Why Industry Cloud Platforms Are Exploding

The global industry cloud platform market in 2023 was valued at $68.5 billion. It is forecasted to grow at a CAGR of 17.5% through 2032. Why are industry cloud platforms becoming so popular?

Traditional “one size fits all” cloud models are reaching their limits as industries become more complex and regulatory demands intensify. Industry clouds represent the next frontier in cloud evolution—they are purpose-built, compliant and deeply integrated with the operational DNA of a specific sector. Whether it’s a healthcare provider navigating patient data privacy, a bank managing compliance under global financial standards or a manufacturer optimizing digital supply chains, the demand for tailored cloud platforms has never been more urgent—or more promising.

These platforms offer built-in compliance, tailored data models and pre-integrated applications that speed up deployment and accelerate time to value. Their ability to seamlessly integrate with existing legacy systems and modern digital ecosystems is vital in sectors such as healthcare, finance and manufacturing, where fragmentation can stifle innovation and compliance.

The stakes are high: early adopters are gaining speed, agility and competitive edge, while laggards risk falling behind in operational efficiency and market relevance. As generative AI, IoT and advanced analytics reshape industries, the ability of industry clouds to blend technology with sector expertise will define the next wave of digital transformation.

For decision-makers, the mandate is clear — invest now to lead tomorrow. But realizing this vision demands more than technology; it calls for an ecosystem of partners, skills and accelerators to succeed.

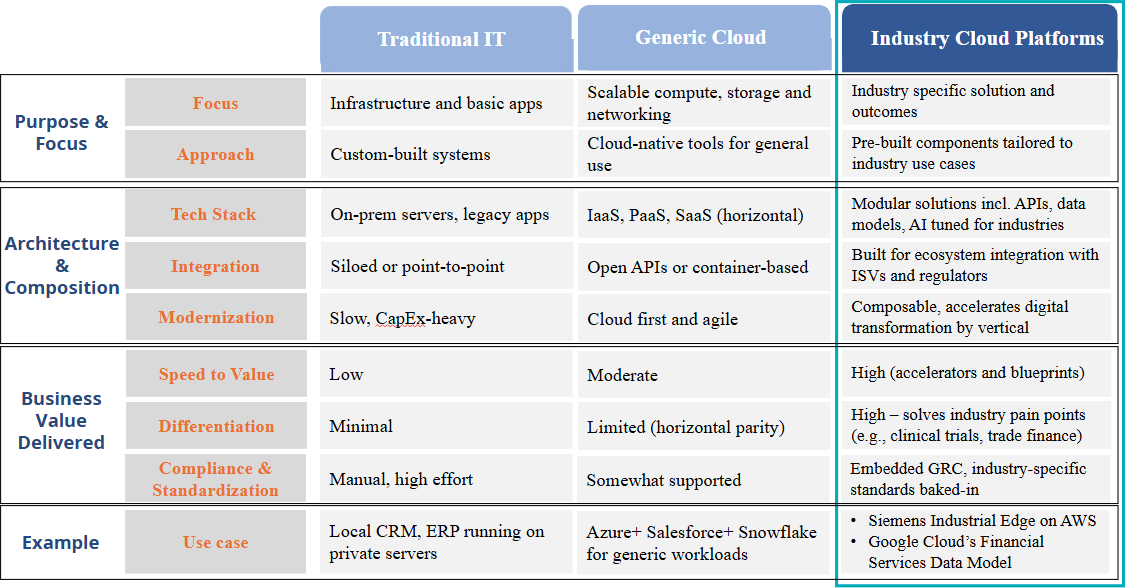

Why Generic Cloud Solutions Fall Short in Today’s Complex Market

The public cloud market has expanded at an unprecedented pace, driven by demands for faster time-to-market, automation, seamless integration and emerging innovations like generative AI. According to the ISG Market Lens™ Cloud Managed Services Study, more than 50% of application categories were in the cloud in 2024, compared with just 23% in 2022. Yet, as adoption accelerates, a growing number of enterprises are recognizing the limitations of generic, one-size-fits-all cloud platforms in addressing the realities of today’s industry landscapes.

