Hello. This is Stanton Jones and Sunder Sarangan with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Hiring

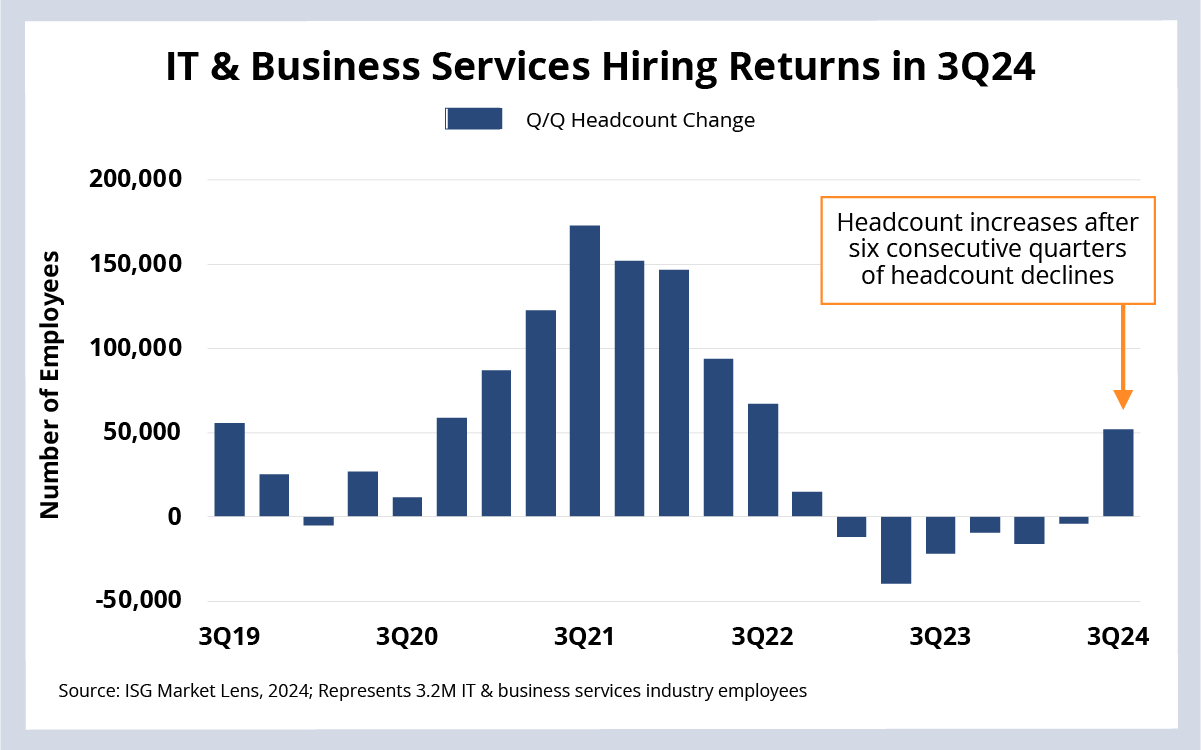

Employee headcount increased in the IT and business services industry 3Q24. Is this a sign that demand is growing?

Data Watch

Background

You may recall that, back in August, we asked the question: is the IT and business services industry at a growth inflection point? We asked this question because, in 2Q24, revenue growth passed headcount growth for the first time since 2021.

Our POV was that, yes, the industry is at an inflection point. But not necessarily a revenue growth inflection point – more of a service delivery inflection point.

The idea here was that providers had been relying on the capacity built up after the pandemic to support the low single-digit growth in the industry. That capacity was “at capacity,” so that’s why we indicated that hiring was likely to pick back up.

And, as you can see in this week’s Data Watch, that’s exactly what happened in Q3.

The Details

- Headcount increased by 52,000 in 3Q24, which was a significant change from the decrease of 4,100 in the prior quarter.

- The last Q/Q headcount increase was in 4Q22, when it grew by 14,500.

What’s Next

So, does the biggest headcount increase in almost two years mean that demand is picking back up? Possibly. As we discussed on LinkedIn a couple weeks ago, several providers saw growth in their banking and financial services in Q3. That’s a great sign for the industry because BFSI makes up around 25% of the annual contract value in the IT and business services market.

However, when you dig into the most recent data, a couple of things pop out:

- Most of the headcount increase was concentrated in a few providers.

- Some of the increase was related to M&A activity that closed during the quarter.

Given this, we think the Q3 uptick was a result of providers keeping up with existing demand and attrition. And this is one of the key reasons we continue to hold our full-year forecast at 2%.