Hello. This is Stanton Jones and Alex Bakker with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Award Trends

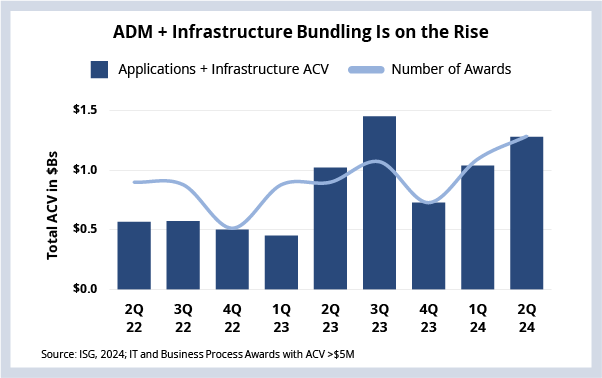

Enterprises recognize they need transformation to capture further savings in outsourcing agreements. This is resulting in larger (and longer) awards with applications and infrastructure bundled into a single contract.

Data Watch

Background

As we’ve discussed in the past several ISG Index calls, cost optimization is the primary driver of growth in the IT and business services industry. This has resulted in a substantial increase in the number of large, multi-tower awards over the past several quarters. Case in point: 2023 saw more awards over $100 million in ACV than any year in the past decade.

The rationale here is that, by bundling multiple towers, enterprises can capture more cost savings – both in terms of year-over-year run-rate reductions and in volume discounts that come with more spending.

This shift toward larger deals has had a big impact on the composition of outsourcing awards. As you can see in this week’s Data Watch, the ACV for awards with applications and infrastructure bundled has increased significantly over the past five quarters.

The Details

- 1H24 ACV for bundled ADM and infrastructure deals was up 60% YTD to $2.3 billion.

- The number of bundled awards was also up, with 111 in 1H24, compared to 83 in 1H23.

What’s Next

Large awards often include a transformation component because transformation is needed to fundamentally change the cost structure of a given function. Providers need time to recoup this transformation investment, which means longer deal terms.

For example, for awards with more than $40 million of ACV, the average deal term is now more than four years. That has not happened since 2017.

We’re likely to see this trend persist through 2024. Cost pressure will continue to drive enterprises to look for new ways to optimize costs, and providers will continue to work to shape large deals.

It’s also important to remember that firms that have been outsourcing for many years – for example, those in BFSI – have already captured the one-time benefit of labor arbitrage. To capture the next level of savings, transformation will be required, regardless of the macroeconomic situation. This means we’re likely to see larger, longer awards even when discretionary spending returns.