Highly regulated and operationally complex sectors face three persistent challenges:

Regulatory gaps: Generic cloud solutions often lack built-in, sector-specific compliance frameworks to address stringent requirements such as HIPAA in healthcare, Basel III in banking or ISO standards in manufacturing.

Interoperability barriers: Integrating with fragmented legacy systems, specialized applications and multi-vendor ecosystems can be cumbersome, slowing transformation and creating operational silos.

Lack of domain fit: Generic architectures rarely align with the unique data models, workflows and performance demands of specific industries, leading to costly customizations and delayed value realization.

These limitations have accelerated the shift toward industry cloud platforms. Industry cloud platforms are cloud solutions designed specifically for the needs of a single industry. They combine general cloud capabilities with industry-specific applications, data models and compliance features, while embedding modern technologies like AI, analytics and automation. Built on standard cloud infrastructure, industry cloud platforms connect seamlessly with core enterprise systems—such as finance, supply chain and HR—so organizations can innovate faster, meet regulatory requirements more easily and adapt quickly to change across their value chain.

These platforms offer flexible architectures that support the high-volume data demands of connected devices, sensors and production systems. The adoption of Industry 4.0 technologies—including AI, edge, IoT and predictive analytics—further underscores the need for cloud platforms that deliver enhanced connectivity, interoperability and automation.

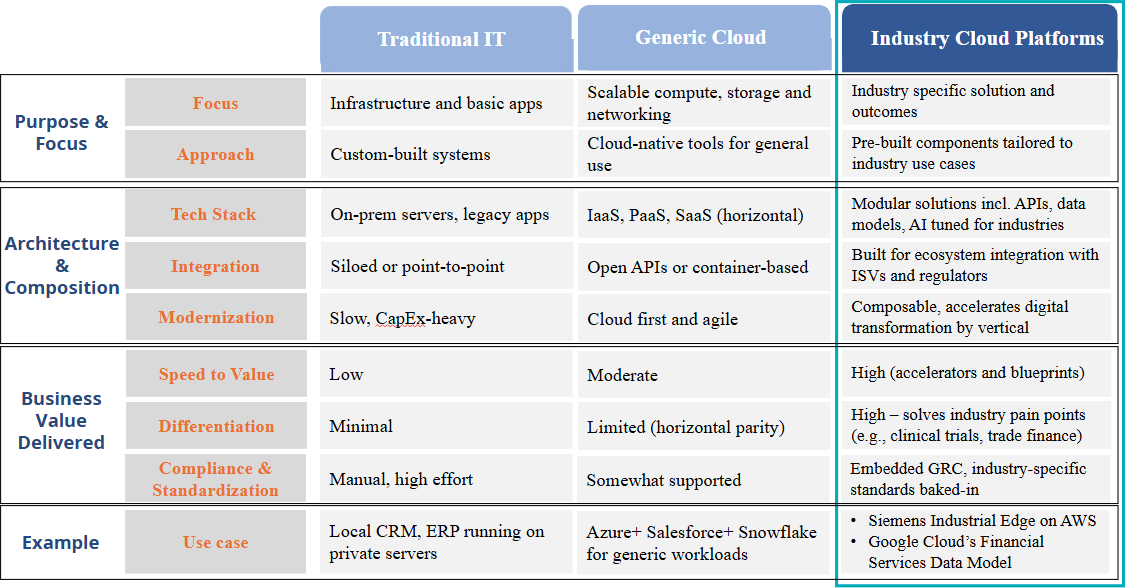

Figure 1: The Differences: Traditional IT vs. Generic Cloud vs. Industry Cloud Platforms

