Hello. This is Sunder Sarangan standing in for Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Mega Deals: Part II

We discussed last week that enterprises are highly likely to have multiple awards or strong outsourcing activity in the years prior to signing a mega deal – an IT or business services contract with an annual contract value of $100 million or more. This week, our analysis of the largest deals looks at related attributes about the enterprises involved and their outsourcing activity.

Data Watch

Background

We have seen strong mega deal activity over the last two years. These large deals are a big deal in the industry. As a result, many providers today are focused on not only pursuing larger deals but also proactively shaping them in market conditions that continue to be highly favorable for such deals.

The Details

- 52% of the mega deals come from enterprises that have had a mega deal award in the prior five years.

- In sharp contrast, nearly 80% of the deals since the start of 2024 were signed by enterprises with no recent awards of the same size.

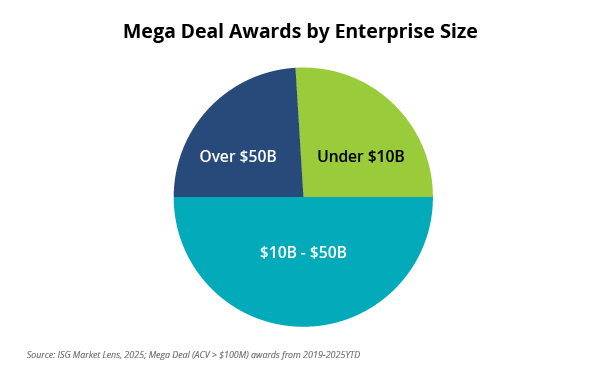

- 26% of the mega deals in our analysis are awarded by enterprises that are smaller than $10 billion in revenue.

What’s Next

It is not surprising to see larger enterprises award deals with bigger TCV and longer durations. However, enterprises under $10 billion in revenue represent a significant share of these awards. For all enterprises, the past is a strong indicator for future mega deal activity – even as favorable market conditions over the last two years have led more enterprises to sign mega deals for the first time. And outsourcing experience – even if it is not always mega deal experience – is an important signal to watch out for as fewer than 10% of the mega deals are awarded by enterprises with little or no history of outsourcing activity.

Another signal to look for is the landscape of incumbent providers in an enterprise. Consistent with our analysis from 2023, providers that have strong positions of incumbency win about 75% of the mega deals awarded by that enterprise.

As we expect this level of mega deal activity to continue, it is increasingly important for all providers to look at this trend as a risk as much as a driver for growth. When an enterprise awards a mega deal, some of its dominant incumbents will be adversely impacted along with some of its smaller providers. While the industry continues to make a big deal about mega deals, providers should pay more attention to these small signals if they want to be on the right side of the next big deal.