Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Industry Demand

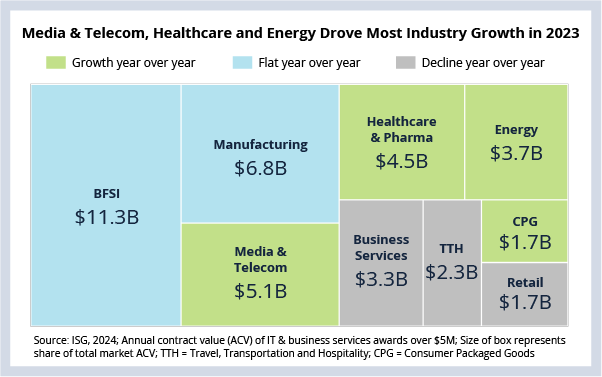

The media and telecom, healthcare and pharma, and energy sectors drove the lion’s share of IT and business services industry growth in 2023. In today’s Insider, we’ll take a look at the momentum for each of these industries – and a few more – to better understand what demand in 2024 could look like.

Background

The $40 billion of managed services annual contract value (ACV) generated in 2023 was a record for the IT and business services industry. That resulted in 5% year-over-year ACV growth, adding over $2 billion ACV to the industry. Much of this growth came from mega deal activity, but when you look at it by industry, most of the growth came from three sectors: media and telecom, healthcare and pharma, and energy.

The Details

- Media and telecom generated a record $5.1 billion ACV in 2023; this was up 10% Y/Y. Almost 50% of this record-setting ACV came from large deals over $50 million ACV.

- Healthcare and pharma was up more than 60% Y/Y. The last three quarters of 2023 each generated more than $1 billion ACV due to a mega deal in each quarter.

- Energy also set an all-time record in 2023, generating $3.7 billion ACV, up 25% year over year. Growth came primarily from an exceptionally strong 1H23.

- BFSI and manufacturing, the two largest sectors, were both flat year over year. Half the mega deals in 2023 came from these two sectors, so both sectors would have been down Y/Y if not for the impact of these large deals.

What’s Next

Will 2024 growth come from mid-size industries again? Here’s what we’re seeing in the data and on the ground with clients:

The second half of 2023 was exceptionally strong for the healthcare and pharma sector, with two consecutive billion dollar quarters. In the U.S., we continue to see a strong focus on cost optimization from the large healthcare payers, with more mid-tier payers starting to execute first-generation outsourcing deals. And, on the provider side, we’re starting to see a shift toward clinical process automation, which means more demand for industry-specific BPO.

Energy, on the other hand, may be starting to pull back. As mentioned above, most of the strength in this sector came in the first half of 2023, then started to slow in the second half. We continue to see strong demand to reduce costs in operations and maintenance as regulators push to minimize decarbonization cost impacts on end-consumers. We also see very strong activity around SAP upgrades, especially within chemical companies.

And while the media and telecom sector had its best year ever in 2023, it also may be set for a pullback in the first half of 2024. There were 13% fewer media and telecom awards last year as compared to 2022. This means a small number of large deals drove the double-digit growth last year. So, while demand still feels strong on the ground, it will continue to be dependent on large deals to sustain growth.

That leaves BFSI and manufacturing, the two biggest sectors in our industry.

BFSI was flat last year with $11.3 billion ACV. And the second half of the year was down 15% compared to the first half, so bookings momentum is slowing. Cost optimization will remain the top priority in 2024 as banks look to break down organizational silos and put in place better cost governance. Technology spending in this industry is heavily influenced by monetary policy, so we’re waiting to see the effect of any changes in 2024.

And finally, in manufacturing, ACV was also flat year over year. The great news is that according to the S&P Global Manufacturing PMI, the manufacturing sector appears to be recovering after many months of contraction. Even if performance continues to improve in this sector, we expect to see continued demand for cost optimization-focused outsourcing in the aerospace and defense subsectors and increased levels of outsourcing activity at mid-market industrial and process manufacturing firms.

Our forecast for managed services growth of 4.25% in 2024 is lower than the 5% growth forecast at the start of the 2023. Much of this is due to the industry-specific factors we mention above. Add to this the continuing headwinds from the macro environment and the tight control on discretionary spending, and it means that most industry growth will likely occur in the back half of 2024.