Facing Industry Pressures? Here’s Why Sectors Need a Specialized Cloud Approach

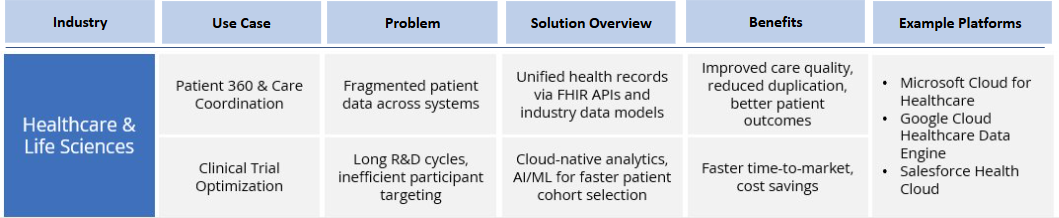

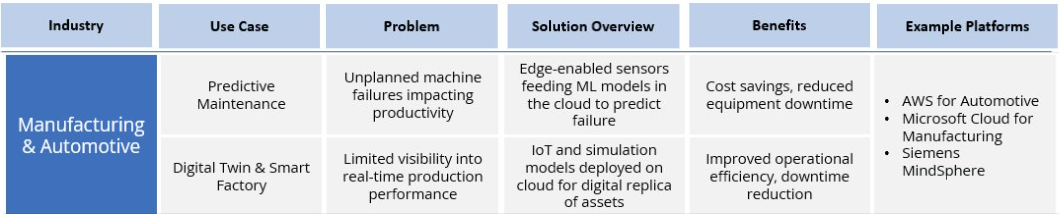

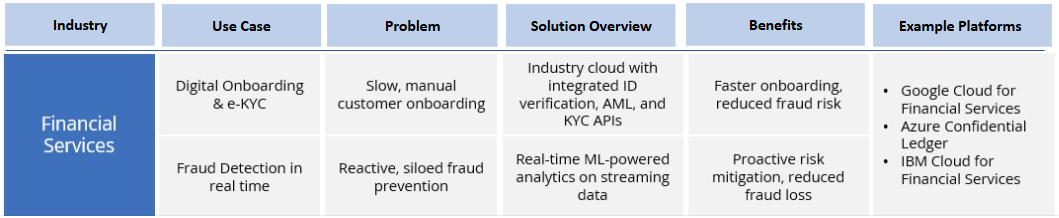

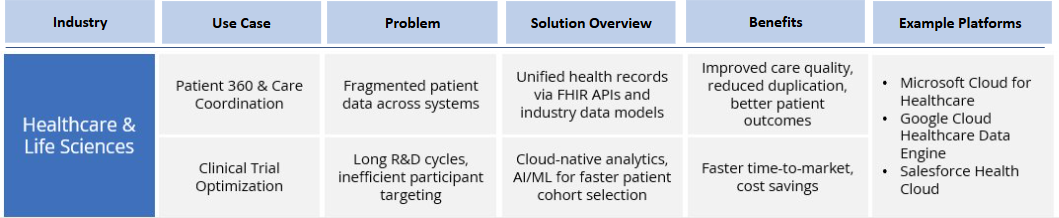

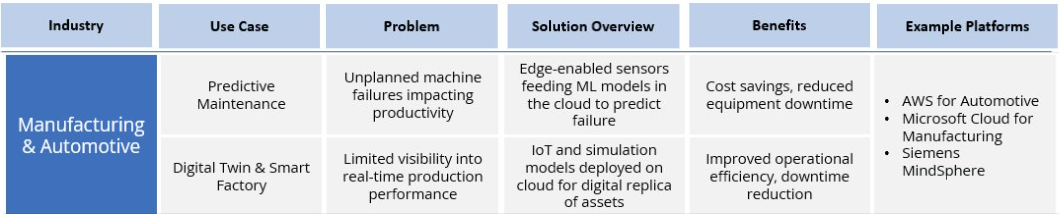

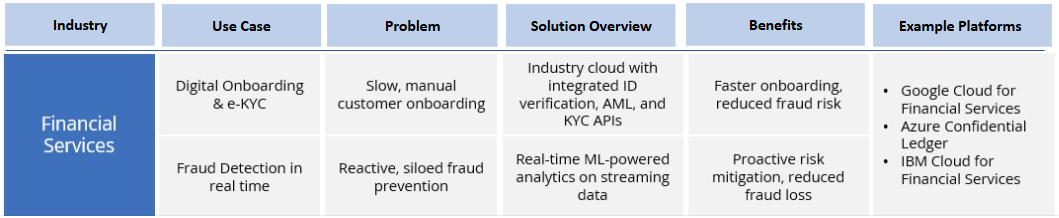

Different industries face different key challenges in today’s technology-enabled landscape. Many of these challenges are linked to how their legacy systems and cloud systems integrate or fail to integrate. Here are some examples of those industry-specific challenges:

