Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week. Today we’re revisiting the red-hot topic of global capability centers. We’re excited to let you know that we’ll be sharing findings from our research and our client interactions on this topic at the NASSCOM GCC Conclave in Bangalore on May 30 and 31. Hope to see you there.

If someone forwarded you this briefing, consider subscribing here.

Global Capability Centers

Sustained strength in global capability center (GCC) activity from 2023 was one of the trends expected to shape the IT and business services industry in 2024. So far that’s holding up. While interest in setting up new GCCs and scaling existing ones remains high, we are seeing equal interest from enterprises looking to transform their GCCs to better align with their parent organizations and the macroeconomic environment.

Data Watch

What You Need to Know

Toward the end of 2023, ISG surveyed more than 300 leaders from global 2000 firms about their GCC plans to date and what they plan to do in the next 24 months. When we combine their responses with our on-the-ground experience helping enterprises make these important decisions, it provides some interesting insights on this subject.

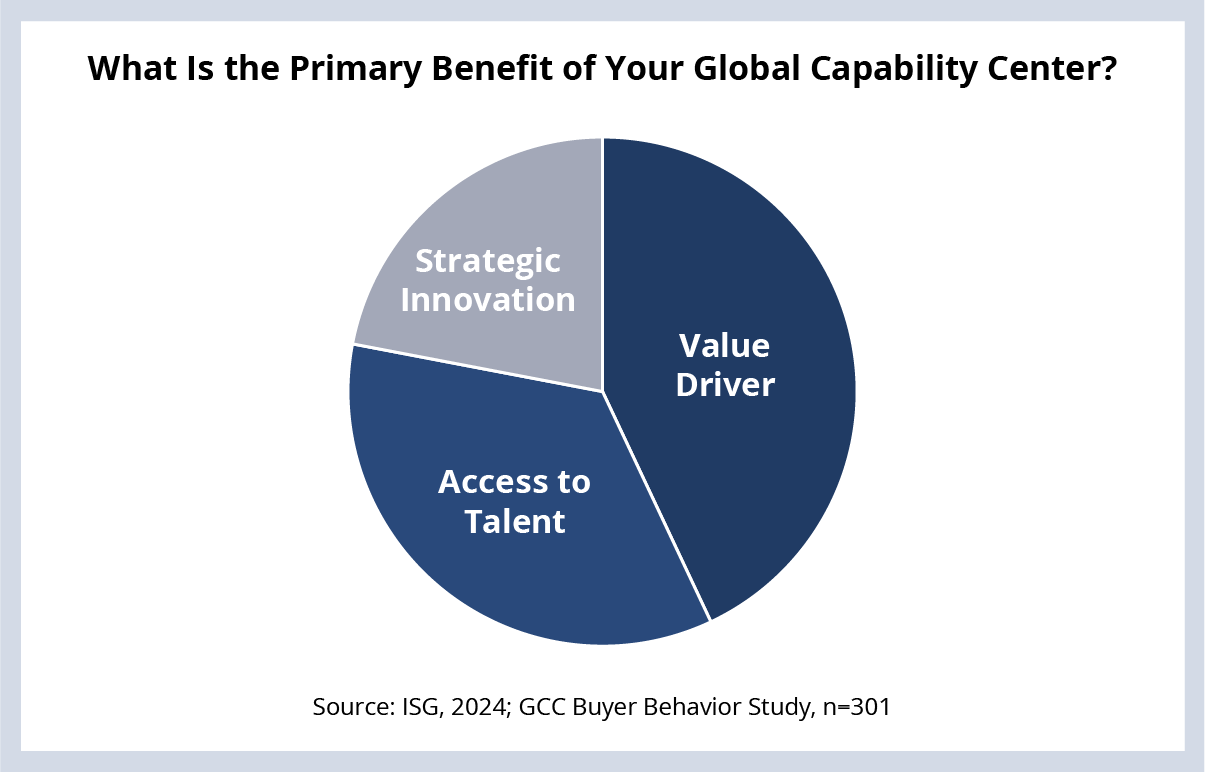

As you can see in this week’s Data Watch, there are three primary benefits GCC leaders are realizing today from their GCCs. A third of the enterprises we talked to say the primary benefit of their GCC is access to strategic talent, 20% indicate strategic innovation and nearly a half indicate value (which could include cost optimization, improved productivity or streamlined operations for the parent organization).

The primary benefit for an enterprise, it ends up, depends on who answers the question.

The Details

- IT functions claim most often that the primary benefit of their GCC is access to talent.

- Value is most commonly cited as a primary benefit or objective for corporate functions.

- Leaders of GCCs focused on industry-specific functions claim innovation is a primary benefit.

What’s Next

Drilling into the data, we looked specifically at the GCCs set up in the last two years. Nearly half of these GCC leaders plan on expanding staff in the next 24 months. What’s interesting is that a similar number also plan to scale back or even exit their GCC during the same time frame. This is consistent with what we wrote about the different challenges and plans for GCCs depending on when they were established.

GCCs have emerged as a very viable operating model for organizations, and a majority of GCCs are set up in India (much like the delivery capabilities of most outsourcing providers) due to the scale of talent, the availability of specialized skills and the cost advantages. What is clear from our research and discussions with enterprises is that the alignment of a GCC with the company’s objectives is critical. When it’s not aligned, plans start to change. And sometimes that change takes the shape of a full exit.

We expect GCC activity to remain high as more enterprises evaluate the potential merits of this operating model, in addition to – or as an alternative to – outsourcing. Meanwhile, we also expect to see strong market activity from service providers (including those who have a relationship with the parent organizations) who are interested in buying GCCs that are not meeting enterprise objectives.

I hope to see you at the NASSCOM GCC Conclave in a couple of weeks where we can discuss this more.