If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CONTRACTING

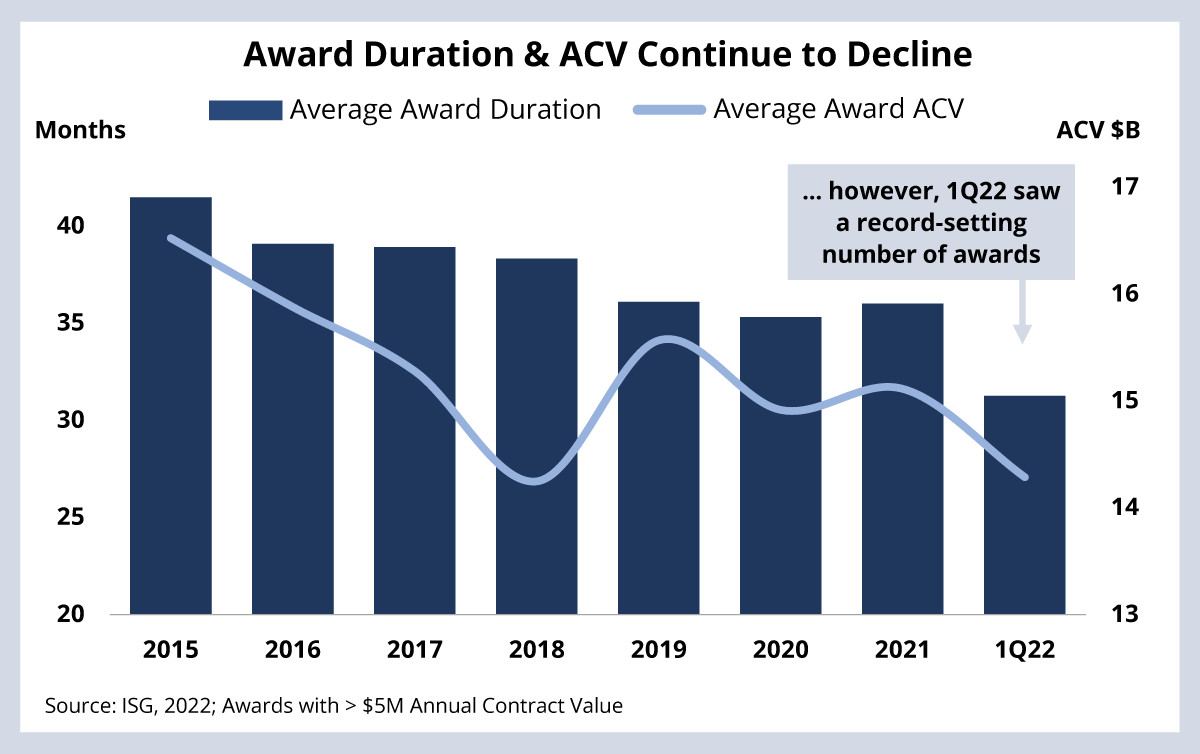

As we discussed on the 1Q22 Index call, the IT services industry saw unprecedented levels of activity in the first quarter. There were over 600 managed services awards. That’s only the second time the industry has seen that level of contracting activity.

While award counts are hitting all-time highs, award durations and values are reaching all-time lows. In the first quarter, the average award duration dropped to less than three years, and average award ACV dropped to below $15 million (see Data Watch).

Enterprises are increasingly favoring smaller, shorter engagements. There are a lot of reasons for this: companies need to realize the results of outsourcing faster, they need to reduce transformation risk and companies are carving out and rebidding less successful components of larger transactions. And finally, there are fewer technology assets – like servers and software licenses – included in awards than in the past.

The movement to greater numbers of awards that are smaller in scope has big implications on both the buy and sell-side of IT services. Providers are building smaller, more autonomous teams to pursue these awards with the goal of landing and expanding over time. And enterprises are accelerating the provider evaluation and contracting process, prioritizing quick wins over long-term transformation.

We’ll have an updated view on this data during the 2Q22 Index call on July 13th. Hope you can join us.

DATA WATCH

M&A

- Accenture will acquire Canadian semiconductor engineering firm XtremeEDA (link). Edge computing use cases are expanding quickly as 5G deployment expands. ML models are moving closer to the edge, where they can be trained locally, reducing the need to push customer data back to the mothership. As data privacy concerns grow, the ability to customize chips on the edge will become an important differentiator for many companies.

- Software engineering firm Exadel is acquiring financial services consulting firm CPQi (link). Banks and investment firms are focused on digital customer engagement, but they must also address the fundamental challenges around banking operations in areas like payments, lending and mortgage processing. This is creating demand for both transformational and cost savings-focused IT and BPO services. In 1Q22, managed services ACV was up over 40% Y/Y in the banking and financial services sector.

- Polish IT services firm ASEE acquired Romanian document management firm Bithat (link).