Hello. This is Stanton Jones and Steve Hall with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Solid Q1, but Uncertainty Ahead

The IT and business services industry continued to show resilience in Q1 despite macro-economic uncertainty. Sweeping tariffs and potential retaliatory measures are further intensifying short-term uncertainty, especially related to discretionary IT spending.

Data Watch

1Q25 Recap

- Managed services annual contract value (ACV) was up 2% Y/Y.

- EMEA led the growth in managed services; Americas was flat.

- BFSI was down 2% but showed signs of recovery over the last six months.

- ITO posted solid growth in both applications and infrastructure.

- Broad-based weakness in BPO spanned all service lines.

- Six mega deals (ACV > $100M) were awarded, up from four in 1Q24.

2025 Forecast

Despite a solid Q1, heightened uncertainty from trade policy, geopolitical tensions and evolving regulations is beginning to weigh on second-quarter forecasts. Enterprises are in a wait-and-see mode, holding discretionary budgets and re-evaluating capital-intensive projects.

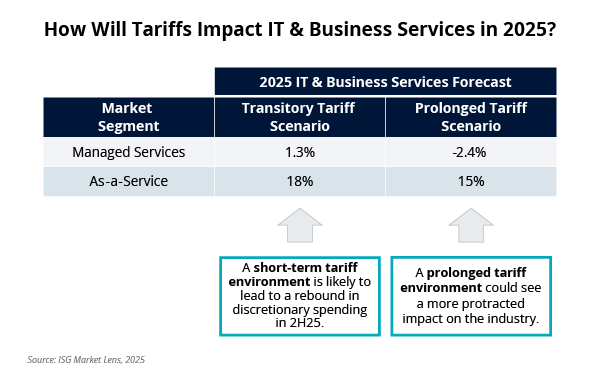

Given the uncertainty in the environment, we’re providing a scenario-based approach for our full-year outlook:

- Scenario #1: If tariffs are short term, we expect to see a rebound of discretionary spending in 2H25. In this scenario, we’re forecasting managed services to grow 1.3% and as-a-service to grow by 18%.

- Scenario #2: If tariffs cause a more protracted impact on the industry, we expect to see −2.4% growth for managed services and 15% growth for as-a-service.

You can catch a replay of the call here and download the slides here.