Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Demand

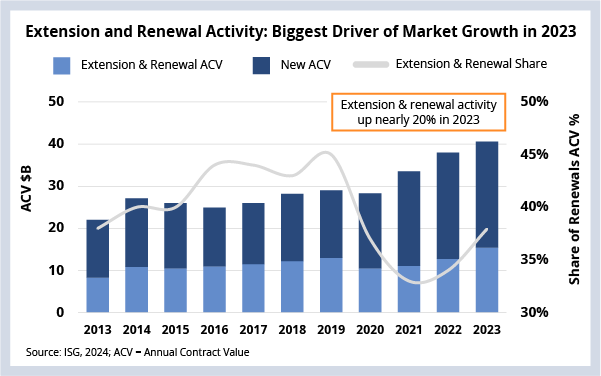

Extension and renewal award activity, more than new award activity, was the biggest driver of market growth in 2023.

Background

We noted back in 1Q23 that we were seeing a steady increase in extension and renewal activity in comparison to new outsourcing activity. This trend continued throughout 2023. So much so that over $15 billion of extension and renewal awards were signed last year – the most ever.

On a percentage basis, as you can see in this week’s Data Watch, nearly 40% of all the ACV in the market last year came from extension and renewal activity. That’s not a huge change from where the industry was a couple years ago, but it represents an important shift in enterprise buying behavior.

And that’s because – while most of the growth in 2021 and 2022 came from new scope activity – much of the growth in the market in 2023 came from extension and renewal activity.

The Details

- $15.4 billion of extension and renewal ACV was signed in 2023, up from $12.9 billion in 2022. That’s a nearly 20% increase year over year.

- In contrast, $25.2 billion of new ACV was signed in 2023, down from $25.7 billion in 2022. That’s a 2% decrease year over year.

What's Next

The return to historical levels of extension and renewal contracting activity started right around the time the economy began to slow. Firms homed in on cost optimization, slowed decision-making and prioritized risk reduction (a pattern we continue to see in 1Q24).

Under circumstances like these, enterprises tend to stick with incumbent providers. They also tend to reduce their engagement with new providers because they are doing less project work, and project work is often a pipeline for managed services work.

This means providers that are laser-focused on delivering value, keeping prices in market range and finding ways to help their clients optimize costs (and drive those savings back into transformation) have a better chance at winning a portion of the growing extension and renewal activity up for grabs.

But it’s also important to remember that this cost-constrained environment will end. We believe discretionary spending will start to loosen up in the second half of the year, which means new scope awards – especially in areas like application development and maintenance – will likely rebound.

When this happens, providers that have the expertise enterprises are looking for (and are struggling to find in today’s market) stand to benefit.