Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

BPO

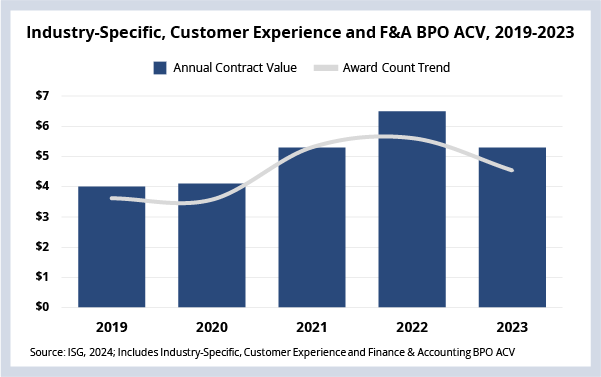

Finance and accounting, customer experience and industry-specific business process outsourcing (BPO) drove double-digit ACV growth in 2021 and 2022 but slowed significantly in 2023. What factors will influence growth in these sectors in 2024?

Data Watch

What You Need to Know

In 2023, BPO ACV was down 14% – and, still, it saw the second-highest number of contract awards ever. The best year ever was 2022, when it generated almost $12 billion ACV. So the 2023 down result was really just due to being in the shadow of the best year in history.

A significant portion of that growth in 2022 and 2023 came from three segments: industry-specific, customer experience and finance and accounting BPO. These three sectors have each seen different growth patterns over the past five years.

The Details

- Industry-specific BPO generated $2.6 billion ACV in 2023, down from $3.6 billion in 2022. Its big growth period was in 2022, when ACV grew by more than 60%.

- Customer experience BPO generated $2.1 billion ACV in 2023 versus $2.3 billion in 2022. Its big growth came in 2021, which almost doubled the ACV from 2020.

- Finance and accounting services generated $560 million in 2023, which was flat compared to 2022. Its big growth period was in 2020, when ACV grew 40%.

What’s Next

Let’s look at Q1 performance for these three sectors and some of the key growth factors looking ahead:

Industry-specific BPO had a very strong first quarter with over $1 billion ACV. That has only happened three times in the history of the sector. Our buyer behavior data indicates that 60% of enterprises use in-house staff to run their industry-specific processes today. Examples include clinical trial support in pharma, financial crime compliance in banking and aftermarket services in manufacturing. Continued cost pressure could drive more enterprises to consider sourcing as an option for these processes, which could drive further growth for this segment of the market.

Customer experience had a $400 million quarter, which was flat Y/Y and very close to its historical average. Our buyer behavior data here indicates that key priorities for 2024 are improving customer satisfaction scores, first-contact resolution rates and customer retention rates, in that order of priority. Generative AI will play a big role here as enterprises experiment with using large language models to improve agent productivity first – and then – eventually – deployment to end customers. Growth here will be driven by providers that can leverage AI to optimize costs and help their clients address one or more of their top three priorities.

And finally, in finance and accounting, ACV was nearly $200 million, which was up 13% Y/Y and up double digits on its historical average. Deal volumes were also up, which is consistent with what we discussed a few weeks ago around the idea that digital arbitrage will continue to reshape F&A outsourcing. The digitization of F&A processes is driving down prices and deal sizes, which will continue to drive up demand for more of these types of services, especially given current market conditions and the enterprise focus on cost optimization.