Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Banking and Financial Services

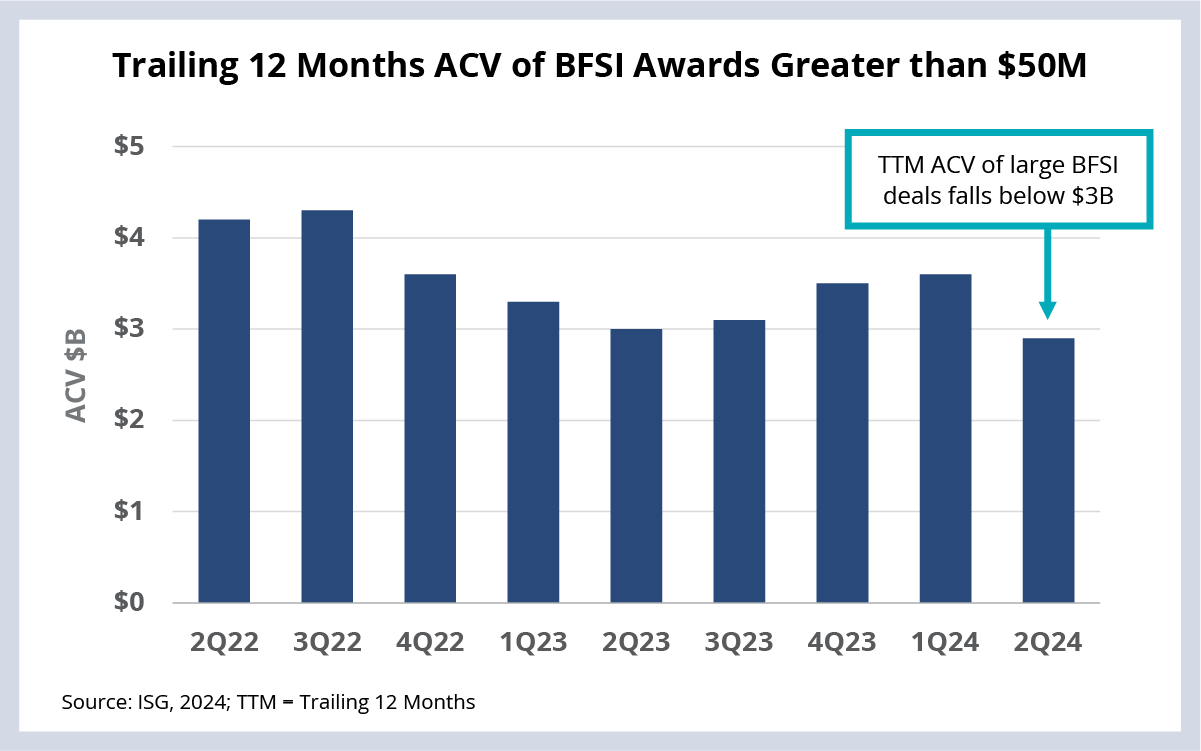

Large deal activity in banking and financial services is at its lowest level since 2022. Will it return in 2025?

Data Watch

Background

BFSI represents a quarter of all the contract value in the market, so as BFSI goes, so goes the market. Through the first half of the year, annual contract value (ACV) in the BFSI sector is down double digits. Much of that decline is due to weakness in large deal activity (see Data Watch).

The Details

- BFSI represents 27% of all contract value in the IT & business services industry.

- ACV is down 11% year-to-date, with Americas down 17% and EMEA down 14%.

- ACV from deals over $50M dropped below $3B and is at its lowest level since 2022.

What’s Next?

While recent central bank rate reductions will of course change the spending outlook for the sector, the question remains: when it does return, where will it go?

We think much of it will be around AI. Our most recent BFSI buyer behavior study found that leveraging AI and data analytics to unlock value is a top priority for BFSI leaders. However, to do this, financial services firms need an operating model and a data architecture to support AI use cases most likely to create value in 2025.

The great news is that BFSI firms are using the IT services sector to support their AI initiatives. Of BFSI firms that are using a service provider to support their AI initiatives, nearly 50% are using them for data analysis and / or data management (tagging, indexing, warehousing, etc.), in addition to more traditional roles like infrastructure support or application management.

Looking forward to 2025 — before we see a rebound in large deal activity, we expect to see an increase in discretionary work in BFSI, much of it focused on AI.

I hope you can join us on the Q3 Index call on October 15th where we’ll dive deeper into what’s happening in BFSI. Register here.