As more and more traditional organizations are shaken out of their “business as usual” slumber by their digital challengers, the typical first response is to go to market guns blazing. Digital is the foremost agenda item for most strategy meetings with C-suite leaders today – and, yet, most organizations appear to lack a coherent plan, relying instead on sprinkling digital initiatives across their presentations and centers of excellence in business and IT. After all, the goals for “going digital” are often ambiguous and require significant change – two characteristics that make them inherently difficult to achieve.

Companies that kickstart their digital transformation journeys often hit roadblocks that impede them from making any genuine gains. In the long term, they may find themselves struggling despite the big dollars spent on strategy sessions, management off-site meetings and special campaigns.

For banks trying to adopt a “digital first” model, here are the top four considerations:

- Going digital cannot be a business-only or an IT-only initiative. The entire organization must come together to deliver a digital experience to the customer. When the push for digital comes only from the business, it results in a multi-speed IT model for the firm. The business often starts by setting up a small digital initiatives team but ends up with significant shadow IT hidden under marketing and sales enablement. This prevents leadership from seeing a clear picture of the firm’s overall IT spend. When the push for digital comes only from IT, the process of discussing, agreeing upon, accepting and implementing ideas and initiatives can take much too long. IT may also end up adopting an “in-house first” development model to show innovation capabilities, which can result in longer delivery cycles, higher costs and a suboptimal solution.

- Define the value proposition for the customer. Define what problems you want to solve for your customers, what the ideal customer experience is and how your products differ from your competitors. Rather than trying to serve everyone, define your target customer and build a persona around characteristics like age, income, education, mobility and digital aptitude. That will allow you to refine your product offerings and pricing by assessing your products in the context of the targeted customer profile. Optimize distribution by minimizing the cost of delivering value to the target customer and scaling your customer base, improving time to market and profitability.

- Go digital from end to end. Map customer journeys and touch points throughout the organization and discuss how to transform them into customer “wow” moments. Though most wow moments are seen in the front office, a true digital transformation redesigns processes from end to end to create the desired customer experience. After all, a process is only as good as its weakest link, so implement a service-oriented architecture and end-to-end process automation through APIs and orchestration for straight-through processing, wherever possible. Standardizing processes and platforms across channels to create a uniform omni-channel experience is becoming increasingly important to satisfy the expectations of discerning Millennials and Generation Z customers. We know that middle and lower management teams are closest to the day-to-day work and thus best suited to drive change, so rely on them to lead digital initiatives. Nurture the perception that digital channels are as important if not more important than conventional channels.

