Advisor Experience Research stresses good solutioning

Advisor Relations

This month I’m teaming up with Alex Bakker, our Director of Primary Research, to share some interesting findings from our annual Advisor Experience research (described at the bottom of this note).

Recently, 228 ISG advisors shared their experiences working with the leading providers in the market. Our research included a section on how different attributes impact pursuit success and how each provider performed on these attributes. We asked advisors: “Thinking about all the deals you have been involved with in the last year, which of the following aspects of in-deal performance do you consider the most important to deal success? Please identify your top 5 in order.”

With the focus on deal success, we found that solutioning, providing personalized solutions, provider preparation for meetings, and demonstrating cultural alignment are the four most critical attributes to the pursuit success. It is also important to include the right subject matter experts on your deal teams and to demonstrate you’re easy to work with.

| Attributes | #1 Most Critical | Top 5 Critical |

|---|---|---|

| Problem solving/solutioning ability | 24% | 85% |

| Customization and personalization of presented content | 20% | 69% |

| Provider preparation for client meetings | 17% | 73% |

| Demonstrating cultural alignment with the client | 13% | 70% |

| Availability of subject matter experts | 7% | 63% |

| Being easy to work with | 5% | 53% |

| Having a good first impression on the client | 8% | 23% |

| Provider presentation skills | 1% | 20% |

| Storytelling skills | 0% | 20% |

| Leveraging key provider executives | 2% | 17% |

| Overall diversity of provider pursuit teams | 1% | 7% |

Source: ISG Advisor Experience Research

This chart may be misleading about the importance of the lower-rated attributes. Things like making a good first impression, effective storytelling, and presenting your ideas well are critical to supporting your overall pursuit, so please don’t interpret them as not being necessary for your pursuit. For clarity, ISG believes all factors listed above are important in provider pursuits, and poor performance on any one can cause you to be eliminated from a pursuit. Ultimately, clients choose their provider based on the confidence the provider conveys concerning their solution (and price, of course).

