If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

BANKING, FINANCIAL SERVICES AND INSURANCE

Banking, Financial Services and Insurance together represent one of the largest and most important sectors for the IT services industry. Banks are frequently on the leading edge of technology adoption at scale and are functionally very reliant on both IT and IT services for their business operations.

Amid the banking crisis of the last several weeks, which included the collapse of Silicon Valley Bank and Signature Bank and the absorption of Credit Suisse by UBS, ISG has been evaluating the likely impact of a broader slowdown on the IT services sector. In March, ISG conducted a study of more than 250 large enterprises in relation to their plans for IT cost optimization – a topic that has been top of mind with many clients for the last year.

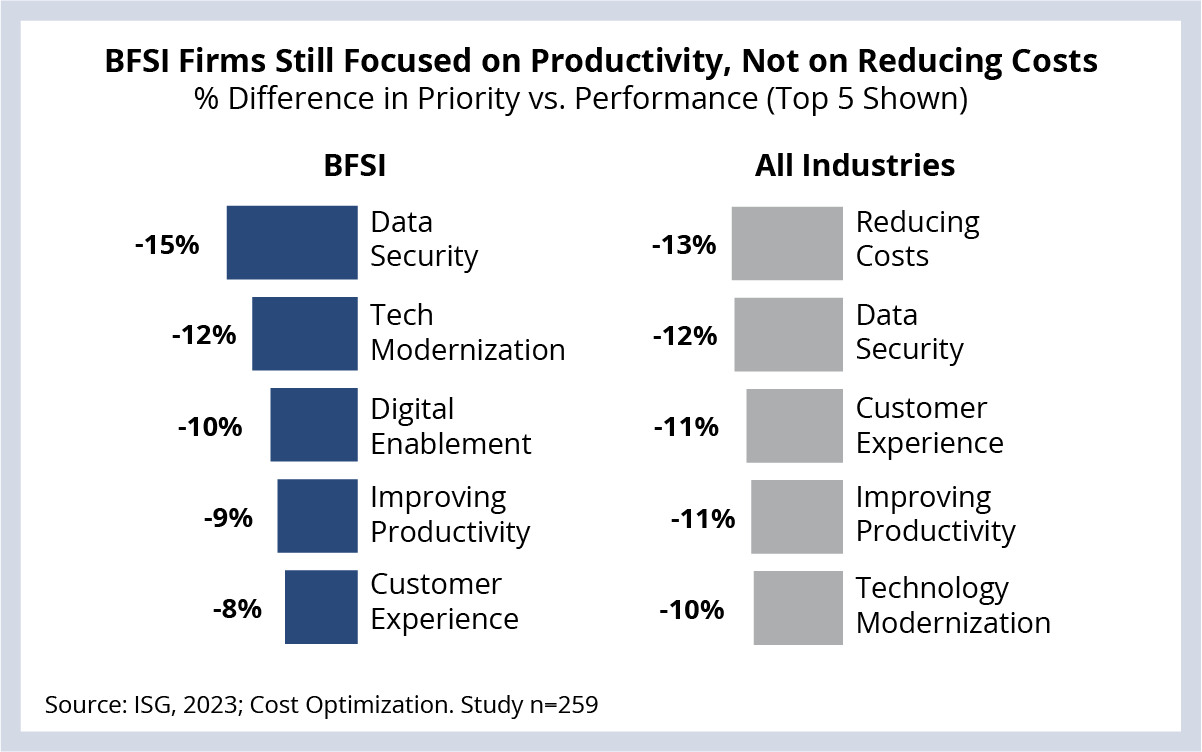

We asked companies to use a five-point scale to rate their priorities and how well they are performing at those priorities. Then we looked at the percent difference between the two. What we found tells an interesting story both for the market overall and specifically for the BFSI sector.

When we look at companies across all industries, cost reduction represents the largest gap between priority and performance, with most companies rating it as an area that is immediately important to their business but that is lacking in success. (See Data Watch)

When it comes to priorities versus performance for BFSI firms, the most significant gaps are in data security, technology modernization and digital enablement. Cost reduction ranks ninth. While present circumstances may alter these results slightly, the data suggest that banks are continuing their transformation efforts with a focus on productivity of both staff and assets rather than on absolute cost reductions in spending on services and technology. Individual banks may struggle, but the industry remains focused on gaining competitive advantage through technology.

We expect that this will manifest as a shift from services focused on “keeping the lights on” to innovation and transformation. In the short term, an emphasis on “difference-making technology” may reduce banks’ spending with some service providers and shift it to others, and it may also alter the portfolio of services that individual service providers offer to their bank clients.

One of the reasons BFSI companies rely on IT outsourcing is to satisfy customer demands in an increasingly competitive environment. Banks have been extremely focused on technology modernization and transformation for the last several years, and our data validate that these priorities remain top of mind for banks.

DATA WATCH