In a recent ISG article on the Automotive industry, we talked about connected ecosystems. In this article we would like to expand and further detail this concept, focusing on the service provider side, specifically the role of distribution utilities in supporting electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) in addition to the base load already served. The addition of EVs and PHEVs to a grid that is experiencing rapid electrification will require a coordinated connected ecosystem.

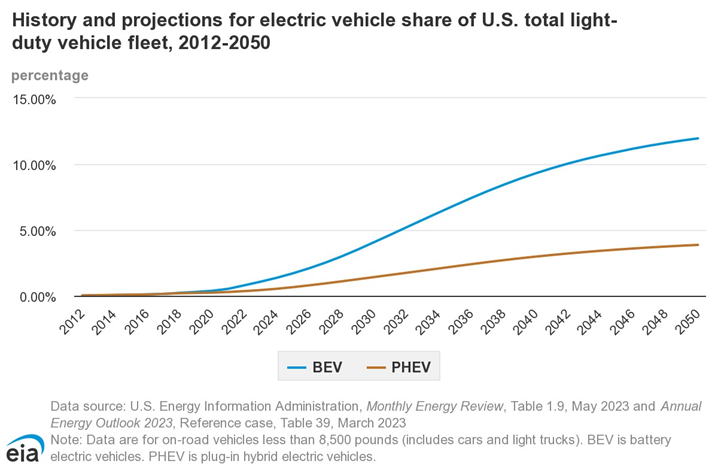

The continuous growth of the EV market is creating significant opportunity for the Automotive industry to expand its reach and become greener. In 2022, 1.2% of all registered light-duty vehicles were EVs, with expected growth exceeding 15% by 2050. This is also a great opportunity for the Utilities industry to respond to the additional demand for electricity supply.

Predicting electricity demand that is shifting toward EVs over time and across geographies can be extremely challenging. This has led in part to the growth of commercial and residential renewables. The market is moving from one almost wholly made up of utilities and consumers of electricity to one that includes “prosumers.” These are businesses and consumers that buy and sell energy on the grid. Most often this is in the form of solar panels that power a house or business, charge a car or feed the grid.

The Impact of EVs on the Grid

Per the Energy Information Administration Use of Energy Explained 2023, when neighborhoods are built in the United States, city planners determine how much electricity the neighborhood will need, and powerlines and transformers are installed to accommodate the expected peak electricity demand or load. If only a few EVs are using Level 1 or Level 2 charging in a neighborhood at different times of the day, the expected peak load would likely remain unchanged, and upgrades to existing local power infrastructure would not be necessary. However, if many EVs are charging at the same time using Level 2 charging, which consumes more energy at a faster rate than Level 1 charging, it could increase the expected peak load and result in the need for upgrades to the existing local electricity distribution system to ensure grid reliability.

When accounting for the fact that renewables can support the load at some times and store energy in batteries at others, it’s easy to see why the system is complex and dynamic.

Addressing Key Challenges of EVs and Grid Stability

The Utility industry must consider the impact of EV charging on the grid.

Source: ISG

As the clean energy company Enel X Way points out, "one Consumer Reports study forecasts, if all of today’s passenger vehicles were fully electric, we would need an additional 950 billion kilowatt-hours of electricity to power them. That would require an increase of 22% in total electricity generation over today’s numbers." Utilities will face difficulties distributing all this extra power, optimizing when and where it’s needed without grid modernization programs.

One of the key challenges for any Utility company is mitigating demand peaks before heavy infrastructure investments have to be made. The primary mitigation methods include energy efficiency and demand reduction programs (EEDR) related to residential customers. Demand response (DR) enables end-use customers to reduce their use of electricity in response to power grid needs, economic signals from the utility, a competitive wholesale market or special retail rates.

Advanced metering infrastructure (AMI), advanced distribution management systems (ADMS) and battery storage are tremendous foundational capabilities required for achieving DR and exploit all the distributed energy resources (DER). This also means that Utilities have many opportunities to expand their offerings into the wider EV charging infrastructure.

As we know, having a robust network of smart EV chargers within a utility service territory can help mitigate blackouts. This is because they can be easily paired with DR events. It makes sense to invest in EV charging stations now, while there are plenty of incentives and increasing demand. The U.S. is expected to have 20 million EVs on the road by 2030, which means the country will need to deploy 1.25 million public chargers to meet the new demand. Utilities should get ahead of the curve and invest in EV charging stations now while taking measures to support grid resilience.

Collaboration Between Utilities and Automotive Industries to Support Grid Infrastructure

A new level of collaboration between the Utility and Automotive industries would benefit both sectors. However, there can be a win-win relationship only if the two industries collaborate, plan and invest symbiotically. For example, EV production plans, sales volumes, geography and purpose (commercial, residential, mixed) scenarios should be clearly communicated to Utilities to allow them to predict demand effectively over the medium and long term.

Commercial and residential EVs require hourly prediction and support of the grid due to continuously changing demand (with different weekday vs. weekend patterns linked to business-related activities). It is no surprise then that we see strong interest in the development of smart-grid substations that are capable of running sophisticated forecasting and optimization algorithms at the point where the utility meets its customers’ energy needs. Companies like Intel, Dell, VMWare, ABB and many others are developing solutions in this field, ultimately enabling better efficiency, environmental impact and reliability of the grid.

A Connected Utility-Automotive Ecosystem

There is no denying that EV adoption is growing and adding strain to an electric distribution grid that is facing new complexities. Consumers are becoming prosumers with EVs, solar rooftops and storage devices in the garage. The Automotive industry is transitioning from fossil fuel combustion engines to EVs while the Utility industry is transitioning from a stable distribution grid to one that fluctuates with new generation sources and storage devices. The Utility industry is working to support EV charger additions but also must maintain reliability, stability and resiliency via new technology and software such as AMI, ADMS, DR and storage to name a few. A connected ecosystem recognized and supported by the Automotive and Utility industries will be required to support EVs as they come on the grid.

With extensive experience working with major utility firms and automotive manufacturers, ISG can provide valuable insights and strategic guidance to navigate the evolving market trends in electric vehicle adoption and grid integration. We enable industry leaders to effectively address the complexity of integrating EVs into the grid, foster a connected ecosystem, and embrace innovative solutions to build a resilient infrastructure that meets the evolving demands of the electric vehicle revolution.

This article is co-authored with Enel X Way, a global electric mobility company that focuses on providing innovative electric vehicle charging solutions and services.