The Insurance sector is a trailblazer in the exploration and integration of generative AI (GenAI). According to ISG Research on GenAI, the Banking, Financial Services and Insurance (BFSI) industry comprises nearly a quarter of all GenAI utilization across various industries. This transformative technology shows promise of unlocking great value and innovation, enabling insurers to gain deeper insights into their clientele, enhance risk assessment precision and improve the quality of their offerings.

Where Is Your Firm on the GenAI Journey?

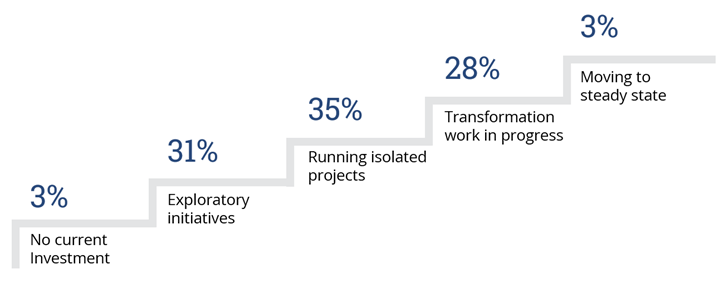

Based on ISG research, 63% of EMEA insurance firms have yet to see significant transformation from GenAI even though it is still considered a key investment priority.

Figure 1: GenAI Investment Stages

What Are Insurance Firms Hoping to Gain from GenAI?

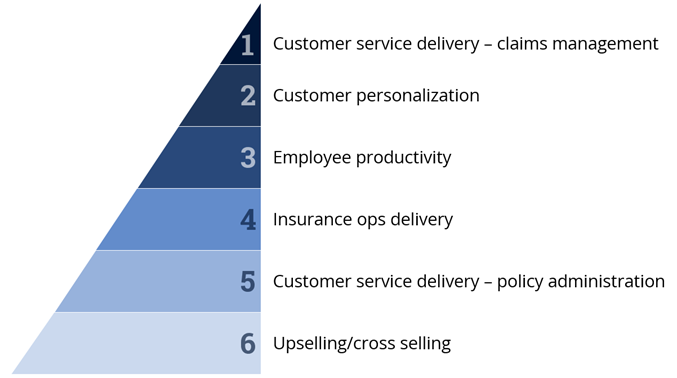

Our research finds the following expectations in order of priority:

Figure 2: GenAI Opportunity in Insurance

Only 5% of GenAI initiatives in Insurance have translated into tangible value.

While insurers have made significant strides to embrace GenAI, particularly in the ideation phase, a mere 5% of these initiatives have translated into tangible value. This underscores a prevalent trend: the Insurance industry is steeped in experimentation and enthusiasm surrounding GenAI, but conclusive outcomes remain elusive.

For insurance firms that are yet to explore this technological frontier, there exists a window of opportunity to get ahead of competitors before the landscape evolves further.

Please fill out this form to continue.

What Is the Impact of GenAI on Insurance Firms?

The insurance value chain encompasses various stages involved in the development and delivery of insurance products and services, from initial customer interaction to claims resolution and beyond. The following are examples that demonstrate the art of the possible with GenAI; enterprises need to adopt a balanced approach in exploring what solutions work best in their specific business context.

Figure 3: Impact of GenAI Across the Insurance Value Chain

Let’s dive into claims processing and explore how GenAI might be transformative in this context. Unlike conventional methods, which rely heavily on manual intervention and predefined rules, GenAI leverages the power of advanced algorithms to generate insights autonomously. This enables organizations to not only expedite the claims processing cycle but also optimize resource allocation and mitigate operational risks.

Impact of GenAI on Insurance Claims Processing

| First Notification of Loss (FNOL) | Claim Investigation | Claim Resolution | Negotiation | Payment |

|

Automated data extraction: Analyze incoming data from various sources such as emails, forms and images to extract relevant information about the claim. Natural language processing (NLP) for customer communication: Engage with customers in natural language, offering personalized guidance and support to policyholders. |

Intelligent analysis: Analyze details of damages submitted by customers to assess the extent and nature of the loss, assisting adjusters in making faster and more accurate decisions, reducing the likelihood of errors or delays in investigations. Pattern recognition: Analyze historical data and patterns, identify potential fraud or inconsistencies in claims and aid investigators in prioritizing cases and focusing their efforts effectively. |

Decision support: Analyze policy details, claim information and relevant regulations to make recommendations for claim resolution, accelerating the process and reducing manual intervention and quicker payouts for policyholders. Fair Outcomes: Ensure that claim resolutions are based on objective criteria and fair assessments, increasing trust and satisfaction among policyholders. |

