Hello. This is Stanton Jones and Steve Hall with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

How Will Tariffs Impact IT and Business Services in 2025?

Given recent changes to U.S. trade policy, the effective tariff rate for U.S. imports is now estimated to be 10.1%, up from 2.4% in 2024. In this week’s Insider, our goal is not to forecast what the impact of this may be on each industry sector (we’ll leave that to the economists), but to provide some insight into how tariffs may impact technology services spending within these sectors in 2025.

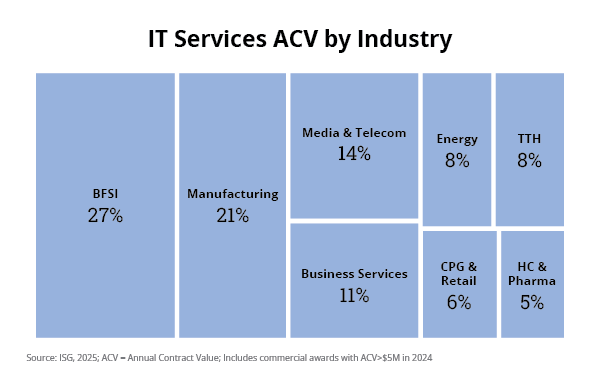

This week’s Data Watch shows the percentage of total market annual contract value (ACV) by industry in 2024. As you'll see, nearly 30% of the IT and business services ACV in 2024 came from banking, financial services and insurance, while the healthcare and pharmaceuticals sector was just 5% of total market ACV.

Data Watch

Tariffs May Impact Industries in Different Ways

Key industries like manufacturing and CPG & retail may see the biggest direct impact from the recently announced policy changes. For manufacturing, tariffs on steel and aluminum could increase input costs, and in CPG & retail, the increased costs of raw materials and finished goods could erode margins or get passed on to price-sensitive consumers.

This could mean a potential slowdown in discretionary spending – and therefore spending on IT services – in these sectors, which held up well in 2024, especially manufacturing, in an otherwise flat year.

In other sectors like BFSI and business services, the impact of the tariffs is likely to be secondary, with a greater impact on IT services demand. For example, while banks may not be directly exposed to the tariffs focused on goods, they own the financing risk of their manufacturing and CPG & retail clients, who are more directly impacted.

BFSI and business services together make up nearly 50% of the ACV in the IT services market, so if banking clients pull back, it could have a downstream impact on – you guessed it – discretionary spending on IT services in these sectors, potentially slowing down the recovery that we talked about in late 2024.

Discretionary May Slow, But Cost Optimization Will Remain

Uncertainty in the market is causing a delay in some decision-making as firms wait to get more clarity on the impact of the new policies. To date, it appears that smaller IT and business services deals will feel the effects more than larger deals, which are more likely to be driven by existing cost optimization goals.

Smaller deals – especially ones in the $5-$9 million range – bounced back in 4Q24. It was one of several signs that discretionary spending was starting to open back up. The recent policy announcements could slow down that growth again – not just in the industries directly impacted by tariffs, but also in those that provide services to the industries most impacted.

That said, we believe demand for cost optimization will remain strong – and likely gain strength given the recent policy changes. As we discussed throughout 2024, large-deal activity was the strongest it’s been in over a decade. There were 34 awards over $100 million in ACV last year, and that momentum does not show any sign of slowing down.

We’ll have more detail on this – and how our full-year 2025 forecast may be impacted by recent policy changes on our 1Q25 ISG Index Call. I encourage you to register here. Steve, Kathy, Namratha, Alex and I look forward to seeing you on April 10.