Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

What You Need to Know

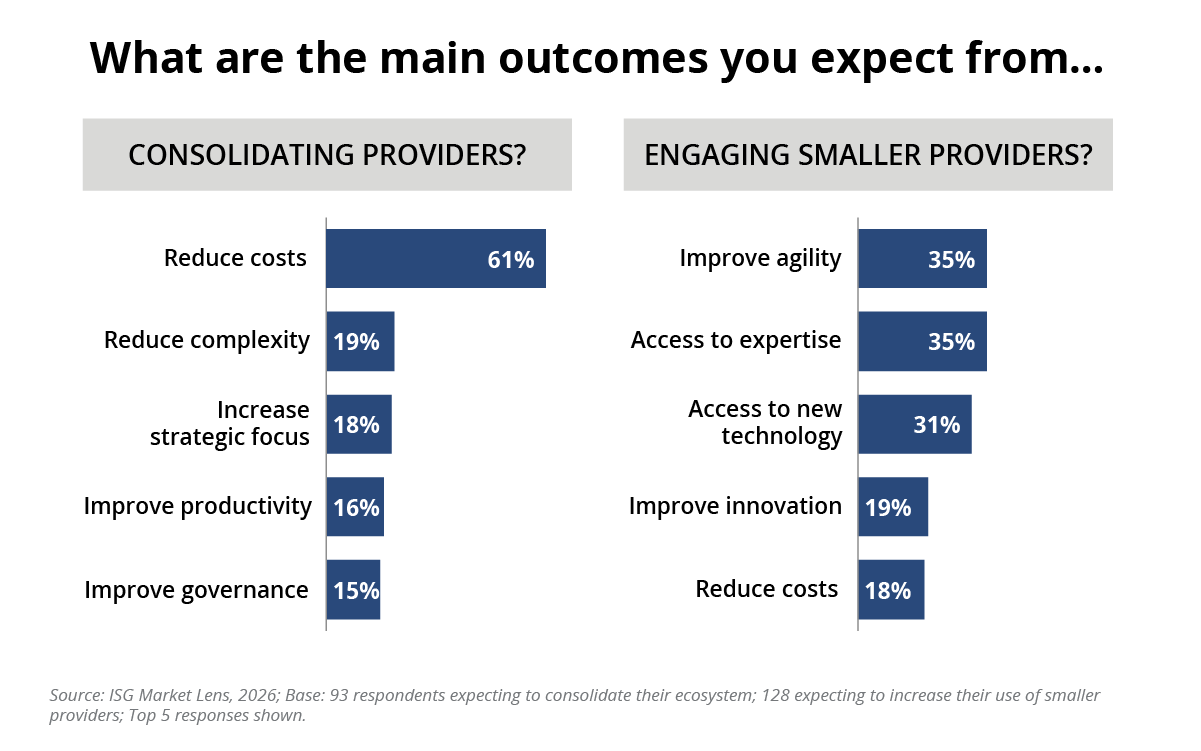

In 2026, enterprises will consolidate providers to reduce costs and engage smaller providers to improve agility and gain access to expertise.

Data Watch

Background

As we’ve discussed at length over the past year, enterprises are consolidating work with their largest providers to reduce costs and reduce complexity, while at the same time increasing engagement with smaller providers to improve agility and gain access to expertise and new technology. What we have not yet dug into is exactly why they plan on doing this.

The Details

- 61% of respondents that are expecting to consolidate their ecosystems are doing so to reduce costs.

- Over one-third of respondents that are expecting to increase their use of smaller providers in 2026 are doing so to improve agility and gain access to expertise.

What It Means

These results are not a surprise. What’s interesting is the strength of the responses. As you can see in this week’s Data Watch, reducing costs is far and away the strongest reason why enterprises are looking to consolidate work. We continue to see this trend on the ground with clients and in the data.

As we discussed on the Q4 Index Call, this focus on cost reduction is having a big impact on deal activity: deal durations are up 12% vs. 2024, and total contract value is up 8% vs. 2024. Enterprises are consolidating work with their biggest providers via large, transformation-oriented awards focused on cost optimization. As one respondent in our 2026 IT Budgets and Spending Survey said, they are focused on “ …giving providers a bigger share of wallet for better pricing terms.”

At the same time, enterprises are increasingly looking for expertise and technology that they are not getting from their large, incumbent providers, who are instead, on the whole, focused on providing capacity. We’ve been flagging this mismatch for over two years now, but, given the pace of AI-related transformation, it’s stronger now than ever.

You can see the response to this mismatch in the strong past and planned future growth of global capability centers (GCC). The perceived lack of innovation in large outsourcing agreements is one of the key reasons we see so many firms re-focusing on building capability themselves. For example, one of the respondents that is planning on increasing engagement with smaller providers this year said they are focused on “ … enabling bleeding-edge capabilities that can be operated and enhanced from our GCC.”

So, what will be the impact of these two diverging trends on the sector in 2026? We think the market will continue to evolve into a dumbbell. Providers that can use their scale and deal-shaping capabilities to drive significant savings through large transformation programs will continue to roll up work from competitors, while smaller providers that can deliver rapid results around data and AI-centric projects will continue to win. Those caught in the middle – on the “handle” of the dumbbell – will face challenges in 2026.