Highlights from the annual Advisor Relations Industry research

Advisor Relations

I had a great time catching up with so many of you at the US SIC in Dallas recently. For those I didn’t connect with, I hope we can catch up soon!

This month I’m sharing highlights of our annual Advisor Relations Industry research. More than 100 Advisor Relations professionals participated, representing nearly 50 service providers with Advisor Relations programs. I’ve shared more detail below, but here are the highlights:

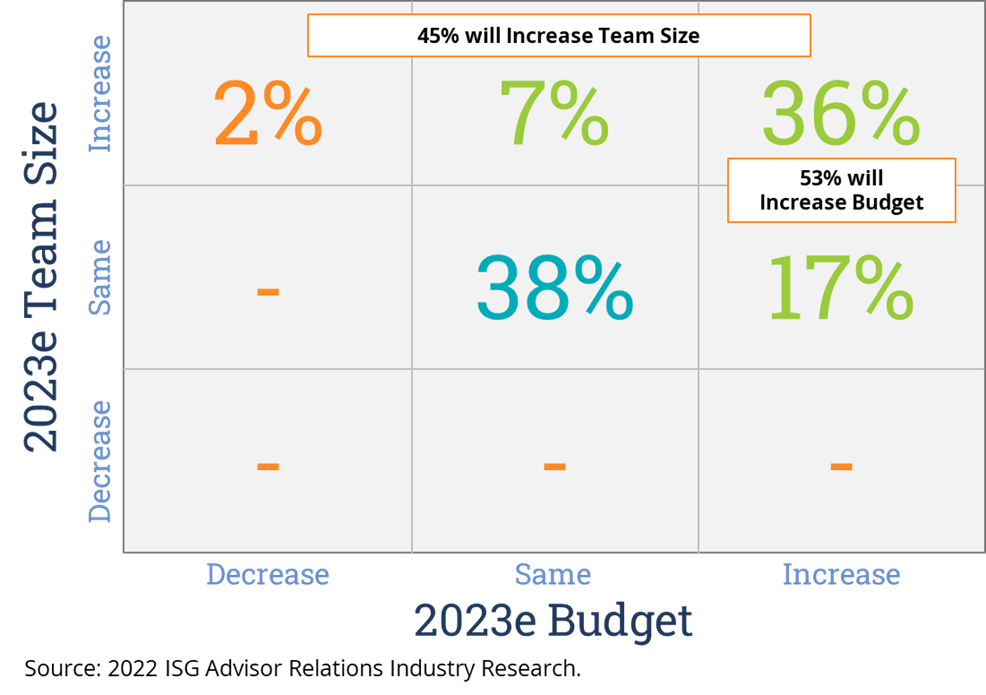

- Collectively, the service provider community has aggressive plans for their Advisor Relations teams in 2023. Team sizes and budgets are expected to reach all-time highs as 62% of Advisor Relations programs will increase their team size and/or budgets in 2023.

- 45% plan to expand their Advisor Relations teams by an average of 1.2 FTE.

- 53% plan to expand their external Advisor Relations spend, with an average increase of 23%.

Overview

In 2023, providers expect to aggressively invest in their Advisor Relations programs. Our research looks at the 2023 plans for provider Advisor Relations programs in terms of both team size and external spending.

- 36% expect to increase both the size of their Advisor Relations teams and their external spend on Third-Party Advisory (TPA) programs. This is up from 31% in last year’s research.

- 62% of providers plan to increase either their team size and/or the budgets, up from 54% in 2022.

- Only 38% of providers plan to run their teams with the same team size and external spend.

One possible reason for this increased investment in headcount is that many providers were unable to hire as many people in 2022 as they intended to at the start of the year. Though the year is not over yet, providers reported difficulty in hiring to

such a degree that some companies’ Advisor Relations teams actually shrank.

Advisor Relations team size

In 2023, providers look to continue to aggressively grow their team size—not a single provider indicates they plan to decrease the size of their Advisor Relations team. Our research shows that 45% of providers plan to grow their team next year.

By comparison, in 2020 only 18% of providers planned to expand their team. In 2021, the number was 42%.

Generally speaking, a higher proportion of large firms intend to expand than small firms and expand by larger amounts of people. But overall, the average growth for anticipated headcount growth is 1.2 FTE per company, or 54.5 FTE total.

That said, the same issues that prevented similar growth this year may show up next year as well. With a limited talent pool, and so many providers actively seeking to add headcount, the likelihood of all these teams growing is unrealistic. The best chance

providers have to expand will be if they include a plan to develop some of their own home-grown talent—if they can’t then individual Advisor Relations professionals may change business cards, and the industry will fail to grow at the same

pace as talent is required.

Advisor Relations Programmatic Spend

In 2023, 53% of providers plans to increase their external spending on TPA programs by an average of 23%. Only one of the firms in the study indicated a plan to decrease spending. Our research shows that spending levels have increased in each of the last several years. This can be attributed to many factors, including:

- increased expectations from the TPA channel.

- increased executive commitment in the TPA channel.

- increased virtual engagement as face-to-face engagement has been more challenging in the recent environment.

- TPA firms providing more value through a wider variety of service offerings.

Please reach out if you are interested in seeing a more rigorous breakdown of anticipated spending and I can share more insights.

TPA Transformation

One additional factor this research reveals is that approximately 60% of Advisor Relations programs are going through some type of transformation—either their programs are in the initial phases of development or existing programs are being rebuilt.

We find that firms just starting their Advisor Relations programs are likely to have a strong need for new leaders or individual team members to help set up the program. These programs are usually looking for Advisor Relations professionals who have had

success in established programs who may be looking to run a global program.

When a provider with an established program goes through a transformational process, it tends to come with increased executive sponsorship. In these cases, programs often require both headcount and budget to re-energize the program and create the desired

market momentum.

Conclusions

Advisor Relations programs generate billions of dollars of opportunity every year. As the market gets more competitive and the headwinds of a potential recessions are starting to be felt, providers are looking to the TPA channel to support their new logo

expansion within strategic accounts, and to explore different ways to support their strategic growth through partnership. As a result, nearly two-thirds of providers are aggressively looking to expand their programs in 2023.

If you’d like to hear more of our analysis about the coming year, including more specific numbers and trends, please drop me a note. Furthermore, if your organization is one of those going through a transformational process, I’d be happy to

be a sounding board in your planning process.

Regards,

Paul

P.S. If you’d like to access any of my prior writings, you can find them here.