Healthcare and Life Sciences: Disconnected EHR systems, strict data privacy laws, poor interoperability and rising demand for cost-efficient, personalized care

Financial Services: Heavy compliance burdens (e.g., Basel III, MiFID II, PCI-DSS), legacy systems slowing innovation, escalating cyber/fraud risks and the push for real-time, AI-driven insights

Manufacturing and Automative: Supply chain fragility, weak IT–OT integration, sustainability mandates and shortage of Industry 4.0-ready skills

Retail and consumer goods: Need for personalized, real-time engagement, volatile supply chains, fierce digital competition and omnichannel integration challenges

Public Sector and government: Data sovereignty rules, outdated infrastructure, high security/compliance demands and budget constraints limiting modernization

Telecommunications: High 5G deployment costs, complex OSS/BSS systems, network performance issues and pressure for rapid service innovation

Energy and Utilities: Aging grids, fluctuating demand, environmental compliance pressures and need for real-time asset monitoring

Education: Unequal tech access, student/staff data privacy, fragmented digital learning tools and growing cybersecurity risks

Media and entertainment: Low-latency content delivery, piracy and IP threats, multi-channel monetization challenges and demand for AI-driven personalization

These sector challenges highlight the limitations of generic cloud platforms and underscore the strategic role of industry cloud platforms in addressing compliance, interoperability and operational complexity.

Please fill out this form to continue.

Discover the Power of Industry-Specific Clouds Built for Compliance and Efficiency

