If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

HIRING

We’ve been discussing attrition in the IT services sector for a couple of quarters now. And rightly so. It’s the number one issue impacting enterprise IT services buyers today. The good news is that the data shows attrition has likely peaked at most IT services firms.

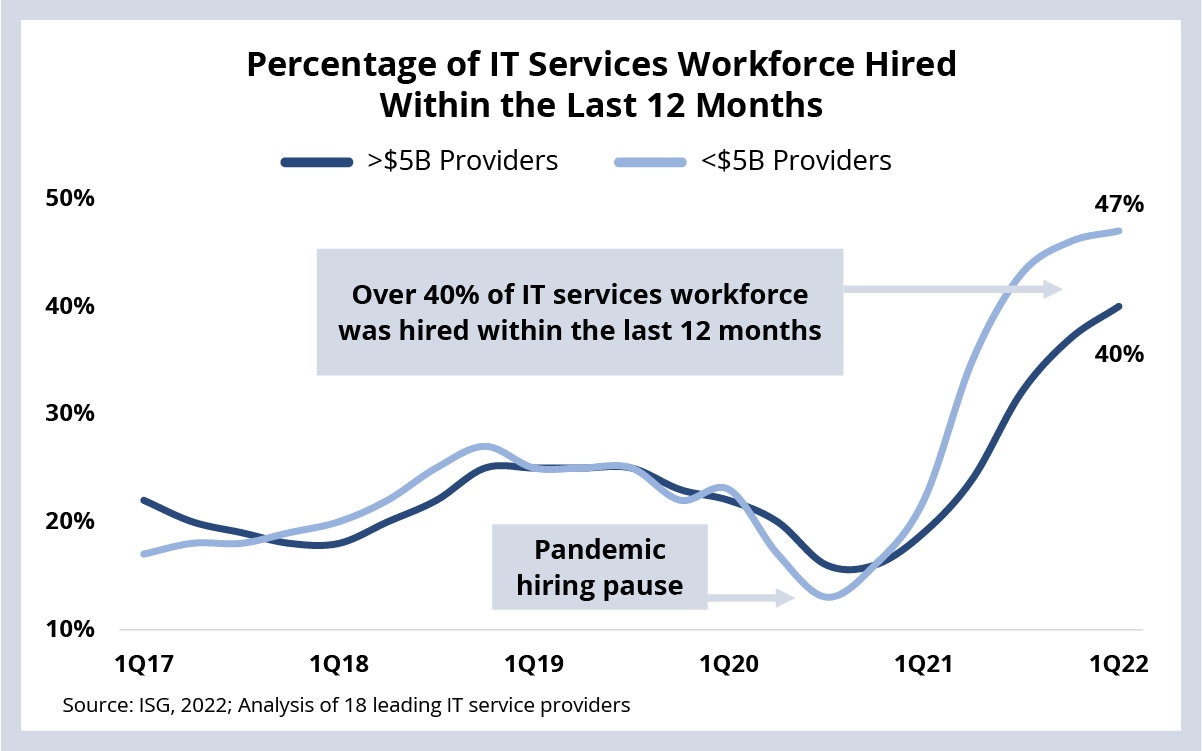

This week, we look at the implications of the record levels of hiring over the past several quarters in response to exceptionally strong demand. Recall that annual contract value was up 13% in the first quarter – that’s the fourth straight quarter with 10%+ growth.

Our research shows more than 40% of the workforce at leading IT services firms was hired in the last 12 months (see Data Watch). This much hiring this fast has led to a massive “reshuffling” in the IT services industry. This workforce rotation – “the Great Reshuffle” as its being dubbed – has certainly helped to keep up with the surge in demand. But it will also put a lot of pressure on providers to sustain and scale their service delivery, while at the same time instilling their unique culture and value into thousands of recent hires – many of whom have come from a competing provider.

If you look back over the past couple of decades, most providers with revenues over $5 billion have experienced a workforce surge like this before. However, many providers below $5 billion don't have the same institutional memory. This means that many providers are in unchartered territory in today’s high-demand, high-attrition environment.

This is not necessarily a bad thing – but it is something important for enterprise buyers to keep in mind. Ask questions about your providers’ track record during times of high growth, and what kind of investments they are making in their people, systems and management processes to scale their delivery – and their differentiation – while still achieving expected value.

I hope you can join Steve, Kathy, Namratha, Bernie and me on the 2Q22 Index webinar on July 13 when we’ll talk more about the Great Reshuffle and how ISG clients and service providers are responding.

DATA WATCH

M&A

- Avanade acquired mainframe modernization firm Asysco this week (link). Recall that Google Cloud acquired Cornerstone Technology in 2020 and AWS acquired Blu Age in 2021. Both are mainframe migration and modernization specialists. Given Avanade’s Microsoft alliance, it’s clear the big three hyperscalers are focused on capturing the massive mainframe workload opportunity.

- Microsoft acquires cyber threat analysis and research company Miburo (link). Cybersecurity-related acquisitions in both threat intelligence and attack surface management (ASM) continue apace. In this case, Microsoft is adding capability in threat intelligence, which is focused on identification of emerging threats. A few weeks ago, IBM acquired ASM firm Randori, which is focused on vulnerability to known threats.

- Argano acquires Oracle specialist NorthPoint Group (link) and SAP consulting firm Echelon Solutions Group (link).