If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

M&A

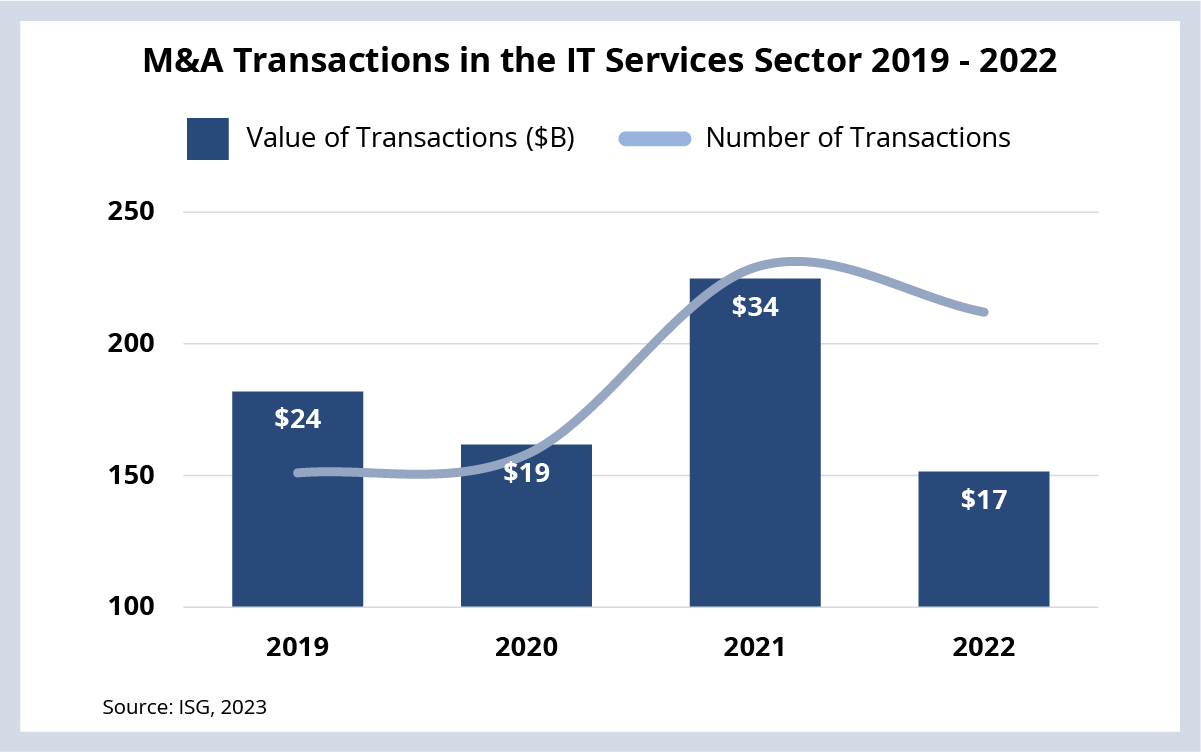

M&A activity in the IT and business services sector remained robust in 2022, despite the macro-driven slowdown in 2H22. IT services and management consulting firms focused on smaller, tuck-in acquisitions focused on high-growth areas like cloud, engineering and analytics.Background

When the macro situation became uncertain, especially in the second half of 2022, the prevailing opinion was that M&A activity in our sector would be down significantly.

And, on value, that opinion was spot on; the value of IT and business services acquisitions in 2022 was less than half of the value in 2021. But, if you look at it through the lens of the number of deals in 2022, the totals for the two years are very close. The number of transactions in 2021 was only 8% less than the record-setting 2021 levels (see Data Watch).

This means that in 2022, the top five most acquisitive firms preferred smaller, tuck-in acquisitions. And, while IT services firms remained active in the M&A space, the big change in 2022 was the degree to which management consulting firms started making bets on the sector.

The Details

- Accenture led the pack again in IT services M&A activity; it closed 29 transactions valued at over $2.3 billion, amounting to nearly 8,000 resources acquired in 2022.

- Deloitte’s 24 acquisitions last year were primarily IT-services related; it focused on cloud, cybersecurity and AI bolt-on capabilities in 2022.

- E&Y acquired 16 companies in 2022, with many of those coming out of the Asia-Pacific region; over half were IT services focused, with the rest in the engineering and digital agency sectors.

- PWC acquired more than 700 FTEs in 2022, three times as many as it acquired in 2021; half of its 13 acquisitions were in Europe, each of which was valued at less than $50 million.

- Capgemini focused on transactions in EMEA last year with seven of its eight acquisitions coming from the region; valuations of these acquisitions were roughly equal to those in 2021.

What’s Next

As we’ve discussed over the past couple of quarters, we’re still in a supply-constrained environment. Labor markets remain very strong despite nagging inflation and high interest rates.

And, while the supply-side disruption of 2022 is improving, there is still exceptionally strong demand for scarce skills in areas like cloud architecture, software engineering and analytics.

This makes it tough for enterprises to find the talent they need when they need it, which will continue to drive demand for IT services. And this, in turn, will continue to drive tuck-in-related M&A activity in specific segments and regions, even in the face of a very uncertain macro environment.

DATA WATCH