If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

SERVICE DELIVERY

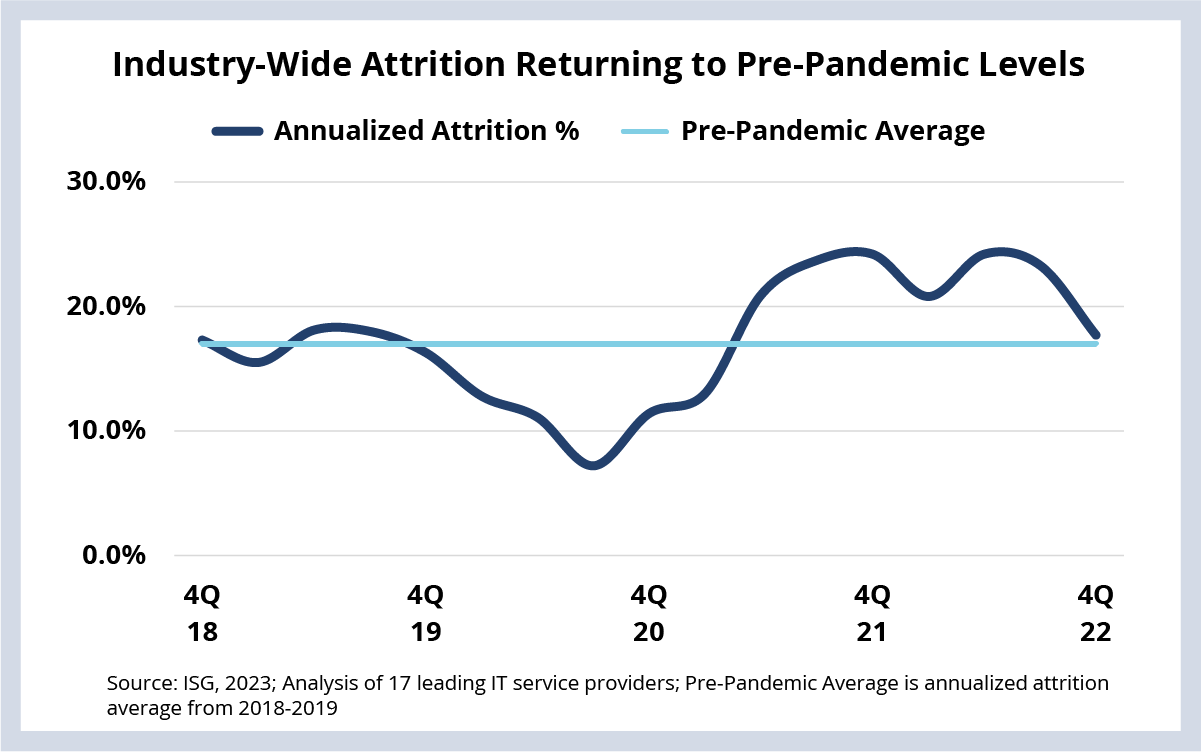

Industry-wide attrition continues to decline to pre-pandemic levels. However, hiring slowed significantly in 4Q in response to macroeconomic concerns. This combination has the potential to create a new set of supply-side challenges for providers in 2023.

Background

Supply-side challenges have been front and center over the past 18 months as a massive wave of post-pandemic attrition swept the industry, matched by an equally massive wave of hiring. This led to the “Great Reshuffle,” when – in the middle of last year – over 40% of the IT services workforce had been at their company for less than a year.

The reshuffle created some huge challenges for the industry. Enterprises struggled to backfill resources that had left, and providers struggled to find resources to kick off transitions. This led many providers to tap into the subcontractor channel more than ever before, driving up delivery costs, while being unable (in most cases) to pass on these price increases to enterprises.

Now that most providers have reported 4Q earnings, we see two key trends: the Great Reshuffle is largely behind us, but macro uncertainties have slowed hiring significantly.

The Details

- Annualized attrition in 4Q was 18%, down from 23% last quarter; this is slightly elevated over 2018-2019 averages (see Data Watch).

- IT services workforce growth was flat from 3Q to 4Q; this was the first quarter since 3Q20 to not post sequential growth.

What It Means

As we’ve discussed previously, demand in the IT and business services sector has been extremely robust. We’ve seen six consecutive quarters of $9 billion of managed services ACV – that’s an all-time record by a mile. And unlike other sectors within tech, the IT and business services sector grows by hiring, which means providers had to ramp up hiring in a big way last year to service this demand.

However, recent market uncertainty has led to a significant slowdown in hiring. The decrease in attrition levels, combined with a decrease in utilization levels from 2022 highs, has created a buffer for providers to be able to service existing work and staff new work without the massive incremental hiring we saw last year.

It’s important to keep in mind that attrition – while declining to pre-pandemic levels – is still elevated compared to historical averages. So, as long as it stays at this level, it means the recent slowdown in hiring is likely to be short lived for providers to capture the 5% growth we’re projecting for the sector in 2023.

DATA WATCH