Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

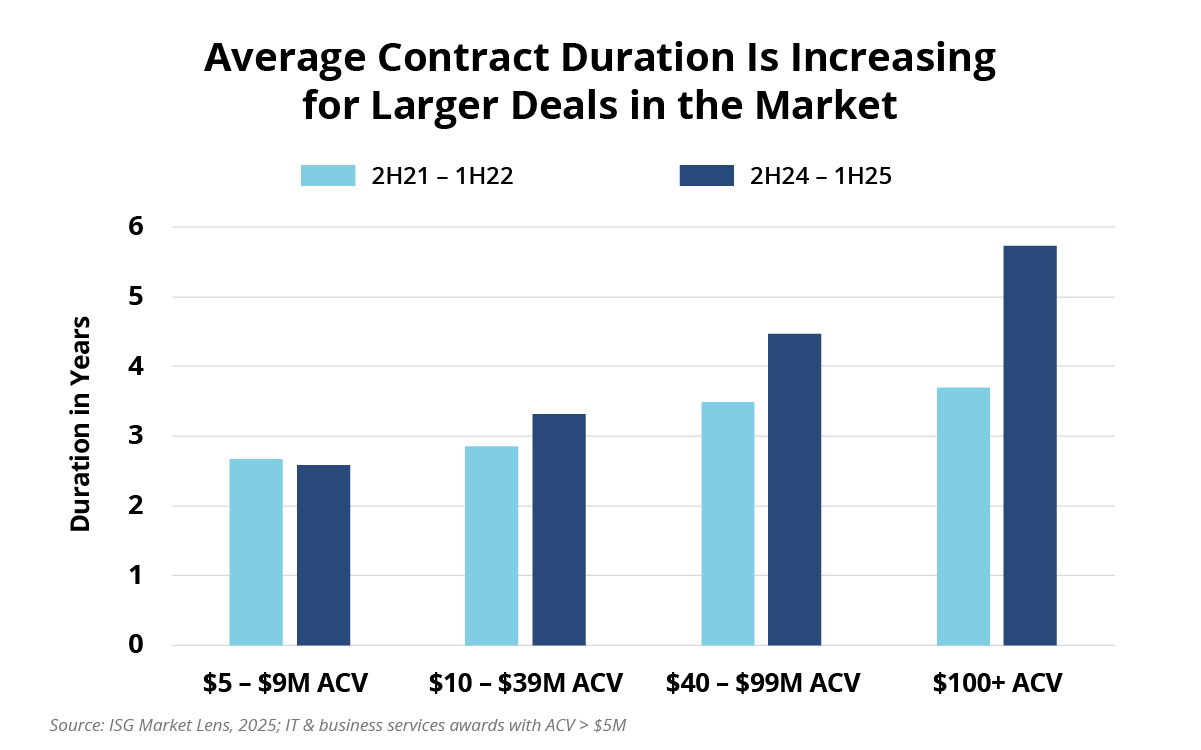

IT and business services award durations continue to lengthen – with the biggest increases in the largest deal categories. As enterprises look for more cost savings, technology and operating model transformation are increasingly the levers to make that happen. But this transformation takes time.

Data Watch

Background

Last week we talked about the fact that, while large-deal activity remains strong, growth in the annual contract value (ACV) of those deals is only happening in four of eight industry verticals. This means that, for the other four industry verticals, large-deal ACV has been flat or declining over the last three years.

Flat to decreasing ACV values may sound somewhat counterintuitive given the fact that many service providers have been announcing record levels of total contract value (TCV) signed over the past few quarters. But what is often overlooked in the TCV equation is deal durations, which – as you can see in this week’s Data Watch – have been increasing for the larger deals in the market.

The Details

- Over the last three years, contract durations for awards between $5 - $9M ACV have remained largely unchanged.

- While the average duration for awards between $40 - $99 million has increased by 12 months.

- Durations for mega awards – awards with $100 million ACV or more – are more than 24 months longer than three years ago.

What’s Next

In Q4 of last year, we reviewed this trend and found that at that point, duration on every deal size band was increasing. What we’re seeing now is that longer durations are happening more often in the larger deals in the market. We believe this is yet another indicator that optimization continues to be the primary driver of growth in the market. As we said last year:

“ …savings generated by cost optimization-focused agreements are not from process improvements and labor arbitrage alone. They are increasingly also coming from transformation…not just to the underlying technology, but to the operating model as well. These are enterprise-wide changes that often have very complex scopes and transitions.”

And, of course, complex transformations take time. The more cost that needs to be optimized, the more transformation that needs to take place, and the longer it takes to execute on this transformation. This means we’ll likely continue to see elevated durations for the foreseeable future as cost optimization remains the priority.

My colleagues Sunder Sarangan and Gary Leaderman and I will be holding a webinar on the topic of large-deal activity on Wednesday, August 6 at 11:30 AM ET. Contact Aroob Fatima for more details.