If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CLOUD

As we discussed on the 2Q22 Index call, IaaS growth was strong in the first half of the year (with ACV up 30% YTD), but showed signs of slowing. This was primarily due to the impact of increased regulations on the big Chinese hyperscalers, who have historically made up more than 10% of the market share in this sector.

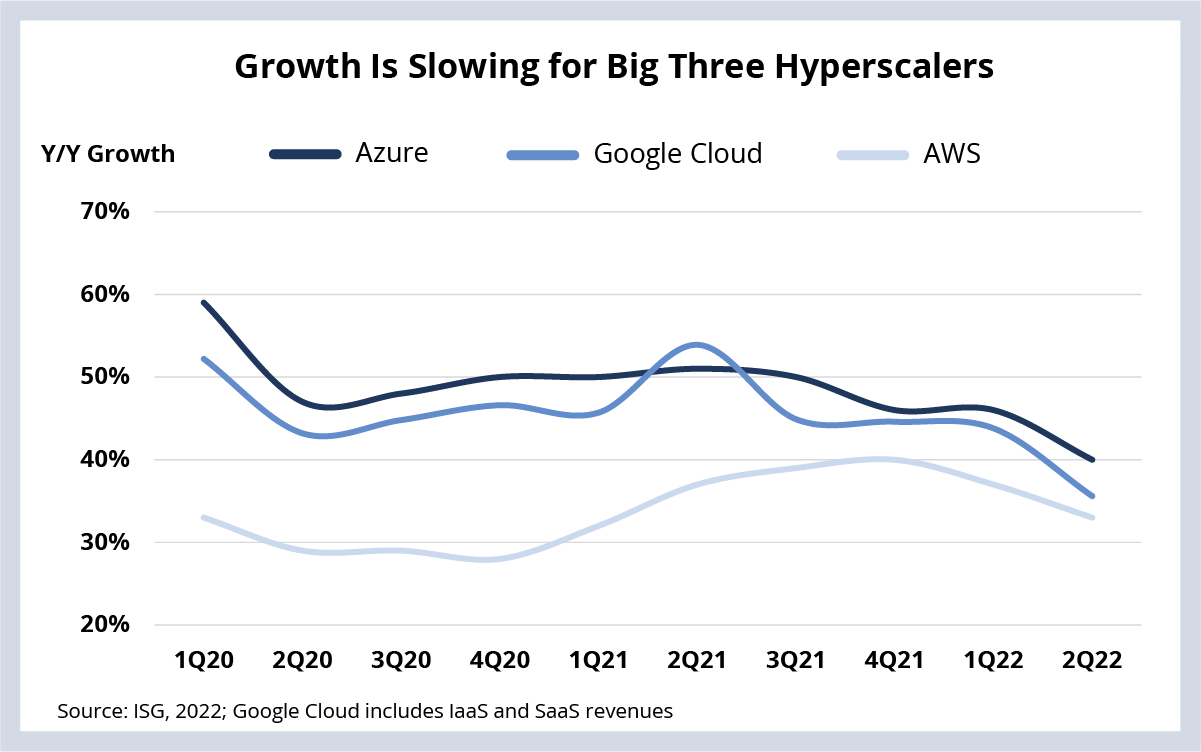

On the other hand, the big three U.S. hyperscalers – Azure, AWS and Google Cloud – have historically made up more than 60% of IaaS market share. So, if growth slows for these companies, it will have an outsized impact on overall IaaS sector growth.

Now that all three companies have reported earnings, we can step back and assess that impact. As you can see in this week’s Data Watch, Y/Y growth did slow for all three. There are different reasons for each – but the main message is that IaaS growth is indeed slowing.

Why are IaaS growth rates so important to the IT and business services sector? Because service provider revenue growth is increasingly linked to these hyperscale platforms. For example, we’ve talked at length about the strong relationship between cloud and ADM. As companies move en masse to the big cloud platforms, they are transforming their applications along the way. And that’s a key reason that ADM – which is now well over half of ITO ACV in the market – is showing such strong growth.

So back to the original question. Will slowing cloud growth impact IT services? For now – the answer is no. Demand for managed services continues to be strong, and we’re not seeing any significant slowing of that demand – even given the myriad of headwinds in the market today.

DATA WATCH

CYBERSECURITY

Private equity firm Thoma Bravo announced this week its intent to acquire identity management firm Ping Identity for $2.8 billion (link). Here’s my colleague Gowtham Sampath with his POV:

As the Zero Trust Access (ZTA) model gains traction with enterprise security leaders, those leaders need specialized identity and access management (IAM) tools to help them continuously apply and monitor privileged access. This capability has become even more critical given the rapid rise of remote work.

Ping Identity is a leading vendor in this fast-growing space and compliments other acquisitions Thoma Bravo has already made in the cybersecurity space, including SailPoint earlier this year as well as Sophos, Proofpoint and Imperva.

This acquisition track record points to aspirations of creating an enterprise security mesh architecture – one solution to mitigate all threats across any environment.

PEOPLE

Hitachi group company GlobalLogic announced a new CEO this week. Current COO Nitesh Banga will succeed CEO Shashank Samant, who will move into a newly created chairman role (link).