Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Mergers & Acquisitions

M&A has long been a key driver for revenue growth in the IT and business services sector. What does recent M&A activity tell us about changes in strategic priorities for the sector?

Data Watch

Background

When IT services firms buy other IT services firms, it’s often an attempt to create scale or beef up talent in high-demand areas. But acquisitions in adjacent markets can tell us something about the evolution of the sector itself.

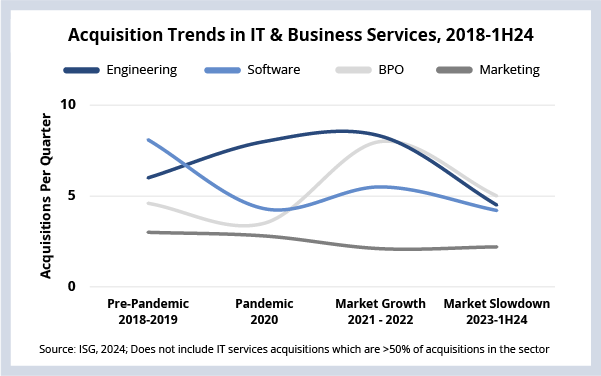

This week we thought it would be interesting to do a 1H24 checkpoint on M&A based on the number of acquisitions in the sector and how that has changed over the last five years (see Data Watch). Acquisitions of IT services firms make up about 55% of all acquisitions. What we focus on here are the other 45%.

The Details

- Software-related acquisitions signal a desire for non-linear growth, including intellectual property that can create non-linearity for managed services. This type of activity was strong prior to the pandemic, with an average of eight acquisitions per quarter. Since then, in the last four years, there has been an average of just four software-related acquisitions per quarter.

- Engineering-related acquisitions signal a desire to move into emerging areas that have a lower penetration of outsourcing compared to IT. During the pandemic, the industry saw the number of engineering-related acquisitions increase to an average of eight per quarter through 2022, but this has now come down to an average of four per quarter.

- BPO-related acquisitions tend to be industry- or function-specific. There were eight BPO-related transactions per quarter during 2021 and 2022.

- Marketing-related acquisitions are strategic bets on growth in areas outside of IT that are seeing net-new investment in technology. This type of M&A has stayed relatively flat over the past five and a half years, averaging between two and three acquisitions per quarter.

What’s Next

With economic conditions potentially improving in 2H24, M&A activity may pick back up and this will reflect the continuing evolution of the sector.

Engineering services demand has started to pick up (ACV is up 33% YTD) as discretionary spending pressure eases in some industries. While many of the large pure-play ER&D firms have been acquired over the past several years, engineering continues to be a regional and industry-specific ecosystem. This will likely translate into opportunities for IT services providers looking to take advantage of the continuing convergence between operational and information technology.

Though many IT services firms today look at marketing and related services as an area for potential growth, we expect to see M&A in this area (including digital or creative agencies) to remain in line with previous few years. AI, including generative AI, will have a significant impact on both BPO and marketing. This will influence most of the M&A in these areas.

But IT services-related companies continue to make up the majority of what has been acquired to date – and that’s likely to continue in a low-growth environment. As we’ve discussed over the past couple of quarters, cloud activity is rebounding (IaaS ACV is up 15% YTD) in part due to strong demand for AI. This means IT services firms may focus their M&A energy here to scale up talent and capabilities.