Just as other industries are being transformed by digitization, automation and innovative business models, the automotive sector is undergoing a similar paradigm shift. A convergence of new technologies, sustainability policies and evolving consumer preferences is propelling the market toward a new future for automobiles.

Where will it go?

There’s no doubt we are headed toward new ways of thinking in the industry, including diverse mobility, autonomous driving, electrification and connectivity. First, it’s important to understand how vehicle ownership models are changing.

Vehicle Ownership Models Are Changing

Consumers are moving away from full vehicle ownership toward a more collaborative model that focuses on shared access rather than ownership. Studies in Germany show membership of vehicle-sharing models increased more than 15-fold in the last 10 years. These changes in consumer habits are being seen across geographies, including North America.

Add to this a ban in the European Union on the sale of any new petrol and diesel cars after 2035, and original equipment manufacturers (OEMs), which have traditionally dominated the automotive sector, are struggling to adapt to these changing conditions.

The industry requires a new, more collaborative approach and a truly connected ecosystem. Early examples of these kinds of ecosystems have already been announced, including Mercedes and Microsoft (2022), Stellantis and Amazon (2022), Mercedes and Google (2023) and Volkswagen and Google (2023).

The Challenges and Opportunities for the Future of Automotive

Regardless of where automotive companies are on their transformation journey, there are three key challenges and opportunities for which to prepare.

1. Putting passengers and drivers at the center.

Challenge: To date, OEMs and manufacturers have been product centric. A pedestrian-, passenger- or driver-first mentality is yet to fully develop. Yet drivers and passengers are key in causing the shift toward these latest changes. One such example is the growing preference for renting and on-demand services. In North America and the U.K., the number of teenagers obtaining driver's licenses is lower than figures in the 1980s. MIT projects that, by 2050, use of the car will go down in North America and Europe.

Opportunity: Not all regions are seeing the same dynamics. The Middle East, Latin America, Asia and Africa see an increase in car usage. In particular, Asia is expected to see 12% growth in car usage by 2050.

Truly embracing customer-centricity means orchestrating digital platforms and services that are tailored for personal interests and behaviors. An immersive customer experience will be interwoven with digital technologies such as the metaverse to meet the needs of future drivers and passengers.

As drivers increasingly contribute and invest in shared systems of ownership and access, different revenue models will emerge, similar to timeshares and other sharing models in real estate.

The following questions will help steer you toward becoming more user-centric:

- Does your company understand whether you have more passengers or drivers of the future by region, age group and personal needs? Do you understand what customers want, what they own and what experience they are seeking? Are you currently designing from a user perspective?

- Have you mapped how you plan to support the end-to-end experience of passengers and drivers of the future, including infrastructure, integrated energy, fleet management, insurance needs and end-of-destination services?

- How are you designing for end-to-end safety, sustainability and comfort?

2. Building an ecosystem that puts passengers and drivers at the center.

Challenge: The complexity of legacy systems is a major challenge to smart manufacturing programs (ISG Smart Manufacturing Survey 2023). Customer-centric services rely on multiple providers to deliver the necessary products and services for the manufacture, quality control, design, R&D, sales, after-sales support and maintenance. Managing this growing ecosystem involves changing the revenue model beyond sales of the vehicle and toward services.

Opportunity: By 2030, subscription services related to the automotive industry – including leasing and rentals – are expected to be up to $40 billion in Europe and the U.S. alone. The total value of the global sharing economy in five years is estimated to be up to $113 billion, a potentially untapped market for OEMs.

In 2012, the British Royal Automobile Club (RAC) commissioned a study that found that cars were being driven only 4% of the time. This means there is room for a greater network of charging stations and a greater ecosystem of products and services.

No longer do automotive manufacturers rely on a single party. They need many, small partnerships, whether it be consortiums or academic institutions, to build an ecosystem that will support the customer of the future. Engagement in the ecosystem will need to be about performance and outcomes for customers rather than delivery of sub-component tasks.

Some questions to ask:

- Whether you are tackling the problem as a single OEM or connected with partnerships, are you qualifying, agreeing upon and defining a business model?

- Have you defined the handover points between providers in the ecosystem to create a full end-to-end experience?

