Hello. This is Michael Dornan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

There’s Still Life in Mainframe

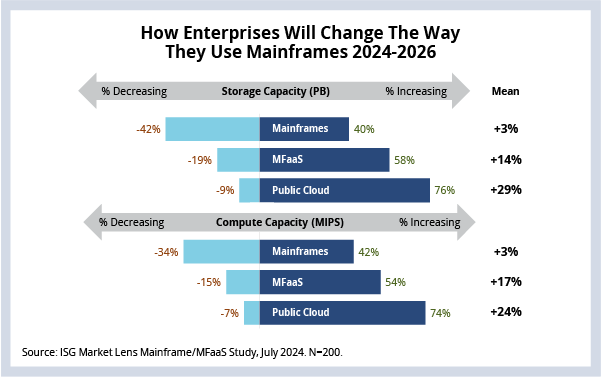

Although most of the focus this week was on the fallout of one of the most significant IT outages in history, the trusty mainframe kept on running. Our latest ISG Market Lens study on mainframe and mainframe-as-a-service (MFaaS) shows that companies that use mainframes in their current IT operations expect to increase their mainframe spending even as they increase their adoption of public cloud.

Data Watch

Background

Recently in Index Insider, we discussed the growth of IaaS and how AI is likely to create more demand for public cloud services. And though public cloud adoption continues to grow, it will not totally eclipse mainframes in enterprise IT. In fact, mainframe compute and storage requirements are expected to rise, particularly in the form of MFaaS.

The Details

- Around 40% of large enterprises expect to increase capacity for traditional mainframes.

- A third of enterprises expect to upgrade processors or storage for existing mainframes, and one in six expect to purchase brand new mainframe hardware over the next three years.

- At the same time, 43% of enterprises expect to migrate applications from mainframe to MFaaS.

What’s Happening?

Mainframe demand is being fueled by enterprises’ inability to decommission their legacy infrastructure. Many large enterprises are struggling to retire legacy infrastructure and applications due to conflicting demands like the adoption of AI. Others are prioritizing data security and resiliency. Meanwhile, application storage and compute demands are on the rise.

Concurrently, there is internal pressure for enterprises and IT departments to optimize costs, and MFaaS is commonly seen as a lower-cost solution offering the flexibility and interoperability associated with public cloud but with fewer migration and security challenges. It’s also a potential solution to mainframe talent challenges as traditional COBOL and C++ skills retire from the talent pool.

What’s Next?

Given the struggle with competing priorities, enterprises will be looking to their provider ecosystem to proactively engage in mainframe modernization to get the full value from existing investments. Providers will be expected to demonstrate capability and value on two key measures: the impact on the bottom line through cost optimization and the benefits of integration and interoperability with other systems and services (e.g., cloud).