Hello. This is Stanton Jones with the key takeaways from the ISG Global Index Call Q3 2024. You can watch a replay of the call here.

If someone forwarded you this briefing, consider subscribing here.

3Q24 Key Takeaways

Data Watch

What You Need to Know

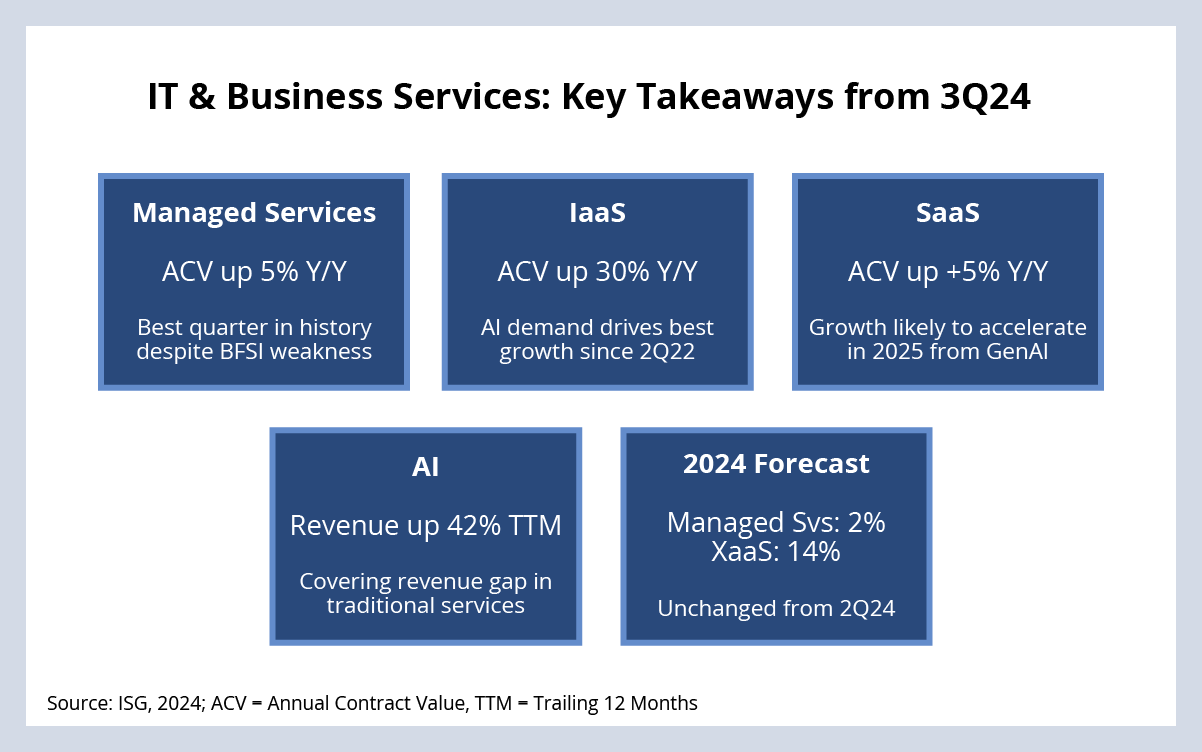

- Managed services remained resilient despite weakness in BFSI. It was the best quarter ever for managed services, with nine mega deals (ACV > $100M) in the quarter. The BFSI sector remained under pressure, but signals point to a stronger outlook for 2025.

- The Infrastructure-as-a-Service recovery is fully underway. IaaS had its best Y/Y result since 2022, as enterprises move beyond consolidation of IaaS spending and into a new phase focused on cloud AI spending.

- SaaS recovery continues to be slow as enterprises move to consumption-based models. Software-as-a-Service growth was positive Y/Y, but demand is likely to accelerate as enterprises start consuming new generative AI features.

- AI project growth remains strong, but pilots have yet to meaningfully scale. Service provider AI revenues are up 42% on a trailing 12-month basis; only 15% of generative AI use cases are fully in production.

- 2024 forecast remains unchanged; 2025 outlook is more upbeat. We’re holding our managed services forecast at 2%, and our as-a-Service forecast at 14%. Signals are pointing toward a stronger 2025. The timing and size of future rate cuts will influence that significantly.