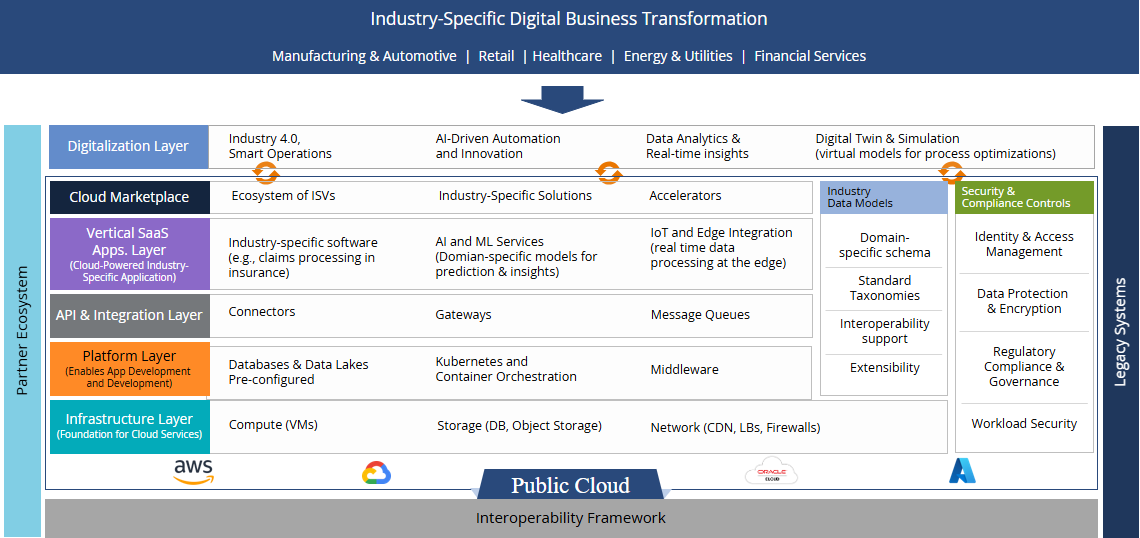

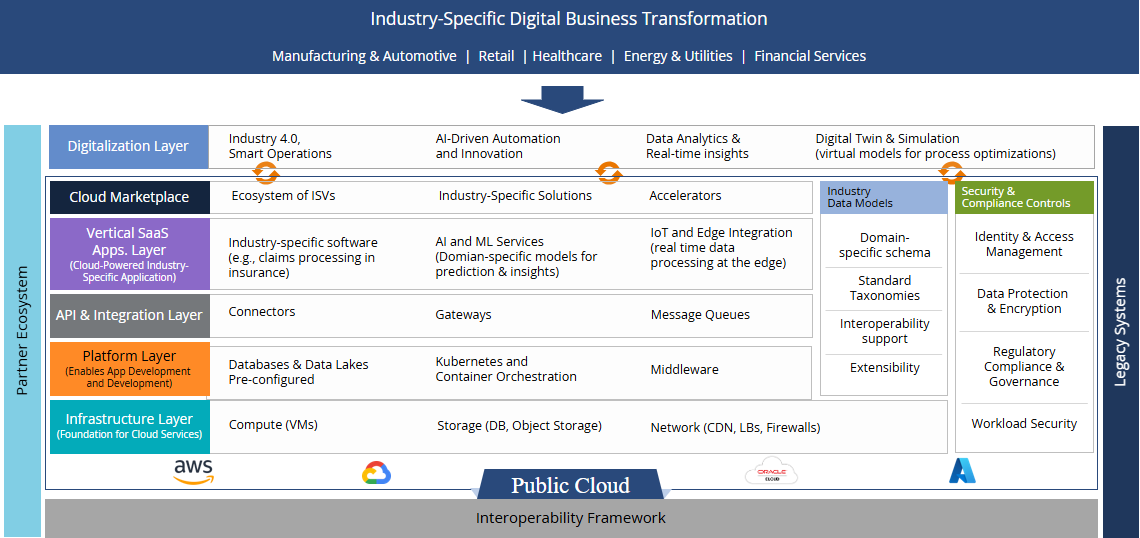

Key technology components that power industry cloud platforms can enable them to meet sector-specific needs with scalability, compliance and interoperability. Some of these components include:

Component | Description |

Industry Data Models | Predefined schemas and taxonomies tailored for sector-specific data (e.g., HL7/FHIR in healthcare, ISO 20022 in finance) |

Cloud Infrastructure (IaaS) | Compute, storage and networking services with compliance built-in for regulated industries |

Platform Services (PaaS) | Middleware, databases and integration services pre-configured for specific use cases |

Vertical SaaS Applications | Industry-specific software (e.g., claims processing in insurance, MES in manufacturing) built on cloud-native stacks |

Security & Compliance Controls | Embedded data protection, identity management, encryption and regulatory frameworks (e.g., HIPAA, GDPR, GxP) |

API & Integration Layers | Prebuilt APIs and connectors for seamless integration with legacy systems, third-party apps and partner ecosystems |

AI/ML & Analytics Engines | Domain-specific models for automation, prediction, personalization and insights (e.g., demand forecasting in retail) |

IoT & Edge Integration | Real-time data processing at the edge; useful in sectors like manufacturing, logistics and automotive |

Digital Twin & Simulation | Virtual models for process optimization and monitoring (e.g., plant operations and patient pathways) |

Industry Cloud Marketplace | Ecosystem of certified ISVs, solutions and accelerators specific to industry needs |

Interoperability Frameworks | Standards-based architecture for cross-system data exchange and orchestration |

These components collectively enable faster time-to-value, regulatory readiness and innovation at scale, making industry clouds a foundational layer for enterprise digital transformation. Figure 2 shows an architectural view of the components and their interactions in an industry cloud platform stack.

Figure 2: Industry Cloud Platform Stack

Industry Cloud Development: How Cloud Providers, Software Vendors and System Integrator Shape the Platform

The successful development and deployment of an industry cloud platform relies on a collaborative ecosystem of three key players—cloud service providers, software vendors and system integrators/managed service providers (SIs/MSPs)—each bringing unique capabilities and value to the table.

