Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

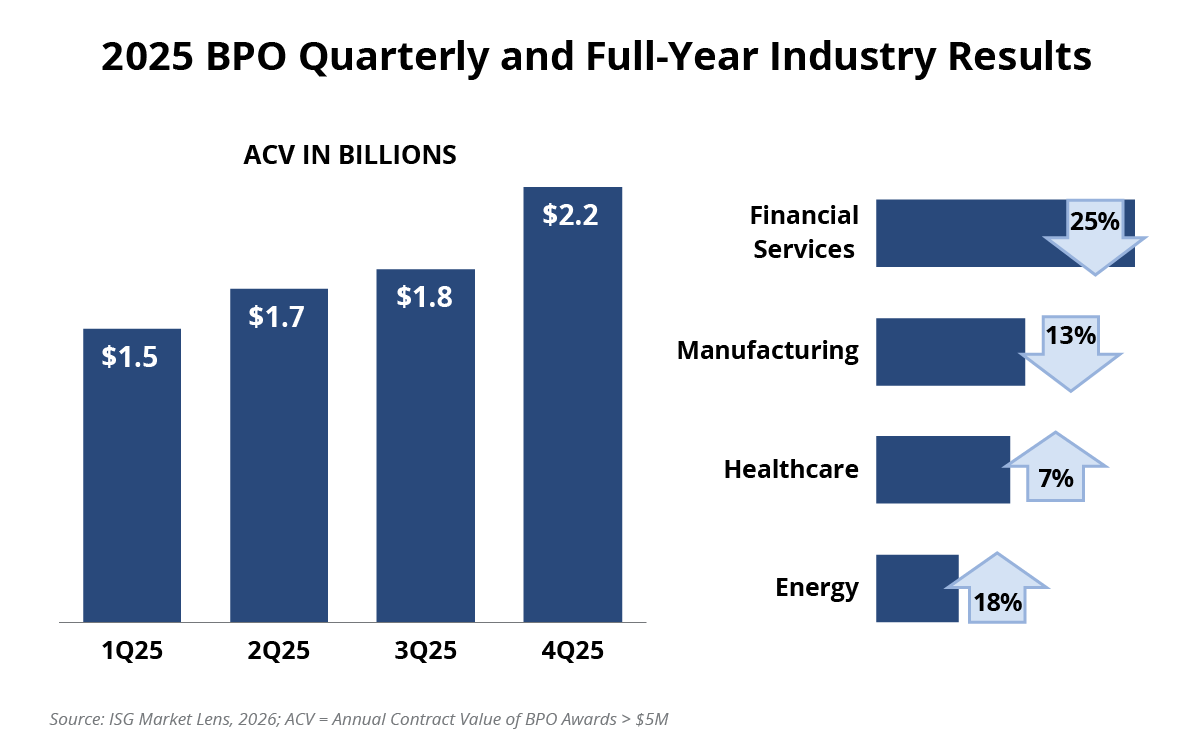

BPO contract value was down double digits in 2025, but signs of stabilization appeared late in the year thanks to a couple of industry sectors. Will AI help BPO bounce back in 2026?

Data Watch

Background

As my colleague Namratha Dharshan discussed on the 4Q ISG Index call a few weeks ago, it was a down year for business process outsourcing. Annual contract value (ACV) was down by 14%, with all three regions down in 2025. The $7.3 billion of ACV generated last year was the lowest since 2020.

The good news is that the BPO market showed signs of stabilization in the fourth quarter. As you can see in this week’s Data Watch, activity spiked in the fourth quarter with $2.2 billion of ACV.

On a sector basis, the two biggest BPO industries – BFSI and manufacturing – were both down double digits as well. Healthcare and energy were the only bright spots.

The Details

- Financial services ACV was down 25% for the year, with the lowest total ACV result since 2017.

- Manufacturing was down 13%, with the lowest total ACV result since 2022.

- Healthcare was up 7% on the year, with its second-best ACV result ever.

- Energy was up 18%, with its third best-ever result for this sector.

Why It’s Happening

There are a lot of factors at play to explain the down year for BPO. The biggest is what’s happening with contract values. Award counts in BPO remain relatively stable. They were down slightly in 2025, but not nearly as much as ACV.

That’s an indication that, while BPO activity remains solid, contract value is under pressure. This is no surprise given that automation and AI generally impact task-centric services like BPO first.

We also believe that some large-deal BPO activity remains on hold, as enterprises continue to wait and see what impact AI will have on their back- and middle-office operations. We predicted this back in 2024, and believe we’re seeing some of this impact now.

And, in terms of the industry results, any time the biggest industry (in this case BFSI) is down double digits, it has a huge impact on the overall sector. However, as you can see, there are some green shoots at an industry level. Healthcare and energy BPO were both very strong last year, and that bodes well for providers with business process offerings tailored to these industries.

As we mentioned on the call, we’re forecasting BPO to recover this year, particularly industry-specific BPO. And that’s in part due to the strong activity we’re seeing with ISG clients across sectors like healthcare, energy and especially retail and CPG, which are increasingly adopting industry-specific services and solutions.