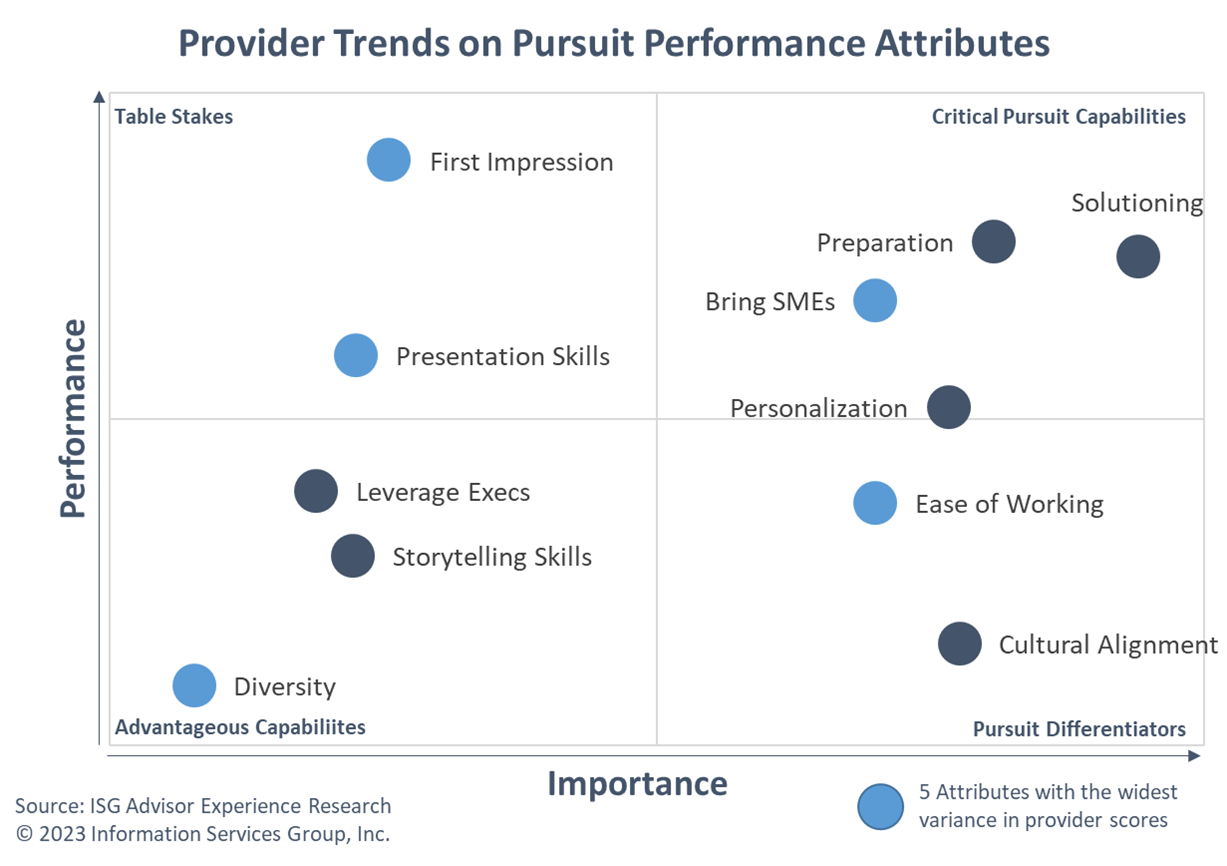

Much of what you see above is probably not earth-shattering to you. What makes this data more interesting is comparing how highly advisors rated the importance of these attributes with provider performance in these same areas.

Providers tend to do some things well, and other things not so well, but the leading providers in our study (in aggregate) demonstrate strong solutioning capabilities, are well-prepared, and bring the right SME’s to their pursuit—all things that are critical to winning a deal.

About the chart: Advisors were presented with a list of 11 attributes and identified the five most important to deal success. Importance ratings are based on those including each attribute among their top 5. Subsequently, advisors rated those providers they’ve engaged with on their performance of each attribute using a 1 (worst in class) to 5 (best in class) scale. Performance ratings are based on the average top-two box scores across the providers.

The ability to personalize and customize solutions to client needs is deemed important by ISG advisors, but it is right on the line between the upper right and lower right quadrants. Other high-importance attributes include cultural alignment and how easy the provider is to work with. Providers tend not to perform as consistently well in these areas, meaning firms that can do this are better able to differentiate themselves.

The attributes listed in the lower right-hand quadrant represent attributes that advisors identified as important, but providers generally were not given high-performance marks. In my experience, these attributes—Ease of Working and Cultural Alignment—are more subjective and tend to become important relative to the other providers in a deal: If you are collaborative, communicative, and responsive, and one of the other providers in the deal is not, it is easy to stand out. Your company can end up worse off if you push hard on contractual terms that others are not.

To improve performance in this quadrant the best position to take is one of transparency. Being more open with the client in the solutioning and contracting discussions will lead to more client communication.. Remember that you don’t have to come in last to lose, but you do need to come in first to win.

To conclude, you’ll notice five of the attributes are a lighter shade of blue. I’ve highlighted these attributes because they have the widest variance in provider scores. This suggests some providers have a distinct advantage in these areas as some are very high performing while others are very low performing. As an example, the attribute “Diversity of team composition, skills, and demographics” has a very wide variance. When examining the sum of Best-in-Class and Above Average, the average score across all providers is 29%, the lowest of all the attributes.

While this might suggest providers are generally poor at assembling diverse pursuit teams, a deeper examination of the data reveals that nine providers are identified by at least one advisor as being Best-in-Class. This means they can and have assembled diverse pursuit teams on ISG-advised deals. Two of these providers stand out head and shoulders above the rest, scoring above 60%. This indicates they consistently assemble diverse pursuit teams. As noted earlier, having a diverse deal team likely isn’t going to win the deal for you, but it absolutely can be a reason for elimination early in the deal process.

The two providers that consistently bring diverse deal teams tend to get past the Provider Scan (first client meeting) more often than their competitors. While I’ve used Diversity as an example (there is no one thing that drives deal success), the concept applies to each of the attributes highlighted in light blue. I suggest examining your firm’s processes for each of these attributes to avoid being beat out by one of your competitors.

As always, I’m interested in your thoughts. Let’s keep the discussion going!

Regards,

Paul

P.S. If you’d like to access any of my prior writings, you can find them here.

Advisor Experience Research Overview

Each year the Momentum team researches advisor experience working with the leading service providers in the market. 228 ISG advisors shared their insights into the frequency and quality of provider engagement (e.g. usefulness and memorability of briefing content), quality of provider pursuits, and future consideration of providers (likelihood to recommend).

This year’s study includes 14 individual providers selected based on their participation in ISG advised transactions. This research provides can provide these individual providers with insights into their results in comparison with other providers included in the study (anonymously) for a competitive context. Findings and insights from this research, in aggregate, will also be valuable to all advisor relations teams and programs, including new ones, to learn from the pursuit performance of these providers and related advisor experience and observations.