Here is how they typically play their roles:

Ecosystem Players | Role | What They Do |

Cloud Service Providers (e.g., AWS, Azure, Google Cloud) | | Provide native cloud services (e.g., AI/ML, IoT, data lakes, analytics) that can be extended into industry use cases.

|

Software Vendors (e.g. SAP, Salesforce, Workday, Oracle) | | |

System Integrators/ Managed Service Providers (SIs/MSPs) (e.g. Accenture, TCS, Infosys) | | |

While cloud service providers deliver the technical foundation, software companies bring deep domain solutions, and SIs ensure successful design, implementation and scaling. Together, these players co-create scalable, modular and industry-aligned platforms that help enterprises modernize operations, accelerate innovation, and unlock new business models.

Real-World Proof Industry Cloud Platforms Deliver Big Results

Across industries, enterprises are already seeing the benefits of industry cloud platforms. These recent, high-impact examples of the value of industry cloud platforms show how companies are driving operational efficiency, supporting compliance and enabling rapid innovation at scale.

Healthcare: "Mayo Clinic Platform provides partners and innovators secure access to 13.6 million de-identified patient records, 5.8+ billion medical images, and 2.7+ billion lab results. This massive, compliant data resource dramatically accelerates the development, validation and deployment of AI-driven healthcare solutions."

Manufacturing: “Volkswagen’s Industrial Cloud integrates more than 120 manufacturing plants globally using AWS services, leading to a 30% improvement in productivity and cost savings of up to €1 billion. This strategic initiative leverages cloud-enabled IoT solutions to standardize and optimize production processes at massive scale."

Financial Services: "JPMorgan Chase has migrated 75% of its data and 70% of its applications into secure cloud environments. Additionally, more than 5,000 employees now leverage AWS SageMaker monthly to create scalable AI models that drive innovation, risk management and enhanced customer experiences."

9 Business & Strategic Benefits: Why Industry Cloud Platform Matters

What are the core business and strategic benefits of industry cloud platforms?

Faster time to value: Preconfigured industry processes, workflows, and integrations dramatically reduce implementation timelines and accelerate digital outcomes.

Operational efficiency: Streamlined data flows, automation, and real-time visibility enhance productivity across departments and reduce dependency on legacy systems.

Cost optimization: Pay-as-you-use pricing, automated updates, and centralized infrastructure lower total cost of ownership and minimize capital expenditure.

Regulatory compliance and risk mitigation: Industry clouds embed frameworks such as HIPAA, Basel III, and GDPR, reducing compliance complexity and mitigating audit risks.

Data-driven decision-making: AI/ML-ready data models and industry-aligned analytics tools provide actionable insights for forecasting, fraud prevention, and customer engagement.

Vertical differentiation: Tailored features and domain-specific functionality help organizations create unique, sector-relevant customer experiences.

Accelerated innovation: Cloud-native development platforms and industry-specific APIs enable rapid experimentation, co-creation, and deployment of new services.

Scalable and future-ready: Support for IoT, edge computing, and hybrid models ensures flexibility and readiness for future technology adoption.

Ecosystem connectivity: Open integration layers and interoperability frameworks foster secure collaboration with partners, suppliers, and regulators.

Overcome Your Cloud Adoption Fears with These Proven Strategies

While industry cloud platforms promise industry-tailored innovation, operational agility and regulatory alignment, many organizations still hesitate to make the leap. These concerns are often rooted in real-world experiences—both from early adopters and cautious observers. Addressing them head-on is key to accelerating adoption. Here is a list of common barriers, their solutions and the expected outcomes.

