Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Deal Size Metrics

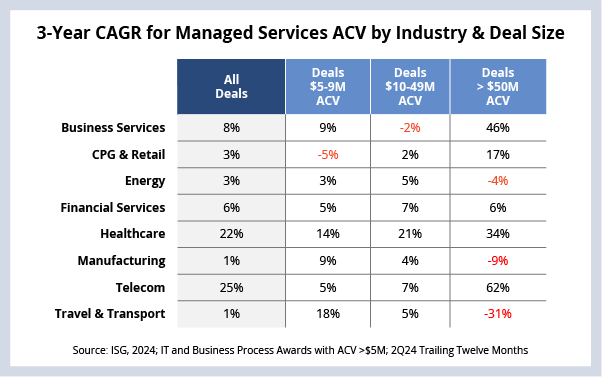

While large-deal activity has been strong of late due to continued enterprise cost pressure, it has been isolated to a handful of industries. In those industries where large-deal activity has been muted, small and mid-size deals have been more prevalent.

Data Watch

Background

As we discussed last week, the increasingly common bundling of ADM and infrastructure has resulted in an increase in large awards. This is because enterprises are looking for more cost savings and providers are working to shape larger awards.

However, as you can see in this week’s Data Watch, that large-deal ACV growth is not even across industries. And, in some cases, where large-deal activity has been muted, small and mid-size ACV growth has been strong.

The Details

- Telecom has seen the strongest growth in large-deal activity. Over the past three years, ACV for large deals is up 62% CAGR, a reflection of the ongoing cost pressure in this sector. On a TTM basis, there have been 10 mega awards in telecom – the most of any industry.

- Financial services growth has been evenly distributed. BFSI represents 25% of the ACV in the market and is typically where much of the large-deal activity happens in the market. This remains the case even with large-deal activity down in 1H24, the main contributor to BFSI’s recent downturn. That said, on a TTM basis, ACV growth has been solid across all deal bands.

- Manufacturing ACV growth has been focused in small to mid-size awards. Small award ACV is up 9%, and mid-size ACV is up 4%, while large deal ACV is down 9% over the past three years. This is partly due to an increase in the number of mid-market manufacturing firms starting to use outsourcing to reduce costs and modernize legacy systems.

- Healthcare has seen broad-based growth across all deal sizes over the past 36 months. ACV for large deals is up 34% on a CAGR basis, but small and mid-size award ACV is also up double digits. As we discussed a few weeks ago, U.S. healthcare payers and providers are embracing managed services at a record pace.

What’s Next

While large-deal activity gets a lot of attention, it’s important to keep in mind that small and mid-size deals are the backbone of the industry. A quarter of the ACV in the sector is from deals between $5-9 million, and 50% is from awards less than $50 million. That means small and mid-size deals make up 75% of the ACV in the sector.

We don’t believe this deal distribution mix will change materially over the next few quarters. However, the way each industry chooses to use outsourcing to meet its goals will continue to flex in response to both macroeconomic factors and changes within the industry itself.