Hello. This is Stanton Jones with the key takeaways from the Q4 and full-year 2024 ISG Global Index Call. You can watch a replay of the call here and download the slides here.

If someone forwarded you this briefing, consider subscribing here.

Q4 and Full-Year 2024 Recap

Data Watch

What You Need to Know

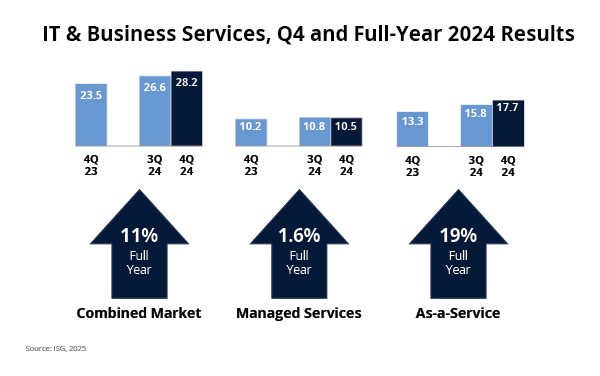

- Managed services was flat in 2024. Sustained pressure on discretionary spending in 2024 had an outsized impact on application development and maintenance services, which makes up more than 60% of the annual contract value (ACV) in the IT and business services industry.

- Megadeal activity was strong. There were 34 deals with an ACV of $100 million or more in 2024. A record 69 megadeals were awarded over the past 24 months, as enterprises continued to focus on using large transformation programs to optimize costs.

- BFSI is recovering. BFSI ACV was down 6% in 2024, but signs show this sector is recovering. Americas BFSI ACV was up 21% Y/Y in the fourth quarter, and we’re seeing early signs that discretionary spending for clients is starting to pick back up.

- As-a-Service continues to accelerate. The combined market of IaaS and SaaS was up 19% in 2024, a huge shift from 2023 when this sector was down 15%. Growth was largely in IaaS, as enterprises are ramping up cloud migrations and spending more on AI.

- 2025 will see stronger growth. We’re forecasting 4.5% growth for managed services in 2025, up from the 1.6% growth we saw in 2024. For the As-a-Service segment, we’re forecasting 18% growth, in line with 2024 results.