Tailored Solutions: Personalize negotiation strategies based on individual policyholder profiles and preferences, maximizing the chances of achieving mutually beneficial outcomes. Data-Driven Negotiation: AI-powered systems can generate personalized negotiation scripts based on the specifics of the claim and policy, facilitating smoother and more effective communication between insurers and claimants. |

Expedited Processing: Generative AI can automate payment processes, reducing administrative burdens and expediting payouts to policyholders, enhancing overall satisfaction. Fraud detection: AI algorithms can continuously monitor payment transactions for suspicious patterns or anomalies, flagging potential fraud cases for further investigation and safeguarding insurers from financial losses. |

What Is the Expected Impact of GenAI on Insurance?

GenAI has the potential to substantially improve the efficiency of claims handling, customer satisfaction and operating costs.

According to ISG analysis, European insurance firms stand to experience significant enhancements in operational efficiency and service quality, with potential improvements in claims handling efficiency and quality ranging between 40% to 60%. This advancement will be coupled with a notable boost in customer satisfaction, projected to increase by 30% to 40%. According to experts in the field, the adoption of GenAI technologies could yield substantial reductions in operating cost.

The realization of these benefits hinges on the extent to which insurance firms adopt and seamlessly integrate GenAI throughout their value chain.

What Is ISG’s Recommended Approach for Insurance Firms to Implement GenAI?

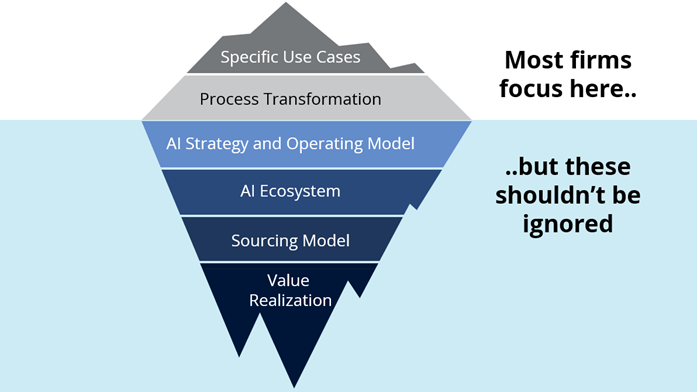

ISG has observed a discernible trend in the adoption of GenAI, with enterprises typically adopting a two-step method, which may seem pragmatic, but is not the optimal approach:

First, insurance enterprises embark on a journey to showcase tangible value through the implementation of specific use cases. These cases often revolve around enhancing day-to-day operations, leveraging AI for tasks like coding assistance or deploying chatbots as knowledgeable assistants. This initial phase serves not only to demonstrate the feasibility of GenAI integration but also to garner buy-in and acceptance from stakeholders.

Subsequently, the focus shifts toward comprehensive transformation initiatives aimed at reshaping end-to-end processes. This evolution sees the adoption of automated claims processing, personalized marketing strategies, and more, as insurers seek to leverage GenAI’s capabilities to enhance efficiency and customer experience.

While this sequential approach may seem pragmatic, ISG advocates for a more holistic perspective. We recommend insurance firms adopt a comprehensive strategy that considers the broader organizational landscape and aligns GenAI initiatives with overarching business objectives. Enterprises should resist the temptation to be consumed by the hype surrounding GenAI or rush to implement the latest GenAI tools and platforms blindly, and instead focus on specific business objectives that GenAI can deliver. In short, GenAI should be a business-led discussion rather than a technology-led one. By adopting this more strategic stance, firms can maximize their chances of realizing substantial and sustained value.

Figure 4: A Holistic View of GenAI Adoption

A holistic approach to GenAI is required for realizing substantial and sustained value. ISG’s reference architecture for GenAI can guide you in this journey.