- Have you defined the revenue model and pricing strategy for all the players involved?

3. Building a blueprint of the ecosystem that prioritizes connectivity and security.

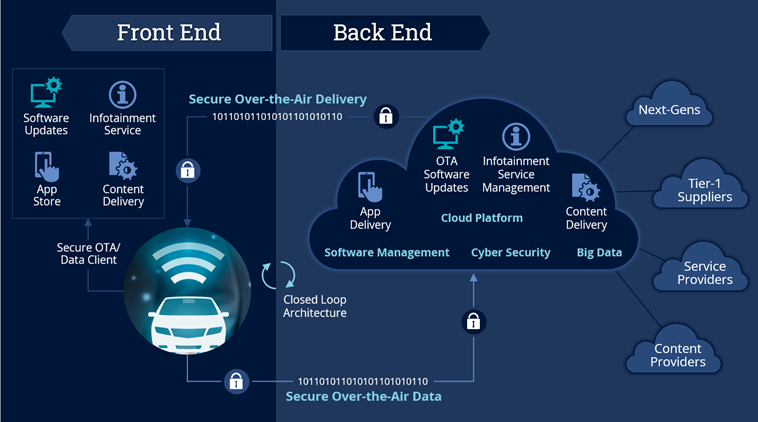

Challenge: Current electric and smart vehicles rely on data, algorithms and insights to provide their services, but customers only need one interface to their mobility experience. Without the right architecture and blueprint, there is no means of coordinating and delivering a sound structure to provide a seamless and safe customer experience.

Imagine a situation where electric chargers are out of service because of a security flaw, and customers are stranded in far-flung places. Will you tell them this is out of scope? No, you will present a unified experience they can rely on and hold your energy and fueling stations accountable on the back end.

Autonomous cars available for use today are configured with partial automation and are already generating around 25 gigabytes of data per hour, circa 300 terabytes per year. This does not include data across the full production, manufacturing and sales supply chain or partner ecosystems, such as the fueling stations, energy providers, fleet management systems and traffic systems. An OEM must build a blueprint that allows for this explosion of data.

Some services like fleet management and energy integration already exist, but an ecosystem that provides the necessary mobility, electricity, connectivity and autonomous services will need to be dramatically expanded. A key factor in creating a blueprint for an expanded ecosystem will be defining what different parties provide and what they do not provide. This is what ISG Partner for Smart Manufacturing Philip Glatz refers to as “a force of creating order.”

Opportunity: Ensuring connectivity in the environment requires integrating multiple services across the ecosystem. With the volume of data and the number of integration points, understanding what data to collect, manage, store and analyze is especially important. To manage this much data – and to supply the power and energy it requires – you must be able to confidently explain how the data is being used. The architecture, data patterns and security can help solve the management and supply of the data.

A connected vehicle will likely have access to information about changes on the roads, changes in traffic, peak demand for car sharing and real-time vehicle decision-making.

With the increased number of sensors in vehicles and environmental surrounds, the data volumes could present an invasive experience that could expose individuals to security and privacy risks. Being connected can exacerbate issues of data theft, manipulation of data and citizen rights. While ecosystems should aspire to be open, creating secure connectivity to such platforms can be a challenge.

Be sure to create a blueprint that defines the interfaces between parties. The architecture needs to connect energy and electricity sources to fleet management and the driver and passenger experience via a full 360-degree view.

To prepare for a comprehensive blueprint, start by answering the following questions:

- Can you test and integrate all existing systems to provide a connected autonomous outcome?

- Have you built the organization to deliver this new ecosystem model?

- Do you have the mindset to develop a “learning vehicle” that can continuously adapt to the latest information? Are you sharing it with your partners and suppliers?

- What open architecture and technology ecosystems are you leveraging or planning?

- Have you established the custodian of the data, insights and products?

- Would everyone in the ecosystem be comfortable with IP being shared with OEMs for the purpose of achieving the vision of mobility as a service?

- In your model, do passengers and drivers have the right to collaborate, inform and lead the requirements of the future?

ISG helps enterprises navigate the changing automotive market and responsibly implement digital technologies and ecosystems to support your future mobility goals. Contact us to find out how we can help.