If someone forwarded you this briefing, consider subscribing here.

MEGA DEALS

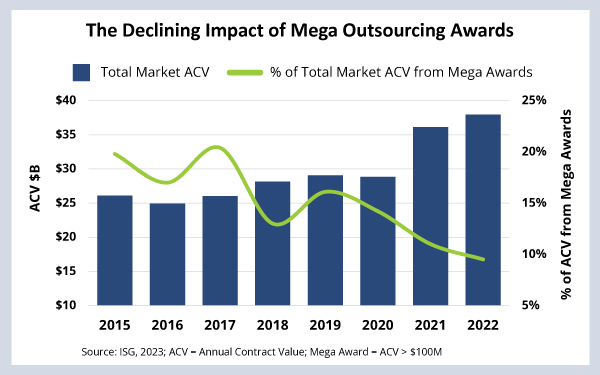

Enterprises are increasingly outsourcing small to mid-sized applications and BPO-centric awards to realize faster results and reduce risk. This means that mega awards – the largest awards in the market – are having less of an impact on overall industry performance than ever before.

DATA WATCH

Background

Mega deals – or outsourcing awards of $100 million annual contract value or more – are always a hot topic. They represent a big muti-year commitment from enterprises and a significant annuity revenue stream for providers, so obviously, they get a lot of attention.

However, as we discussed back in mid-2022, the overall impact of these large awards on the industry is waning. And now that we can look back on the full year, we can see that, while the actual number of mega awards has stayed consistent, their overall impact on the industry is at an all-time low.

The Details

- In 2015, there were 26 mega awards valued at $5.1 billion; in 2022 there were 25 valued at $3.5 billion.

- The percentage of total market ACV that comes from mega awards has dropped from almost 20% in 2015 to just under 10% in 2022.

What's Next

This trend of flat-ish mega award counts with decreasing values is likely to continue. That’s because what’s driving growth in the market today is – as we have discussed – applications, engineering and industry-specific BPO. These areas lend themselves to either relatively smaller contract values (like BPO) or shorter contract durations (like apps and engineering).

And that means infrastructure is no longer driving growth. Areas like data center, network and workplace used to make up more than 60% of the ACV in the market. When infrastructure is outsourced, it usually means that assets like servers and storage are transferred to the provider. Given this, the provider needs a long timeline to make the deal profitable.

But there is another, more fundamental reason as well. As my colleague Bill Huber said earlier this year, “Enforcing large, centralized agreements negotiated in the past impedes your ability to optimize rapidly changing costs and risks.”

And are we ever in an era of rapid change and risk: central banks continue to tighten; inflation continues to be a challenge; geopolitical tensions persist in Europe; generative AI is everywhere. Enterprises need to transform and modernize – but they need to do it now and in smaller, lower-risk tranches.

Given this, the market will continue to grow, but mega awards will play a smaller and smaller role.

And if you’re in the Frankfurt area on June 19 or 20, I encourage you to join us at our SourceIT event to discuss these outsourcing trends in more depth with your peers and our experts in the DACH region. Hope to see you there.