Hello. This is Stanton Jones and Steve Hall with a special recap edition of the most important things you need to know from the 2Q24 ISG Index Call.

If someone forwarded you this briefing, consider subscribing here.

2Q24: Quick Look

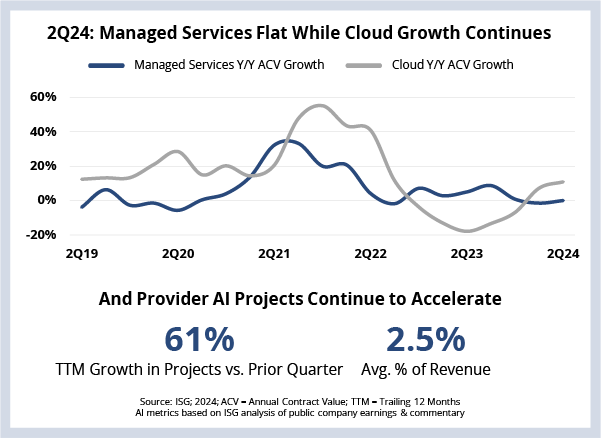

Managed services ACV was flat Y/Y, primarily due to continued weakness in BFSI. Cloud bookings grew 11% Y/Y on strong IaaS results. AI project work continued to accelerate in the second quarter, with the number of projects up more than 60% on a TTM basis. Watch the 2Q24 ISG Index replay here.

Data Watch

What You Need to Know

Managed services annual contract value (ACV) was flat year over year in the second quarter, due to continued weakness in the BFSI sector. Deal count was healthy in BFSI, and we see smaller ACV bands bouncing back, but deals over $50 million ACV (including megadeals) are down Y/Y in the sector.

Cloud ACV was up 11% Y/Y, with most of the growth coming from infrastructure-as-a-service, while SaaS bookings were up just 2% Y/Y.

Service provider AI project work is also accelerating. On a trailing 12-month basis, the number of AI-related projects reported on quarterly earnings calls was up more than 60%. However, the ISG estimate of average percentage of firm revenue derived from AI remained at 2.5%.

What’s Next

The weakness in the BFSI sector continues to be a concern. Last quarter, it was isolated to the Americas region; this quarter both Americas and EMEA saw the impact. The weakness was not unexpected.

Certain sectors continue to perform well. As we discussed last week, healthcare has been very strong of late, and both manufacturing and telecom performed well this quarter. The Asia Pacific region has also been very strong lately, with two consecutive quarters with more than $1 billion of ACV.

That said, the market – especially the BFSI sector, which makes up nearly 25% of the overall market – is feeling the impact of rising interest rates over the last 12-18 months. Hence, we are lowering our managed services revenue forecast for 2024 from 3% to 2%.

Meanwhile, cloud bookings are recovering. ACV for the big three hyperscalers grew by 30% in the second quarter, and, as we discussed on the call, 50% of enterprises plan on renewing or expanding an IaaS agreement over the next 12 months. Both of these are strong signals that IaaS is on a path to recovery and growth.

SaaS, on the other hand, remained in a low-single-digit ACV growth range. The promise of new AI features is compelling, but these features won’t be cheap and will require a modernized software infrastructure, which will slow broader adoption. We’re slightly lowering our cloud revenue forecast from 15% to 14% for the full year.

You can watch a replay of the call here.