Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

SOFTWARE-AS-A-SERVICE

As we discussed back in November, SaaS revenues took a pause during the pandemic. Growth slowed to an average of 2% during the COVID-impacted quarters of 2020. But it took just a few weeks for companies to recognize they were going to need to work remotely, build resiliency into their operations and, eventually, be able to capitalize on the vaccine-fueled growth surge.

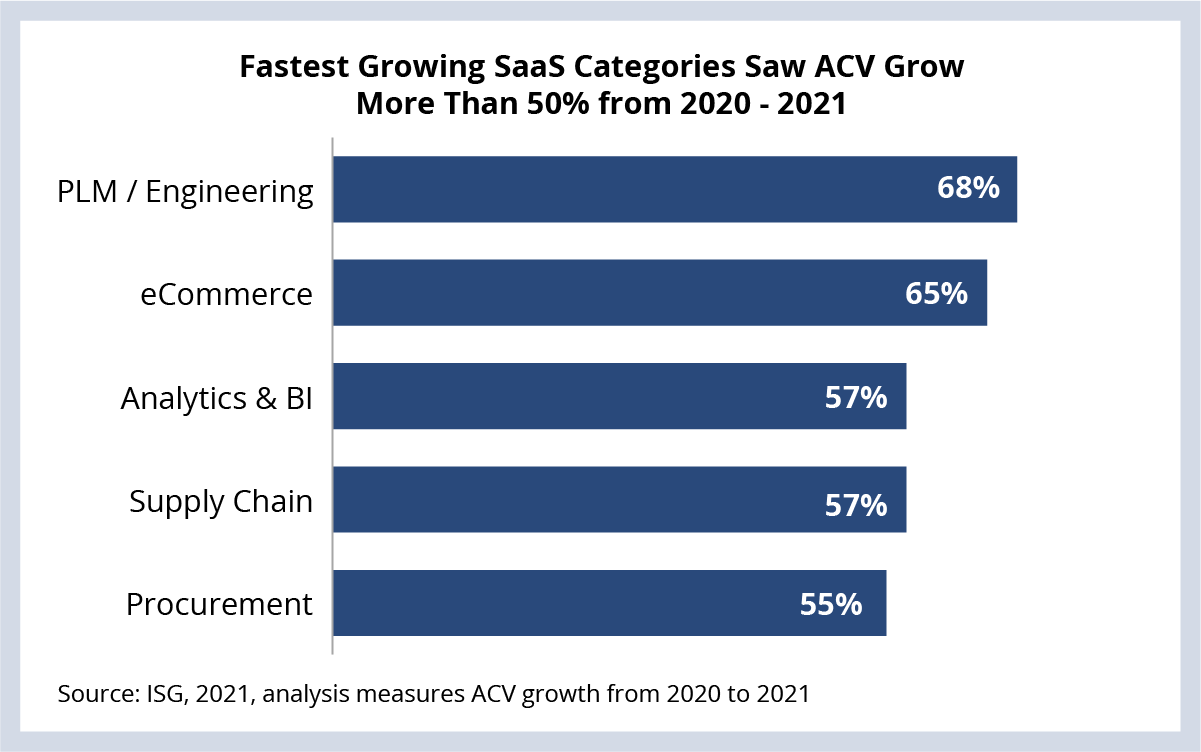

This led to a stampede to SaaS. As we reported last week on the 4Q21 Index Call, SaaS ACV is up over 30% year over year. What’s interesting is what’s driving this growth. Traditional SaaS strongholds like CRM, ITSM and collaboration continue to grow – but it’s the under penetrated categories, accelerated by the pandemic, that are really taking off (see Data Watch).

ACV for PLM/engineering, e-commerce, analytics & BI, supply chain and procurement SaaS grew by over 55% between 2020 and 2021. The PLM/engineering and analytics & BI categories are especially interesting as they were heavily impacted by the spending pause early in 2020. But both categories have come roaring back as 1) industrial companies turn their products into services and 2) as companies across every industry make better use of their data.

The e-commerce category has been steadily growing for a while, but the pace of growth has accelerated dramatically as retail and CPG companies make the shift to hybrid operating models that include both a physical and digital presence. Take grocery for example: Online sales in the U.K. more than doubled in less than one year. That’s a big, fast change. One that favors the configuration of SaaS over the customization of ERP.

And, unlike the capital-intensive IaaS sector (which is consolidating), the SaaS sector is expanding. SaaS solutions typically start out by solving domain- or industry-specific problems in clever, low friction ways. This dynamic favors smaller technology providers that can move quickly. And that’s why SaaS companies outside of the top 10 in terms of revenue are growing faster than their bigger competitors.

DATA WATCH

M&A ACTIVITY

- Rackspace Technology acquires Singapore-based cloud analytics firm Just Analytics (link).

- IBM acquires environmental analytics firm Envizi (link).

- Tech Mahindra acquires Eastern European insurance specialist CTC (link).

- HCL acquiring Eastern European data engineering firm Starschema (link).

- CDI acquires U.S. data management firm Clearpath Solutions Group (link).