In this edition: Industrial sector M&A will alter the engineering and IT services landscape. European semiconductor firm extends full ITO relationship. North American pure-play Salesforce consulting firm expanding to Asia Pacific.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

INDUSTRIAL SECTOR

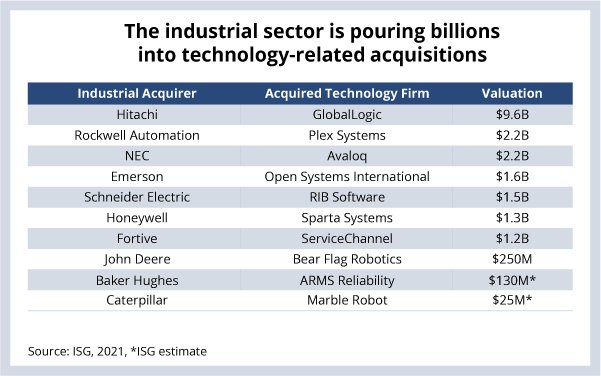

Industrial sector companies are pouring billions into technology-related acquisitions to incorporate software into their products, connect them and build new business models around them. In the last 18 months, Hitachi acquired GlobalLogic for $9.6 billion, Rockwell Automation purchased Plex Systems for $2.2 billion, and NEC bought Avaloq for $2.2 billion. And it’s not just the technology-centric industrial companies that are active – it’s also agricultural and energy industrials. For example, John Deere purchased Bear Flag Robotics, Caterpillar bought Marble Robot and Baker Hughes acquired ARMS Reliability.

Our POV: Software and data engineering expertise is becoming critical for industrial companies. And while they do leverage the IT services ecosystem for this expertise, some are busy acquiring the capability themselves. This is all part of how industrial companies are redefining their core business – which is beginning to blur the boundaries between technology provider and technology customer.

With low interest rates, ample financing and a feeling that most of the uncertainty of the pandemic is in the rearview mirror, M&A activity has become a lever for acquiring both technology and talent – and the trend is likely to continue at a brisk pace. In fact, six of the top 26 ER&D services firms have been acquired since 2019. The acquirers come from a bevy of different industry positions: staffing firms, multi-national conglomerates and, of course, IT services.

For the IT services firms, this M&A trend could put them in the longer-term position of having to compete against or partner with industrial firms – in addition to their traditional competitors. For example, the digital solutions unit of Baker Hughes is on pace to tally an annual run rate of $2 billion, and Honeywell’s connected industrial solutions business is up double digits year over year.

My colleague Gaurav Gupta will be covering the red-hot engineering sector on the 3Q21 Index call. We hope to see you there!

DATA WATCH

DEAL ACTIVITY

- NXP Semiconductors and TCS. European semiconductor manufacturer extends full ITO relationship (link).

- Frost Bank and Infosys. Texas bank redesigning mortgage loan processes (link).

- Ausgrid, Microsoft and Infosys. Australian energy firm modernizing application estate (link).

- Virginia Department of Transportation and Conduent. State agency signs three-year $51 million contract for toll road analytics (link).

- CaixaBank and IBM. Spanish bank extends existing relationship into new cloud region (link).

- Wells Fargo, Microsoft and Google. U.S. bank selects Azure as primary cloud; GCP for additional services (link).