In this edition: Managed services ACV is on an upswing, but don’t forget about the mean. Vista Equity Partners is acquiring Blue Prism for $1.5 billion. One of largest commercial banks in Germany signs five-year ADM deal with TCS.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

MARKET GROWTH

We’ve used annual contract value (ACV) as the primary metric to report on the IT and business services market for over a decade. It represents the best measure of activity and overall health of the market.

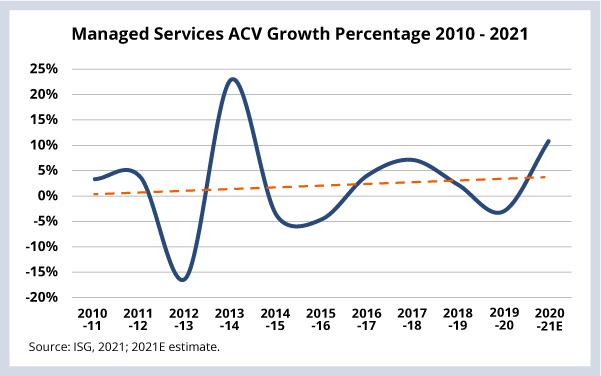

The great news is that managed services ACV is currently on the rise. As we discussed on the 2Q21 Index call, managed services had its best quarter ever at nearly $8 billion in ACV. This was up 24% Y/Y and up 11% over 2Q19.

But it’s also important to remember that a portion of this spike in ACV was due to pent-up Covid demand. Now that this demand has been released, ACV levels will likely start to come back down to Earth. That’s why we’re forecasting 9% growth in managed services for the full year.

There is a phenomenon in American baseball called the “Plexiglass Principle,” which basically says that teams that improve one season tend to decline the next. Same goes for individual players. Essentially, it’s that, over time, things regress to the mean.

And that’s exactly what you can see below in the Data Watch section. While there have been ACV spikes over the past 10 years, over time, ACV growth tends to regress to the mean.

We’ll be discussing this and the next big sources of growth in our industry next week at the Sourcing Industry Conference in Dallas, and on our 3Q21 Index call on the 12th. We hope to see you there!

DATA WATCH

AUTOMATION

In 2019, Blue Prism acquired Thoughtonomy in an effort to pivot to the cloud. But this did not generate the expected benefit, and today Blue Prism is still playing catchup behind the market leaders.

The bigger news in this story may be that Vista intends to transfer Blue Prism to its portfolio company TIBCO, which is focused on data integration, unification and analytics. This is an innovative and visionary move. RPA is just one tool in a very large toolchest of automation and digitization capabilities; the real power of automation comes into play when companies take several tools from the “digital toolbox” and integrate them to optimize business outcomes.

Many organizations use RPA to move data from one place to another; data normalization and standardization is also a common benefit with RPA. Melding Blue Prism with TIBCO could yield a very powerful solution for clients looking for a way to harness the power of data on their digital transformation journey.

DEAL ACTIVITY

- NORD/LB and TCS. One of largest commercial banks in Germany signs five-year ADM deal (link).

- MCX and TCS. India’s largest commodity exchange modernizes trading systems (link).

- Apoteket and TCS. Swedish pharmaceutical retailer expands full ITO relationship (link).

- Maxis and Wipro. Malaysian telecommunications firm signs full ITO deal (link).

- State of Wisconsin and Unisys. Department of Workforce Development moving to cloud-based contact center (link).

- Proximus Group and HCL. Belgian telecommunications firm modernizing data center (link).

- U.S. Cyber Command and Peraton. Four-year $109 million security operations deal (link).

- i3D and Equinix. Ubisoft-owned gaming company migrates its gaming platform (link).