Hello. This is Stanton Jones and Jill Stabler with what’s important in the IT and business services industry this week.

This week we launched ISG Market Lens™, our new market intelligence product that enables you to dive deeper into the data behind the Insider and get a closer look at how changes in enterprise demand are shaping the IT and business services industry. Read the press release here.

If someone forwarded you this briefing, consider subscribing here.

BPO

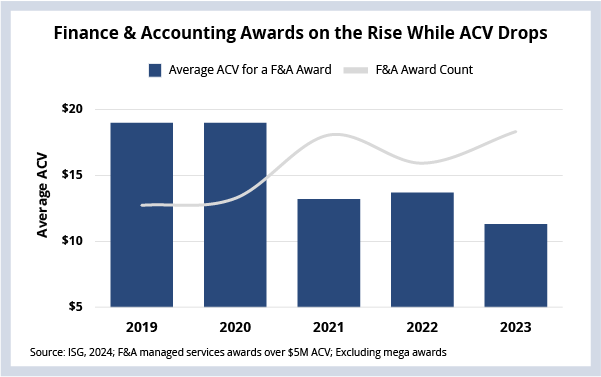

Finance and accounting outsourcing activity is the strongest it’s been in years. However, award sizes are getting smaller as standardization and technology continue to drive down the cost of F&A operations.

Background

As we discussed on the last ISG Index call, though BPO annual contract value (ACV) was down year over year in 2023, it still had its second-best year ever. Service lines like customer experience, HR and industry-specific BPO were all above their five-year average ACV.

Interestingly, one of the oldest and most mature BPO disciplines – F&A – dropped below its five-year ACV average last year. But when you look at F&A activity – measured by the number of awards in the market – it had its best year in over a decade.

The Details

- There were 50 F&A awards over $5 million ACV in 2023; the five-year average is 40.

- Average ACV in 2023 was $11 million; the five-year average is $15 million.

- Average duration of an F&A award holds at approximately three years, with no significant change over the last five years.

What’s Happening

The value proposition of BPO has changed a lot over the past decade. In the past, this was mostly cost savings enabled by labor arbitrage.

Given today’s macroeconomic environment, there is still a lot of focus on cost, but savings are generated through a combination of labor arbitrage, process standardization and application of technology. This means the current BPO value proposition is driven by digital transformation.

And what we mean by transformation here is essentially the processing of F&A activity with significantly less human intervention. This is taking the form of straight-through processing via workflow and automation technologies and process standardization. The goal is to minimize exceptions and maximize what the virtual workforce can handle to ultimately lower the cost of a transaction.

When companies use a BPO provider to leverage this “digital arbitrage,” they can expect to see a 25% - 50% cost reduction over the term of the agreement. Of course, the savings generated can vary, and these percentages are benchmark ranges based on what we see in today’s market. A lot of this depends on the maturity of the client and the degree to which the provider feels confident it can transform the environment.

Digital arbitrage is just one of many factors that can impact deal sizes. And we believe it’s having a big impact in F&A BPO contract values. That’s because digital transformation led by the application of automation technology – and increasingly AI – is finally starting to deliver the promised results of greater efficiency, which is bringing down prices, and now deal sizes.

And speaking of AI, we think this trend will only build as generative AI starts to come online in the F&A function. Up to this point, most of the productivity improvements have been focused on the transaction itself. Generative AI could make the people managing these exceptions more productive, which will continue to drive down F&A BPO costs.