Was this email forwarded to you? Sign up here to get the Index Insider every Friday.

Here’s what’s important in IT and business services this week:

- Digital engineering M&A is surging

- Platform expertise most important when selecting a systems integrator

- McCain Foods taps WNS for F&A transformation

Don’t miss next week’s Q1 ISG Index call. We’ll cover the performance of the global managed services and as-a-service markets and take a closer look at the energy sector. Register here.

ENGINEERING SERVICES

As the control point in the manufacturing value chain shifts from hardware to software and data, OEMs are making software engineering capability a strategic priority. Digital services integrated with physical devices creates recurring revenue, which means hardware companies need to master software – and fast. This is why digital engineering M&A is surging. This week, Hitachi announced a $9.6 billion acquisition of GlobalLogic, a San Jose-based product engineering firm.

The digital engineering sector is hyper-competitive. Manufacturers recognized years ago they need software expertise to close the “digital loop” between operational technology and information technology – especially in industries like automotive and aerospace.

But it’s not just OEMs that are after the digital engineering opportunity. Pure play IT services firms are in a race to capture market share in the connected devices and IoT space as well. In 2019, DXC acquired Luxoft and Capgemini acquired Altran to keep pace with product engineering capabilities from leading Indian-heritage firms.

Join my colleagues – and some amazing enterprise speakers – for our virtual Smart Manufacturing TechXchange on Tuesday, April 13, to learn more about what’s happening in this fast-changing industry.

HR TECH

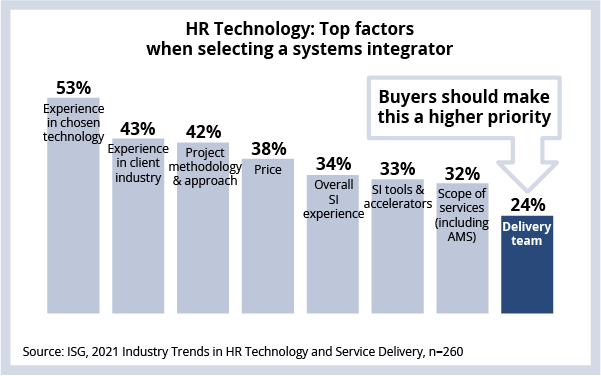

Enterprise HR and technology leaders say that experience in the chosen HR SaaS platform is the most important factor when selecting a systems integrator. Over half of respondents in our 2021 Survey on Trends in HR Technology and Service Delivery cited this as most important, with industry expertise and methodology rounding out the top three most important factors for selection (See Data Watch).

Price is just outside the top three but will always be a deciding factor for high-impact, high-visibility HR implementations. We see enterprises increasingly exploring a range of SIs – from large global consulting firms to India heritage firms to boutique SIs – which increases price competition.

Also interesting is the relative lack of importance of the SI’s delivery team. We believe the implementation team is a critically important area and should be a high priority on any HR tech buyer’s list. With increased demand today for HR SaaS technology, employee experience and talent analytics solutions, providers are struggling to staff projects – making it even more important to lock in key resources as part of the buying process.

DATA WATCH

DEAL ACTIVITY

- McCain Foods and WNS. World’s largest manufacturer of frozen potato products shifts F&A services from incumbent. Link

- HCL and Tenneco. U.S. automotive OEM modernizing its IT estate. Link

- Amcor and Orange Business Services. Australian-American packaging company extends hybrid cloud scope. Link

- SEB and Google. Nordic bank extends Google Cloud Platform internally and with customers. Link

- Alstom and BT. French rail transport company signs five-year SD-WAN agreement. Link

- Bloomin’ Brands and Virtusa. U.S. casual dining company signs five-year managed infrastructure deal. Link

- NAFCU and Persistent. U.S. trade organization representing federally insured credit unions picks a new preferred partner. Link

- Groupe PSA and Altran. French car maker uses simultaneous development model to build electric quadricycle. Link

M&A, ALLIANCES

- Microsoft acquires The Marsden Group. Digital engineering firm. Link

- Accenture acquires Cygni. European cloud native firm. Link

- Thoma Bravo acquires Calabrio. PE firm buys workforce optimization company from KKR. Link

- Wipro acquires Ampion. Australian cyber security services firm. Link

- RingCentral acquires Kindite. Cloud data encryption startup. Link

- Infosys and LivePerson. Partnership focused on creating omni-channel customer service conversations. Link

- Digital Realty and Google. Co-location provider adding five new on-ramps to GCP. Link