Hello. This is Stanton Jones and Michael Dornan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

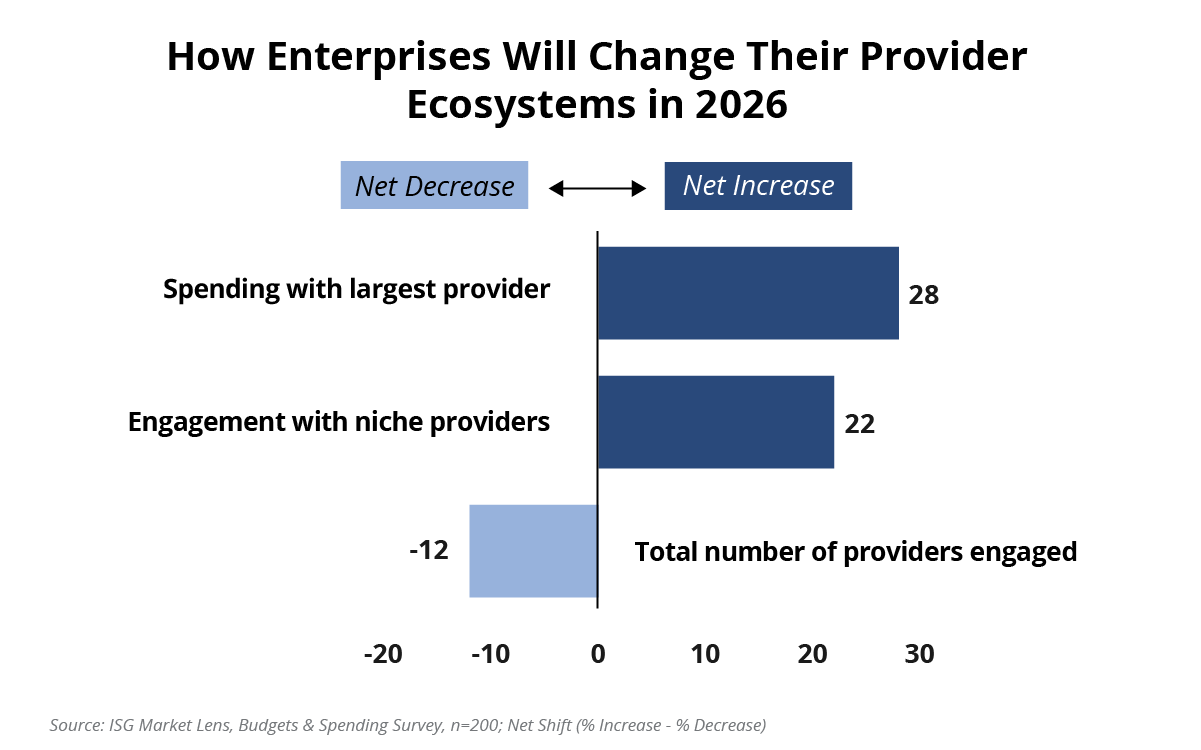

In 2026, enterprises plan on continuing to rebalance their provider ecosystems using a more deliberate mix of large strategic partners and niche specialists.

Data Watch

Background

In late 2024, we highlighted the early signs of service provider ecosystem rebalancing driven by two forces: ongoing cost optimization and the push to scale AI beyond pilots. This week, we are revisiting that analysis using a “net shift” measure: the percentage of enterprises expecting to increase specific provider activities minus those expecting to decrease (see Data Watch).

The Details

- Enterprises expect to spend more with their largest providers, indicating a planned shift toward deeper relationships focused on scale.

- They also anticipate continued use of niche specialists, though the momentum appears to be moderating compared to 2025 expectations.

- Most organizations plan to keep their provider portfolios relatively stable, with only a slight expected decrease in the total number of providers they engage.

What It Means

These shifts mirror what we’re seeing in enterprise deal activity. Organizations continue to consolidate spend through longer, transformation-led contracts, often shaped directly with their largest providers at the executive and board level.

At the same time, enterprises are sourcing specialized AI, analytics and data capabilities from smaller firms — not for additional capacity, but for expertise they can’t find elsewhere at the price and scale they need. The resulting enterprise behavior resembles a barbell: engagement with a few deep strategic partnerships on one end and a curated set of specialists on the other.

So — a key question for enterprise technology leaders in 2026 isn’t “how many providers do I need?” but “which providers create differentiated outcomes, and which no longer do?"