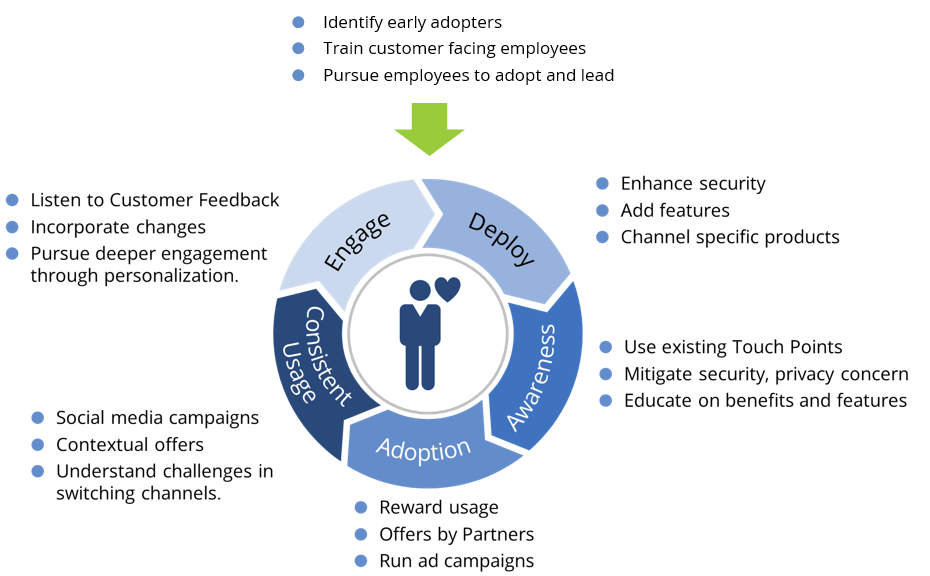

- Get the customer interested. Create a virtuous cycle based on building awareness, engaging the customer and rewarding usage. Start by defining your customer value proposition, what problems you can solve for them and the ideal experience you want to give them. Augment your existing delivery channels and integrate new ones. Continuously listen to the feedback from customers, increase engagement through personalization, enhance features and security and reward consistent usage.

Figure 1: Getting and Keeping Customer Interest

In an industry like banking, the goals for digital transformation are continuously being reset. Customers are changing, and their expectations are changing with them. This is why digital transformation is sometimes described as “the journey with no end.” The digital team needs to set “stretch targets” to ensure they are ready for continuous disruption and can deliver solutions that are disruptive themselves.

Becoming a Digital-First Enterprise

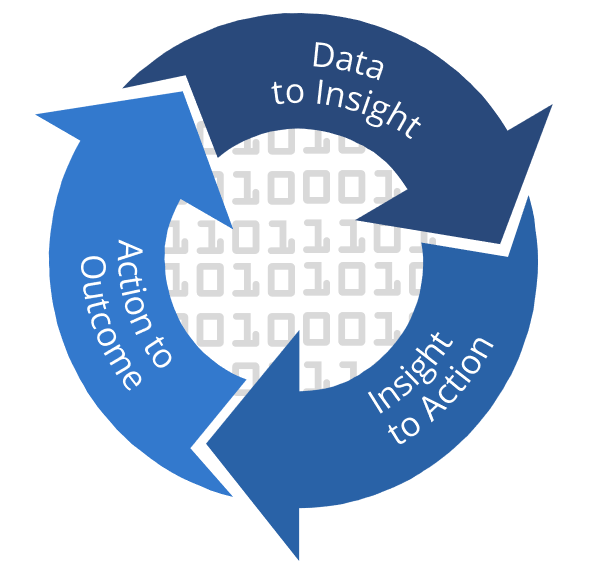

As you transform from a physical-first to a digital-first organization, your customers, IT, vendors and other members of your ecosystem will generate a great deal of data. With a centralized data system and a single source of truth for the organization, you can build a 360-degree view of your customers. Although difficult for large, established banks who typically have multiple data repositories and older, legacy technology, this step is critical to reduce customer journey friction and improve customer experience. This will enable you to apply intelligent analytics to generate business and operational insights to help you deliver tangible benefits that will delight your customers.

As you transform from a physical-first to a digital-first organization, your customers, IT, vendors and other members of your ecosystem will generate a great deal of data. With a centralized data system and a single source of truth for the organization, you can build a 360-degree view of your customers. Although difficult for large, established banks who typically have multiple data repositories and older, legacy technology, this step is critical to reduce customer journey friction and improve customer experience. This will enable you to apply intelligent analytics to generate business and operational insights to help you deliver tangible benefits that will delight your customers.

Be open to partnerships across the industry and the start-up ecosystem to help you identify opportunities to adopt new approaches and technologies suitable for your organization. Such partnerships can drive great value for your customers without risking wholesale core banking replacement. From an internal perspective, make information on transformation accessible to all so you can ensure participation and promote innovation by teams across business units. Share your successes and failures and communicate the firm’s technology strategy to partners, management and employees. Finally, build adherence to policies and standards into IT governance to ensure investment decisions align with your organization’s objectives and strategic goals.

ISG has a rich history helping banks and financial services firms prepare to become digital-first enterprises. Contact us to find out how we can help.