Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

PEOPLE & TALENT

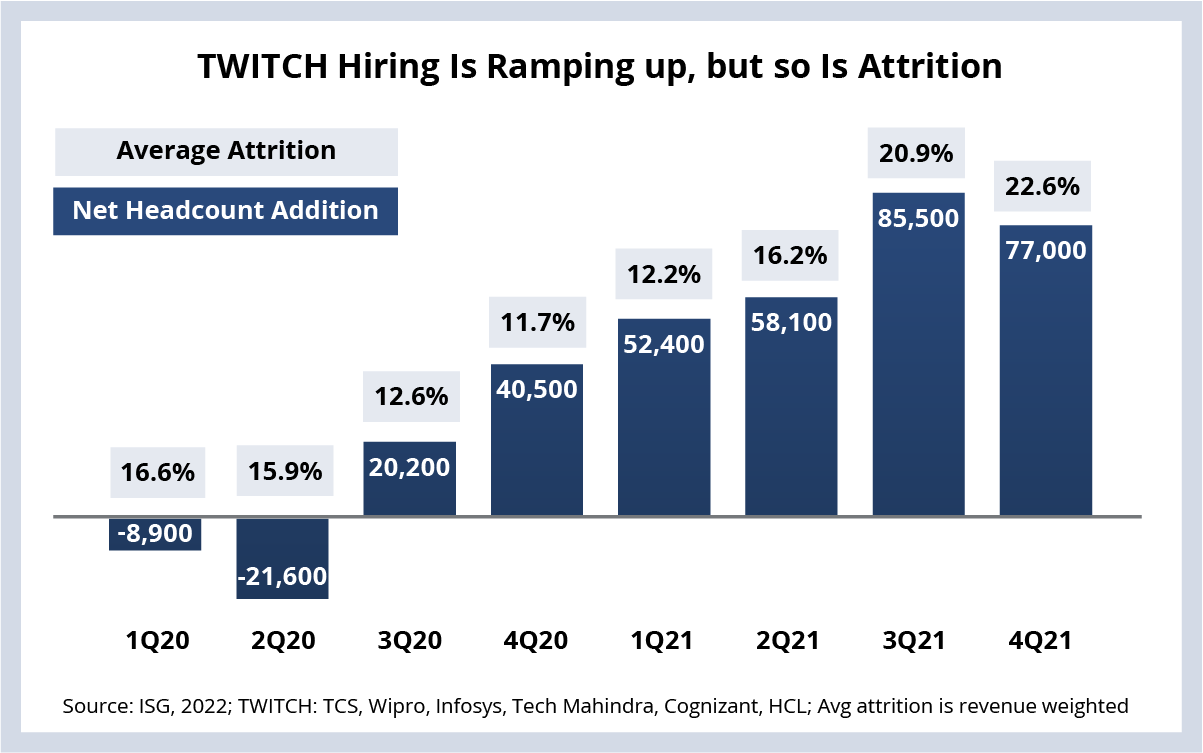

Indian IT hiring is ramping up to meet demand. While hiring plummeted in 2Q20 due to the pandemic, it started to pick back up in 3Q20 and has been on the rise since. The third quarter of 2021 saw the highest net headcount addition in seven quarters before tapering off in the fourth quarter (see Data Watch).

Typically, the Indian IT sector tends to use Q1 and Q4 to onboard “lateral hires” (more senior people), while Q2 and Q3 are used for “fresher” hires (more junior people). The slight drop in net headcount additions in Q4 could be due to a variety of factors. For example, providers could have chosen to focus more on meeting margin goals than on ramping up new projects. Or December start dates may have been pushed to January given the importance of new employee onboarding.

Of course, we can’t ignore the potential effect of the biggest challenge facing our industry right now – and that’s demand for talent. So another potential reason for the Q4 drop in hiring is that providers could not add people fast enough. Think about a slowly leaking bucket: you can add water to it, but the level keeps dropping. And, if the leak gets bigger, it gets harder and harder to fill. Take a look at the Data Watch chart again and notice the increasing average attrition rates relative to net headcount additions.

We’re obviously going to continue to watch this closely, and I hope you can join Steve, Kathy, Namratha and me on April 6 for the 1Q22 Index Call where we’ll be discussing this and, of course, recent contracting and pricing activity in more detail.

DATA WATCH

M&A

- One of Europe’s largest private equity firms EQT is buying Baring Asia Private Equity for $7.5 billion. Why is this important for our industry? Because Baring is a big player in IT and business services. Baring's portfolio includes companies like Coforge (formerly NIIT), Virtusa, IGT Solutions, Straive (formerly SPi Global) and HGS’s healthcare division. Last year, Baring sold portfolio company Hexaware to Carlyle for $3 billion (link). Private equity has been exceptionally active in the technology sector of late. Last year private equity made 187 acquisitions with a value of over $256 billion – both all-time records.

- Accenture acquires Spanish supply chain services firm Alfa Consulting (link).

- Infosys acquires German digital agency oddity (link).