Joining me this week are Mark Smith and Dave Menninger, who are now part of ISG through our recent acquisition of Ventana Research, a leading technology research firm specializing in coverage of the $800 billion software industry.

If someone forwarded you this briefing, consider subscribing here.

CLOUD & AI

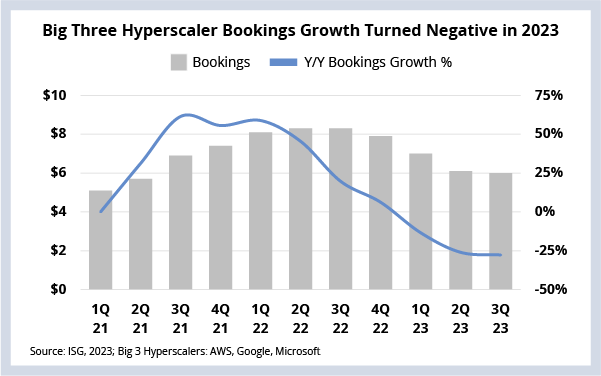

Hyperscaler bookings growth moved into negative territory in 2023 as enterprises pulled back on discretionary spending, which slowed revenue growth. Amazon Web Services is betting that will change in 2024 with a slew of new product launches announced this week focused on enabling enterprises with new generative AI-based applications and integrations.

DATA WATCH

Background

As we’ve discussed at length this year, cloud growth slowed significantly in 2023. The choppy macroeconomic environment has led to a significant pullback in discretionary technology spending. This has in turn impacted the IaaS segment as enterprises focus on cost optimization over net-new spending.

But it’s not just new spending that has been impacted. Over the last few years, many enterprises have entered into framework agreements with cloud vendors, agreeing to a certain level of spending in exchange for discounts. In some cases, these agreements have not proved as financially successful as anticipated because the work of cloud migration has proven to be more complex, costly and time-consuming than originally anticipated.

The combination of these two factors – discretionary spending pressure and slower migrations – have had a significant impact on cloud infrastructure providers. Through the first three quarters of the year, the big three hyperscalers have seen negative bookings growth for the first time ever (see Data Watch).

But this may change in 2024 for a couple of reasons. First, the year-over-year financial comparisons get easier next year. But there’s a bigger reason as well: artificial intelligence. All three hyperscalers are doubling down on AI – specifically generative AI – as the next big growth frontier.

And this week at re:Invent, AWS announced a series of advancements and new services to integrate generative AI across its vast portfolio of services:

The Details

- Amazon Q: AWS is positioning Q as a generative AI assistant that will solve problems, generate content and take actions on behind-the-firewall data for both IT and non-IT users.

- Database: AWS is layering Q on top of its database products, enabling developers to inquire and interact with databases through natural language.

- Code remediation and transformation: Q will provide code suggestions, identify security vulnerabilities and perform Java (and soon .NET) application upgrades.

- Analytics: Q will be embedded into AWS analytics services to help with cataloging and summarizing of data and into BI tools to generate executive summaries.

- Contact Center: Q will recommend agent responses and generate post-contact summaries.

What’s Next

As we discussed in our recent State of Generative AI Market Report, generative AI use cases are quickly maturing. We also flagged that one of the areas that enterprises will need to get their arms around to scale these use cases is a new reference architecture for AI.

The “newness” of this architecture could be a net positive for AWS. Q provides a rapid onramp to generative AI for firms that have not yet begun to put this architecture into place. But there’s a challenge for Amazon here as well: Many enterprise application software providers have already integrated generative AI into their offerings. And there will likely be many that don’t want to backtrack on those investments in order to use Amazon’s new approach.

But back to the bigger question: will generative AI revive hyperscaler growth?

It’s important to keep in mind that cloud infrastructure spend is fundamentally coupled to production applications. Given this, Amazon has three paths with generative AI that could accelerate application deployments: First, AWS can offer enterprises tools that allow them to build generative AI into existing applications. Second, it can enable enterprises that are migrating legacy applications to use generative AI tools for code migration and application re-architecture. And, finally, it can use its early lead in ISV and SI cloud ecosystem mindshare to push the AWS generative AI technology stack versus those of Microsoft and Google.

Most enterprise application migrations are still fundamentally lift-and-shift or minimum viable re-architecture efforts, so it may ultimately be the work that generative AI does behind the scenes within the AWS technology stack, rather than the generative AI products themselves, that helps accelerate the velocity of enterprise application migrations. And this could reinvigorate bookings growth, not only for the hyperscalers, but also for the service provider channel AWS relies on to make these migrations happen.