Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Global Capability Centers Redux

Global capability centers (GCCs) that are not highly specialized – or have not achieved scale – will likely see headwinds over the next two years as macroeconomic conditions change and AI evolves.

Data Watch

Background

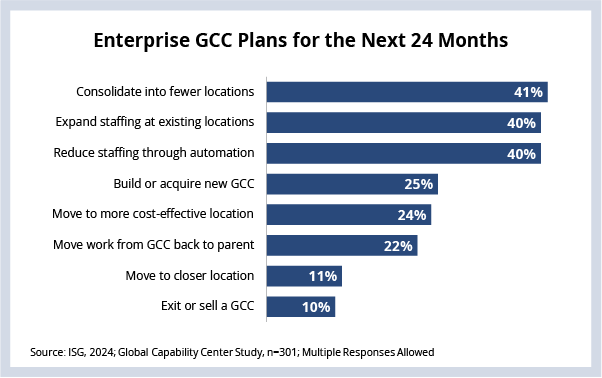

GCC activity remains very strong as firms look to build their own technology or domain-specific capabilities. Approximately 25% of enterprises plan on building a new GCC within the next 24 months, and 40% plan on adding staff to an existing GCC over the same time.

We see the same on the ground when we talk with clients. There is a strong undercurrent in the market right now that has many enterprises feeling they have lost their ability to innovate. And, often, their response to this is to find new talent. But that talent needs to be at a scale and cost that makes a viable business case.

Meanwhile, enterprise budgets are largely flat, and macroeconomic uncertainty persists.

In times like these, enterprises often consider a GCC located where talent is plentiful and can offer cost advantages. And, most of the time, India is at the center of that conversation. This is a key reason the GCC sector in India is more than 1.6 million people today. We discussed this at length last week during our keynote at the NASSCOM GCC Conclave in Bangalore.

That said, we believe a number of potential headwinds are on the horizon for GCCs that are misaligned with their parent organization. You can see this reflected in this week’s Data Watch:

The Details

- 40% of enterprises plan to reduce staffing through automation.

- 24% plan on moving their GCC to a more cost-effective location.

- 10% plan to exit their GCC entirely.

What’s Next

For many organizations, the underlying motivation for change is cost. That cost pressure could be an organization-wide optimization program, or it could be something like the rising cost of talent in a specific location. We’re seeing this scenario play out often in our advisory work as rising labor costs in many locations collide with a downturn in business elsewhere in the world. And this is before we’ve started to see any true impact of generative AI on productivity and cost.

As we’ve discussed at length, providers are promising 30%-60% cost reduction due to generative AI. While we have not yet seen this level of cost reduction reflected in contracts, it’s likely just a matter of time until it starts to make a significant impact on areas like functional requirements development, code generation and code refactoring. A similar pattern will happen in BPO in areas centered around understanding language and the underlying sentiment – for example, in customer experience.

And, when this happens, it will drive down prices for these services – and the underlying benchmarks for “in-market pricing.” This cost reduction opportunity will put even more pressure on GCCs that primarily exist to drive efficiency and cost arbitrage back to their parent organization.

And speaking of AI, we’re hosting our inaugural AI Impact Summit in London on September 9 and 10. It will be jam-packed with use cases, new research and lots of networking opportunities. We hope you can join us.