Barriers | Solutions | Expected Outcome |

Legacy System Complexity: Older on-prem systems have deep customizations, making integration difficult. | Use middleware/adapter layers Prioritize systems with high integration feasibility Gradually modernize core platforms in parallel | Reduced integration friction, phased modernization without business disruption |

Data Sovereignty & Compliance: ICP data storage may conflict with local laws and industry-specific mandates. | Choose region-specific hosting options Employ hybrid deployment for sensitive workloads Leverage in-country data encryption & key management | Compliance with jurisdictional requirements, avoidance of regulatory penalties |

Vendor Lock-In Concerns: Long-term dependency on a single provider limits flexibility and inflates costs. | Use API-first, standards-based architecture Negotiate exit clauses & data portability Employ multi-cloud interoperability | Flexible architecture, reduced dependency risk, better negotiation leverage |

Migration & Change Complexity: Shifts in roles, processes and culture create adoption friction. | Use phased migration starting with low-risk workloads Implement structured change management Leverage vendor accelerators & automation | Smooth transition, minimal disruption, faster adoption |

Skill Gap & Adoption Readiness: Lack of in-house expertise to operate and innovate with ICP. | Create structured ICP training programs Partner with vendors for knowledge transfer Upskill teams through certification tracks | Stronger internal capabilities, reduced dependency on external consultants, sustainable operations |

High Cost & Uncertain ROI: Industry cloud platform features may not justify higher spend without clear benefits. | Run targeted pilot projects Track tangible & intangible benefits Align KPIs to business outcomes | Faster proof of value, improved board confidence, optimized spending |

Real-world adoption challenges are valid—but they are not insurmountable. Enterprises can tackle vendor lock-in, ROI uncertainty, migration complexity and compliance doubts with structured, proven strategies.

Below is a recommended roadmap to guide business and IT leaders from exploration to enterprise-wide adoption.

Assess strategic fit and readiness.

Align industry cloud platform adoption goals with enterprise business strategy and digital transformation roadmap.

Identify high-value business areas and processes where industry-specific capabilities can create measurable impact.

Assess current technology landscape, legacy systems, integration constraints and organizational change readiness.

Conduct market scan and vendor shortlisting.

Research available providers relevant to your industry.

Benchmark capabilities, adoption maturity, compliance readiness and innovation track record.

Create a shortlist of vendors aligned with your regulatory, operational and budgetary requirements.

Evaluate platform capabilities and selection criteria.

Define evaluation framework (technical fit, industry depth, scalability, security and ecosystem support).

Conduct RFPs or structured demos to assess vendor offerings.

Include integration capabilities, AI/automation potential and partner network as key decision factors.

Launch a Controlled Pilot / Pilot Implementation

Select a representative business function or geography for initial rollout.

Set clear pilot objectives, KPIs and success benchmarks.

Minimize operational risk by limiting scope but ensuring end-to-end process coverage.

Measure ROI and refine business case

Track pilot outcomes against predefined KPIs (efficiency gains, compliance improvements, cost savings).

Gather user adoption feedback and lessons learned.

Refine financial and operational projections for enterprise-wide rollout.

Plan enterprise-scale rollout / enterprise-wide adoption plan

Develop a phased adoption strategy by business unit, geography or process cluster.

Create integration and migration timelines with clear dependencies.

Ensure robust change management and training programs are in place.

Define success metrics and governance / foster strategic partnership

Establish ongoing performance tracking dashboards linked to business outcomes.

Set governance structures for continuous improvement, innovation adoption and compliance monitoring.

Cultivate a strategic relationship with the ICP provider to influence roadmap and co-create future capabilities.

Industry cloud platforms are not just an investment in infrastructure—they are an investment in industry agility, resilience and innovation. Taking a structured approach to evaluation, piloting and scaling ensures you unlock maximum value while staying in control of cost, compliance and competitive differentiation.

How ISG Helps You Capture Maximum Value from Industry Cloud Platforms

Realizing the full value of an industry cloud platform requires strategic planning, technology alignment and ecosystem orchestration. This is where ISG can play a critical role.

We help enterprises navigate complexity by assessing the industry-specific cloud landscape, maturity and provider ecosystem. We understand companies need to mitigate risks differently depending on their industry. We help them evaluate technical feasibility, compliance requirements and integration challenges before they get started down the route of selecting a provider. Our design roadmaps are designed specifically to link industry cloud platform adoption to measurable business outcomes, so companies can accelerate time to value. And we support operating model shifts, reskilling and stakeholder alignment.

