If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

ENGINEERING

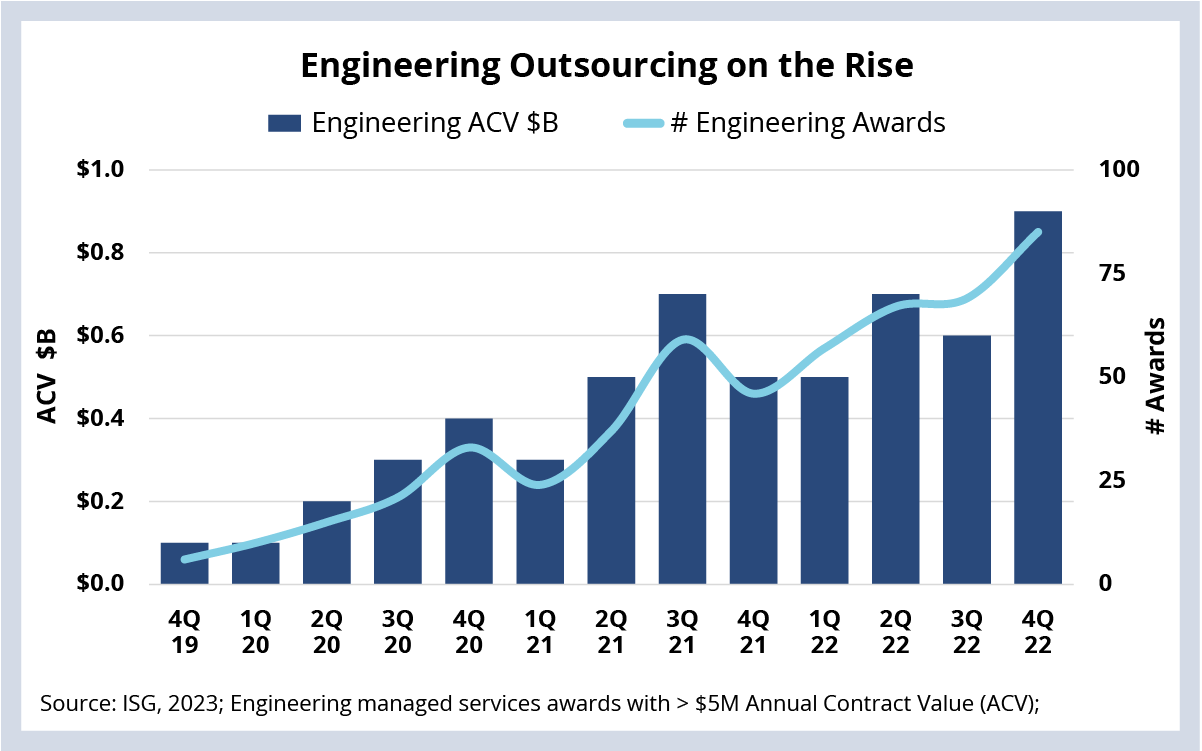

Engineering outsourcing grew by almost 40% in 2022. Firms in manufacturing, healthcare and telecom sectors are increasing their use of third parties to help them build connected products, improve throughput and re-imagine aftermarket experiences.

Background:

The pandemic dramatically accelerated the need for companies in these sectors (and others) to stitch together people, processes and data across areas like design, manufacturing, distribution and aftermarket support. This is known as the digital thread.

However, firms are realizing they need help. Especially in areas that have been traditionally outside their wheelhouse, like designing customer experiences, building software for continuous releases and connecting supply chains with data.

This has turbocharged demand for digital engineering services like product design and development, connected operations (in both discrete and process industries) and integrated user experiences.

The details:

- Engineering annual contract value is up 38% Y/Y, and the number of engineering awards over $5 million ACV is up almost 70% Y/Y. (See Data Watch)

- Of the $1.5 trillion in engineering spending, less than 10% of it is outsourced; as a reference, around 70% of IT services spending is outsourced.

What’s Coming:

The engineering market today is dominated by internal spending. And much of this internal spending is done through captive centers. Many of these centers are feeling immense pressure to keep pace with fast-moving peers in an environment in which talent is extremely difficult to find and retain – especially in India.

This is creating the aforementioned demand, but it is also changing the makeup of the supply side of the equation. ER&D providers have traditionally focused on short-cycle project-based work. However, as client projects get bigger (think people, process, technology and data) this is increasing the size and duration of awards and tilting them more toward multi-year managed services agreements.

And this trend is also driving market consolidation. In a sector that has traditionally been highly fragmented, almost a quarter of the top 25 engineering services providers have been acquired over the past five years. And consolidation is also happening on the enterprise side, as many large industrial firms think through how to rationalize and consolidate the many small engineering providers they are using today.

And that’s why we’re continuing to project that engineering services will be one of the primary growth drivers for the IT and business services sector for the foreseeable future.

DATA WATCH