If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

HYPERSCALERS

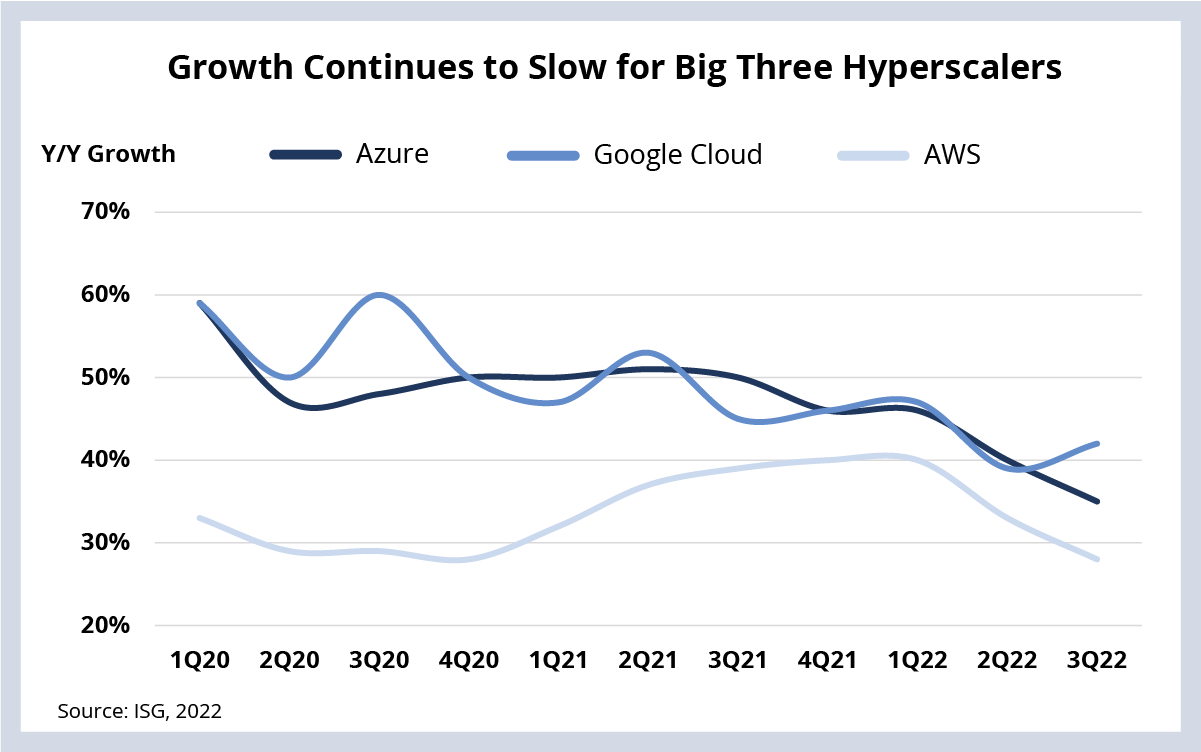

Growth continues to decelerate for two of the three big U.S. hyperscalers in response to the murky macroeconomic picture. On the ground with clients, we see some large transformation projects with cloud in scope getting delayed, consistent with what we discussed last week: Enterprises are strategically reprioritizing technology budgets to focus on short-term results.

Background: AWS, Microsoft and Google recently reported quarterly earnings. AWS and Microsoft both reported declining growth in their cloud businesses, while Google reported growth. This is a continuation of a trend we flagged back in August, with the big question being: what impact will slower cloud growth have on the managed services sector?

The Details:

- AWS reported 27.5% Y/Y revenue growth, which is its lowest growth rate since it started tracking cloud as a separate division.

- Azure reported 35% Y/Y growth and forecasted slowing growth based on the fact that it sees customers optimizing existing workloads and / or delaying recently booked projects.

- Google Cloud reported 41.5% Y/Y growth, up from 38.5% last quarter. However, it continues to operate at a loss, unlike AWS and Azure, which typically run mid-20% operating margins.

What’s Next:

It’s important to keep in mind that this slowdown is not due solely to declines in demand. Currency headwinds and Y/Y comparisons to post-pandemic quarters when demand spiked both have a big impact here.

But there is a common theme emerging that customers are re-focusing on optimizing what they have today – rather than buying in anticipation of what’s coming tomorrow. This is a really important point because it reflects what we are seeing with many clients today: large cloud framework agreements that customers are struggling to fulfill.

This slowdown is important to keep an eye on because service provider pipelines are increasingly linked to these hyperscale platforms. As we’ve discussed previously, moving to the cloud is not the same as outsourcing. It requires companies to fundamentally re-think their tech architecture. And it can fundamentally change how an IT department (and other departments) operate on a day-to-day basis.

Both of these are things that IT service providers are good at transforming and running, and that’s why the hyperscalers are increasingly relying on the MSP channel to grow. But for now – as we said back in August – we’re not yet seeing any significant impact from the cloud slowdown on managed services demand. We’ve seen five consecutive quarters of $9 billion of ACV – and based on our 2022 forecast, we believe we’ll see another solid quarter in 4Q22.

DATA WATCH

M&A

- French customer experience firm Teleperformance acquiring recruitment process outsourcing firm PSG Global Solutions (link).

- Cognizant acquiring Workday partner OneSource Virtual (link).

- Capgemini acquiring data modeling consulting firm Quantmetry (link).

- U.K. based telecommunications firm Colt Technology Services acquiring Lumen’s EMEA business (link).

- KKR acquiring product engineering firm Ness Digital Engineering (link).