarking data with ISG Inform™.

Build a defense against the risks of fixed-price long-term contracts. Compare your contract price, terms and conditions to the market and know when your contract falls out of favor.

The terms and conditions of your contracts set guidelines of acceptable behavior, but they are evolving entities – and you need to manage that evolution. A commitment to benchmarking your contracts is a commitment to progress and improvement.

An ISG contract terms and conditions assessment can:

KPIs and SLAs are essential for tracking performance in terms of achieving strategic goals and making decisions. In the best of cases, KPIs can serve as an early warning system to let you know when you are heading off course and where

action might be needed.

An ISG performance benchmark compares your performance against industry peers and leaders and gives you a cost-effective approach to share, compare, improve, and transform internal functions and processes.

SLA Benchmark

assesses service levels against the market, including both performance levels and structure

User Experience Benchmark

measures the impact of technology on users, including customer satisfaction

ISG is a leader in proprietary research, advisory consulting and executive event services focused on market trends and disruptive technologies.

Get the insight and guidance you need to accelerate growth and create more value.

Learn MoreAgentic AI is emerging as a transformative force that redefines how organizations think, decide and act. Unlike traditional automation or GenAI, agentic AI systems are designed to autonomously execute business processes, dynamically pursue goals and collaborate across workflows. This shift to agentic AI marks a new chapter in enterprise intelligence, where decision velocity, contextual awareness and orchestration become the cornerstones of competitive advantage. Agents are capable of breaking down objectives into smaller tasks, planning execution strategies, interacting with multiple applications, collaborating with other agents and adapting to feedback. In this sense, agentic AI is designed to function more like a digital employee than a static tool. Although still an emerging market, with experimentation outpacing scaled adoption, agentic AI has already begun to shape the future of how organizations think about productivity, decision-making and business transformation.

Data governance is an issue that impacts all organizations large and small, new and old, in every industry, and every region of the world. Data governance ensures that an organization’s data can be cataloged, trusted and protected, improving business processes to accelerate analytics initiatives and support compliance with regulatory requirements. Not all data governance initiatives will be driven by regulatory compliance; however, the risk of falling foul of privacy (and human rights) laws ensures that regulatory compliance influences data-processing requirements and all data governance projects. Multinational organizations must be cognizant of the wide variety of regional data security and privacy requirements, not least the European Union’s General Data Protection Regulation (GDPR). The GDPR became enforceable in 2018, protects the privacy of personal or professional data, and carries with it the threat of fines of up to 20 million euros ($22 million) or 4% of a company’s global revenue. Europe is not alone in regulating against the use of personally identifiable information (other similar regulations include The California Consumer Privacy Act) but Ventana Research’s Data Governance Benchmark Research illustrates that there are differing attitudes and approaches to data governance on either side of the Atlantic.

Data governance is a hot topic these days. In fact, we are conducting benchmark research on the subject here. With increasing regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), organizations face more external oversight of their data governance practices. The risk of significant fines associated with these and other regulations, coupled with organizations’ internal compliance requirements, has brought more attention to data governance practices. We anticipate through 2023, three-quarters of Chief Data Officers’ primary concerns will be governing the privacy and security of their organization’s data.

Let's be blunt: The pressure to adopt AI in HR is a panic button being hit by the C-suite. The mandate from the boardroom is clear, and the pressure is intensifying: HR must adopt AI to remain competitive. This directive often lands on the desks of HR leaders who are already managing complex environments, creating a dangerous disconnect between executive ambition and operational reality.

Revenue organizations are running out of room to hide. With increasingly complex buyer journeys, longer sales cycles and rising expectations for personalized outreach, today’s CROs face a mounting challenge: deliver predictable growth in a market that’s anything but predictable while simultaneously building a team that doesn’t burn out.

Benchmarks ground strategy in reality by showing how you compare to peers on cost and performance. Used well, benchmarks reveal outliers to investigate and areas for improvement without pushing you to chase the lowest price or sacrifice quality.

Benchmarks reveal market-competitive rates and terms, letting you renegotiate with current providers instead of running a full RFP. That shortens time-to-value and reduces disruption while giving you the confidence that you’re paying a fair, defensible price.

A TCO benchmark looks at the whole solution, design, volumes, service levels, operating model and efficiency levers, so you spot bigger, more sustainable savings. Price-only benchmarks compare line items and can miss structural changes that lower overall cost.

No, benchmarks work best for fungible offerings with multiple suppliers. For proprietary products (e.g., software), pricing is shaped by bundles and SKU choices, so optimizing the bill of materials and total cost of ownership matters as much as discount level.