We use the value equaton vector to help companies achieve their business goals. In the below equation, V is business value delivered, P is platform capability, I is industry workflows, R is adoption readiness. Coefficients a, b and c are weights that vary based on the enterprise’s priorities, complexity and readiness.

ISG supports the following strategic activities to enable and accelerate value realization:

Activity | Description |

Client Priority Assessment | Rank strategic goals (e.g., cost optimization, compliance, speed-to-market, customer experience).

|

Define Platforms, Workflows and Adoption Readiness | P (Platform Capabilities): Assess cloud service provider and independent software vendor offerings to identify solutions that align with the client’s target architecture, scalability requirements and innovation goals. This includes evaluating integration flexibility, security posture and alignment with enterprise technology roadmaps.

I (Industry Workflows): Design sector-specific workflow blueprints that leverage leading practices and digital enablers. (E.g., smart factory automation for manufacturing, care coordination platforms for healthcare and real-time fraud detection for financial services). These workflows are optimized to address industry pain points while maximizing the value of platform capabilities.

R (Adoption Readiness): Evaluate the organization’s ability to absorb and operationalize the new solutions, factoring in legacy system complexity, integration challenges, operating model shifts and workforce readiness. Address change management, training, and governance to ensure sustainable adoption and measurable business impact.

|

Establish Measurable Outcomes | Establish specific, measurable, achievable, relevant and time-bound (SMART) KPIs that will be used to track progress and prove value realization. |

Ongoing Recalibration | Help recalibrate a, b, c as business evolves by |

As a trusted strategic advisor, our role is to guide enterprises through the complex journey of value realization, ensuring that platform capabilities, industry workflows and adoption readiness are aligned to deliver measurable business outcomes.

Lead Your Industry with Next-Generation Cloud Innovation

Industry cloud platforms are no longer a “nice-to-have” — they are fast becoming the decisive battleground for industry leadership. In a world where compliance is complex, customer expectations are soaring, and innovation cycles are shrinking, ICPs deliver what generic cloud cannot: industry-tuned intelligence, embedded trust and the agility to outpace disruption. They don’t just support transformation — they accelerate it, enabling organizations to reimagine operations, launch differentiated offerings and create value at unprecedented speed.

Here are the six key trends driving adoption of industry cloud platforms across industries:

Integration of emerging tech: industry cloud platforms are evolving to include AI/ML, IoT, digital twins and low-code/no-code tools to drive process automation and industry specific intelligence.

Shift toward vertical SaaS: The rise of vertical SaaS players (e.g., Veeva in life sciences, nCino in banking) is forcing hyperscalers and ISVs to bundle domain-specific offerings.

Procurement trend: Enterprises are increasingly bundling industry cloud with transformation programs (ERP modernization, digital factory, etc.).

Faster time to value: Organizations report 20–30% reduction in implementation timelines using industry cloud platforms versus traditional cloud.

Ecosystem convergence: Strategic partnership between cloud providers, ISVs and SIs and joint go-to-market models are becoming a dominant trend to co-create and scale industry cloud platforms

Skills and change management gap: Limited domain-specific cloud skills hinder industry cloud platforms adoption, driving demand for advisory services and specialized training platforms.

The winners of tomorrow will be those who see industry cloud platforms not as a technology purchase, but as a strategic growth engine — weaving together AI, interoperability and ecosystem collaboration into powerful, real-time capabilities. The trajectory of the industry cloud platform market will be shaped by how effectively they embed emerging technologies—notably AI, VR,and IoT—to deliver real-time intelligence, automation and immersive user experiences.

From healthcare diagnostics and financial prospecting to construction proposal automation, AI-powered industry clouds are beginning to redefine what sector-specific innovation looks like. It may enable enterprises to custom-build their own solutions much faster, essentially getting to a more bespoke version of the industry cloud without constraints.

For forward-thinking enterprises, the question is no longer whether to embrace industry cloud platforms, but how quickly they can harness them to lead their markets. ISG helps organizations move quickly to assess need, map a path forward and select and contract with the right partners. Contact us to learn how we can get started.