This is Alex Bakker standing in for Stanton Jones with your weekly briefing on what’s important in IT and business services. It’s been an eventful week. Strong growth continues in the IT services market while India works hard to alleviate the surge of COVID cases.

If this email was forwarded to you, sign up here to get the Index Insider in your inbox every Friday.

Here’s what’s important in IT and business services this week:

- COVID surge continues in India

- IT spending shifts toward software and services during 2020

- Apollo Funds buys Verizon Media (AOL, Yahoo)

UPDATE ON INDIA

The COVID-19 surge in India has continued over the last week, reporting 414,000 new cases in the last day. Today is the tenth day with more than 300,000 new cases. As with last week, our focus is on our friends, families and employees in the region. We are seeing continued resiliency in IT service provider operations, but we have heard of reports of at least one service provider shifting workloads out of India as part of their preparedness planning. Many of the largest firms in the service sector also have stepped up to supply aid in the relief effort, vaccines to employees and expanded benefits to their India-based employees.

IT SOURCING SPEND ON THE RISE

Large enterprise IT spend as a proportion of company revenue decreased by more than 15 percent from 2019 to 2020. And the total amount of IT spending likely decreased more than that as many enterprises found their revenue decreasing at the same time. During the chaos of the early pandemic, many cloud infrastructure, software and IT services providers chose not to strictly enforce the volume-based provisions of their contracts in an effort to extend aid to their clients in the hardest hit industries. This means they had to absorb some costs on behalf of their clients.

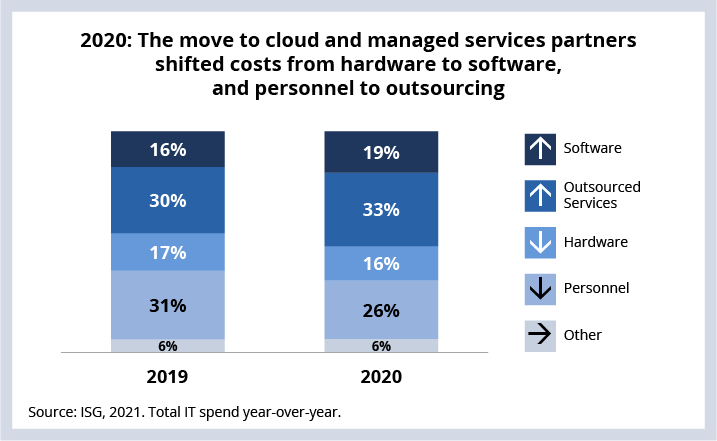

In addition to the overall decrease in IT spend per revenue, other shifts in the way spend was allocated point to a trend we have seen accelerating over the last several years. Enterprise spend on software increased from 16 to 19 percent during the pandemic year, and spend on IT services increased from 30 to 33 percent. Taken together, this represents a 6 percent rise in enterprise IT spending. Personnel spending took the greatest hit, which is no surprise as unemployment rates have remained high throughout the pandemic. Hardware saw only a 1 percent drop in spending year over year, which is part of a larger trend in the commodification of hardware. Its importance to overall IT strategy is diminishing.

The increase in outsourced services spend underscores the stability of the IT services sector through the pandemic. Most providers and contracts were able to maintain delivery quality after the initial adjustment period, and the globally distributed nature of the industry facilitated a shift to full remote work. Many enterprises also felt the pandemic as a driving force in their digital transformations. As physical workplaces shut down, work relied – and continues to rely – more than ever on software.

This year will be a telling year. As much of the world prepares for a gradual return to work, will we see a return of previous staffing numbers to enterprise IT and a reduction of outsourced services? Or will the catalyst of the pandemic and the long-standing labor shortage in technology permanently shift enterprise IT spend toward outsourcing partners and software? The data from our Q1 ISG Index suggest that the increase in services is continuing into 2021.

DATA WATCH

DEAL ACTIVITY

- ALD Automotive, Telefonica and Geotab. Global fleet managing and car leasing company rolls out connected car solution. Link

- Avant Homes and BT. Housebuilder improves its customer journey. Link

- Bristol Water and Wipro. U.K. water utility gets new digital experience platform. Link

- Copasa and DXC Technology. Spanish construction engineering firm transforms its business processes. Link

- Zurich Insurance Group and DXC Technology. Swiss insurance company gets five-year extension on infrastructure transformation deal. Link

- Raspadskaya and Orange Business Services. Russia-based mining company deploys IoT solution. Link

- The Walt Disney Company and AWS. Media and entertainment giant improves its streaming services. Link

M&A

- Apollo Funds acquiring Verizon Media. Link

- IBM acquiring software provider Turbonomic. Link

- Francisco Partners buying integration platform service Boomi from Dell. Link

- Thoma Bravo acquiring enterprise security firm Proofpoint. Link

- Deloitte ramps up Salesforce prowess with Soda Strategic acquisition. Link

- Accenture acquires cybersecurity firm Openminded. Link