Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Cloud Demand

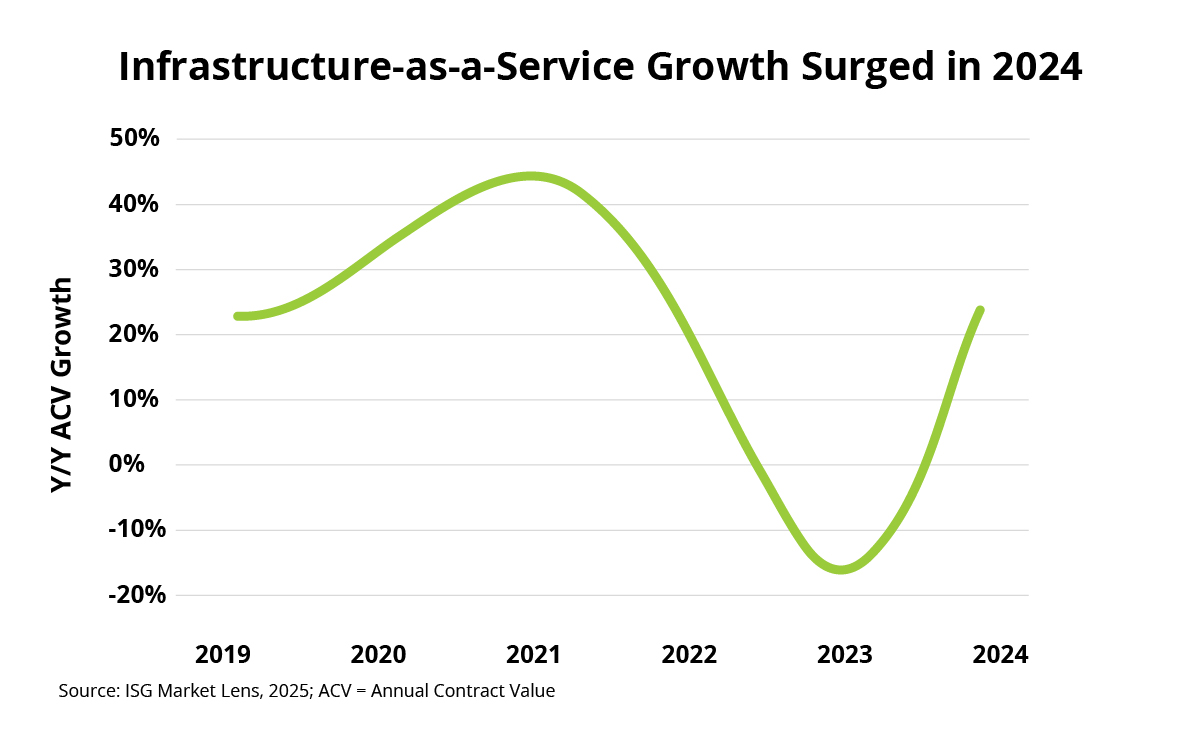

Infrastructure-as-a-Service annual contract value (ACV) surged in 2024 as enterprises moved from optimization to consumption, with a strong focus on AI.

Data Watch

Background

As we discussed on the Q4 and full-year 2024 ISG Index call, cloud demand surged in 2024 as enterprises moved back into consumption mode after spending much of 2023 focused on optimizing existing IaaS investments.

Much of this new consumption was focused on AI. As we wrote about last year, enterprises doubled down on AI spending in 2024. And cloud was the beneficiary of much of that spending as enterprises prioritized moving data products, business intelligence and analytics to a cloud delivery model.

The Details

- IaaS generated over $46 billion of ACV in 2024, up 25% from 2023.

- In the Americas and EMEA, IaaS ACV grew 30%; in Asia-Pacific, it grew 13%.

- All industries were up in 2024, with retail leading the way at 40% Y/Y ACV growth.

What’s Next

The IaaS recovery is great news for the IT services sector. Enterprise cloud migrations have been – and continue to be – a critical revenue stream for providers. And net-new enterprise AI projects are rapidly becoming a critical vector of growth for service providers. For example, AI was less than 1% of provider revenues in 1Q23. Today it’s nearing 8%.

And while deploying data and AI services in hyperscale clouds may be getting easier, the management of these estates is most definitely not. This will create more complexity, which is, of course, more opportunity for service providers in 2025.

However, that opportunity won’t be evenly distributed. Providers need to keep in mind that cost optimization goes hand in hand with AI this year. Anything not directly supporting AI is likely to be cost optimized or reevaluated. And this is one of the reasons that the number of providers that are neither strategic nor niche in a typical enterprise ecosystem will likely shrink in 2025.