Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Applications and Discretionary Spending

Data Watch

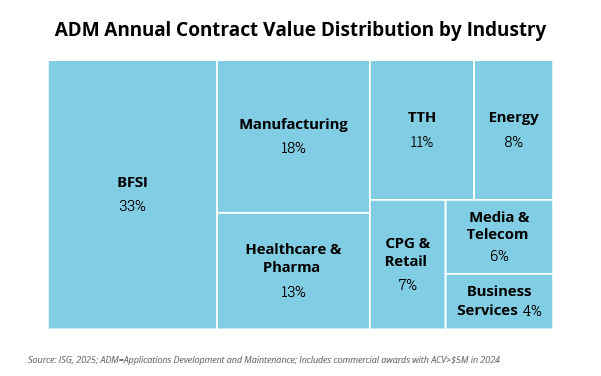

The degree to which this portion of ADM work is at risk in 2025 will likely vary by industry. Here are the details, in order of impact:

- Manufacturing: 18% of ADM ACV. This is the sector that will likely face the most pressure in 2025, and where we expect to see a decline in capital expenditure projects, especially those related to large ERP implementations and upgrades.

- Travel, Transportation and Hospitality: 11% of ADM ACV. With travel to the U.S. already showing weakness in Q2, this will likely have an impact on TTH firms and their near-term discretionary spending.

- Retail & CPG: 7% of ADM ACV. This sector relies heavily on imported goods and is therefore seeing an outsized impact from recent tariffs. It also has a higher share of ADM spending relative to its overall contribution to the market.

- Healthcare & Pharma: 13% of ADM ACV. Healthcare tends to be less impacted by macroeconomic changes than other sectors. However, if tariffs on pharmaceuticals go into effect, which appears to be a possibility, they will have a major impact on the pharmaceutical side of this sector.

- BFSI: 33% of ADM ACV. BFSI will be impacted by the secondary effects of tariffs and policy uncertainty, but this sector is ADM heavy – over 50% of its ACV comes from ADM. Despite recent signs of recovery, we expect to see more caution here with a focus on renegotiations and vendor consolidation.

What’s Next

We discussed a scenario-based revision to our 2025 forecast on the 1Q ISG Index Call and in the Index Insider last week. In either scenario, we expect some industries, especially those with a higher share of ADM ACV, to be affected more than others. I encourage you to check those links out if you have not already.

Looking forward, this level of business uncertainty will have a ripple effect outside of IT and business services, and into other areas like global capability centers. We’ve discussed this topic a good deal lately and how it’s impacting IT services.

I’ll be diving into this connection deeper next week at the NASSCOM GCC Summit and Awards in Hyderabad, India, so if you are planning on being there as well, let’s connect.