ISG’s GenerativeAI Reference Architecture

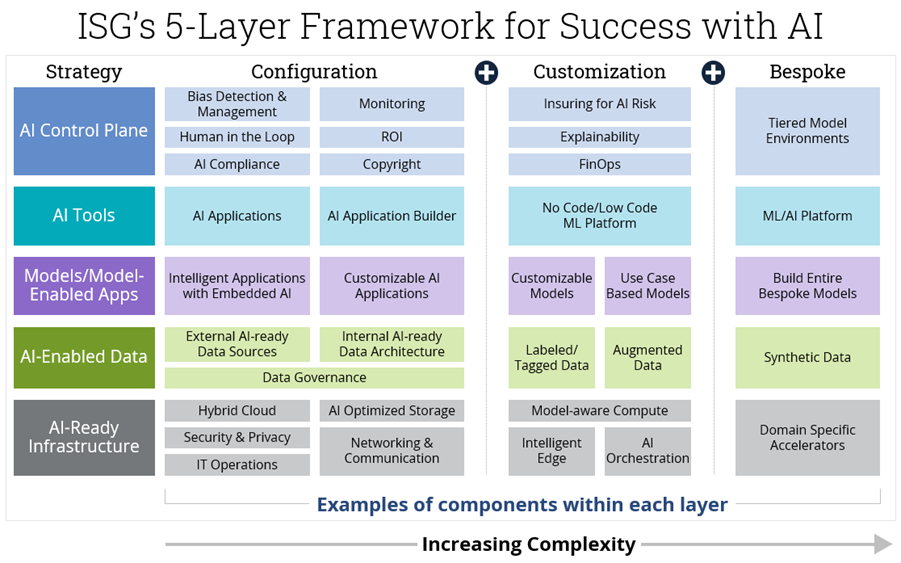

Enterprises often view GenAI as a standalone solution capable of addressing various business and technological hurdles while generating value independently. However, such an approach may yield subpar outcomes. At ISG, we advocate for a paradigm shift, urging enterprises to perceive GenAI as a constellation of relationships and components. These elements, akin to conceptual building blocks, amalgamate to construct a robust framework that caters to business needs, aiming at cost reduction and fostering avenues for revenue expansion.

To facilitate this transformative perspective, ISG has crafted a reference business architecture. This blueprint serves as a guide for enterprises navigating the complex terrain of integrating GenAI into their existing business landscape. By delineating key relationships and components, ISG's approach transcends the conventional notion of GenAI as a mere tool, elevating it to the status of a strategic enabler poised to revolutionize business operations and drive sustainable growth.

Figure 5: ISG’s GenAI Reference Architecture

The ISG GenAI reference architecture includes the following five layers:

- AI Control Plane: This consists of capabilities and tools that allow GenAI to be executed in a controlled manner with the appropriate level of oversight. This ensures ethical, secure, compliant, reliable implementation, operation and tracking of GenAI.

- AI Tools: This layer consists of the tools and platforms that support AI development, implementation, maintenance and support. While there are several clear leaders in this category, there are also a lot of newcomers in the market.

- Models / Model-Enabled Apps: This constitutes the models that could be used by an enterprise, which could be applications with built-in AI capabilities, customized model for a specific purpose or bespoke models built from the ground up.

- AI-Enabled Data: Data is the cornerstone of a successful AI strategy. Investing in the right data, data processes and architecture and understanding the limitations are keys to leveraging GenAI models.

- AI-Ready Infrastructure: This forms the technological foundation needed to operate AI workloads and AI applications, including hybrid cloud technology platforms, security policies, edge computing and other purpose-built assets that serve and enable GenAI.

This reference architecture can serve as a useful guide for enterprises venturing into GenAI deployment, by providing a view of building blocks required across five layers. The “configuration” level is the initial steppingstone into GenAI deployment and is likely to be sufficient for most enterprises. The more complex “customization” level allows for fine-tuning of GenAI in alignment with the business context and objectives. The most complex “bespoke” level is a fully customized GenAI landscape for targeted outcomes. ISG recommends that enterprises choose the least complex level that matches their technical capabilities and achieves specific business objectives. With the hype around GenAI, it’s easy to be distracted and get stuck in an endless loop chasing the latest technical innovations. ISG’s reference architecture helps enterprises ensure their GenAI investments deliver business outcomes.

How Is ISG Supporting Enterprises with GenAI Implementation?

ISG is actively advising enterprises around the world in their GenAI journey. Specifically, we support the following activities:

- Overall market landscape: ISG AI research provides a review of the state of the market to better understand how large enterprises are sourcing and buying AI and AI-related services.

- AI service categories and offerings: We provide the current state of services, service categories and offerings for AI technologies, implementation, provisioning and adoption at enterprise scale – as a basis for provider-ecosystem selection and pricing.

- AI provider ecosystem: We have the current perspective of the top market players by service category, including a perspective on traditional and niche providers and emerging services.

- How to approach sourcing for AI: Translate the above into the implications for sourcing for AI (e.g., implementation of use cases, provisioning hosting) including considerations for competitive bidding.